- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- MetaTrader Copy Trading

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Bank of England hikes again

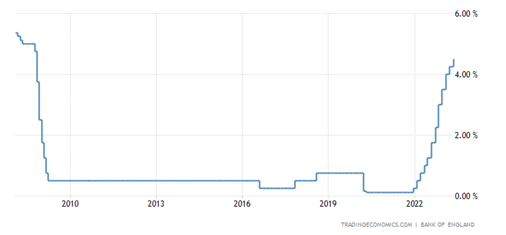

News & AnalysisBank of England announced the latest policy decision on Thursday, raising interest rates for the 12th consecutive time from 4.25% to 4.5%, which was in line with expectations.

Bank of England’s Monetary Policy Committee voted by a majority of 7-2 to raise interest rates to 4.5%.

Two members voted to maintain the interest rate unchanged at 4.25%.

The current interest rate is at its highest level since October 2008.

Inflation

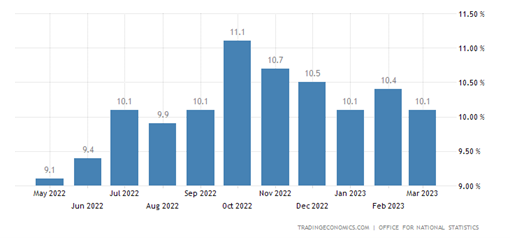

UK’s annual inflation rate decreased from 10.4% to 10.1% in April and remains high. The bank expects inflation to continue falling in Q2 and in the near term.

”CPI inflation is expected to fall sharply from April, in part as large rises in the price level one year ago drop out of the annual comparison. In addition, the extension in the Spring Budget of the Energy Price Guarantee and declines in wholesale energy prices will both lower the contribution from household energy bills to CPI inflation. However, food price inflation is likely to fall back more slowly than previously expected. Alongside news in other goods prices, this explains why the Committee’s modal expectation for CPI inflation now falls back more slowly than in the February Report.”

Economic outlook

As for the economy, the central bank expects it to remain flat but there are signs potential growth.

”UK GDP is expected to be flat over the first half of this year, although underlying output, excluding the estimated impact of strikes and an extra bank holiday, is projected to grow modestly. Economic activity has been less weak than expected in February, and the Committee now judges that the path of demand is likely to be materially stronger than expected in the February Report, albeit still subdued by historical standards. The improved outlook reflects stronger global growth, lower energy prices, the fiscal support in the Spring Budget, and the possibility that a tight labour market leads to lower precautionary saving by households.”

The unemployment is expected to remain below 4% until the end of next year.

Market reaction

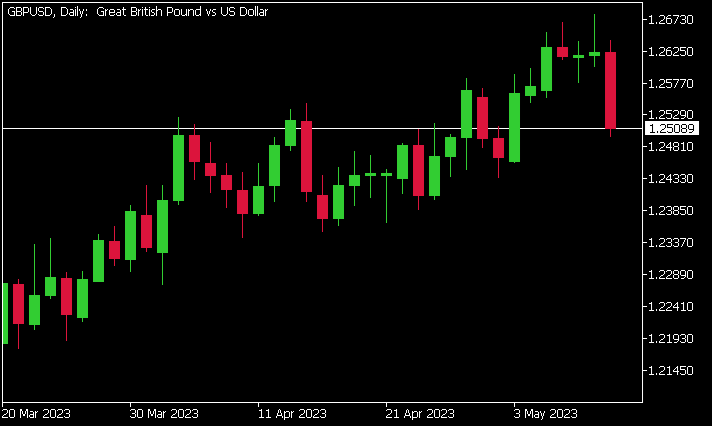

The Pound was weaker against the US dollar on Thursday, down by around -0.93% at 1.25089.

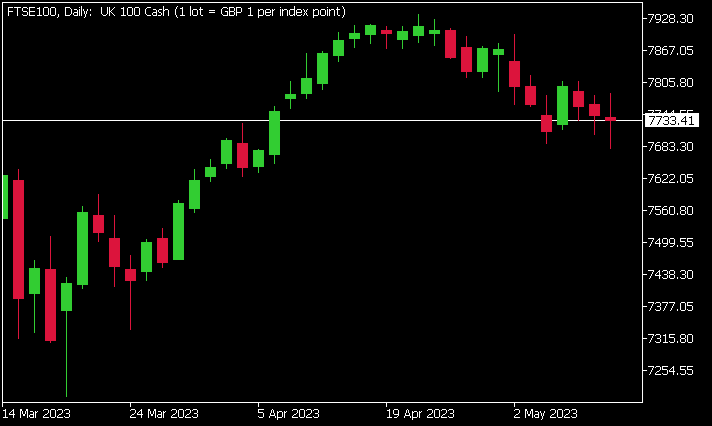

FTSE100 was down by -0.14% at 7733.41.

The next Bank of England rate decision will be on 22nd June.

Source: Bank of England, Trading Economics, MetaTrader 5

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US stocks finish in the green on weak data and regional bank short squeeze

Major US indices finished broadly higher after weak Empire State manufacturing figures fed into the “bad news is good news” for equities narrative, and a surge higher in regional bank stocks allayed fears of further crises in that sector in the short term. The Russell 2000, being the home of most of these mid-sized banks outperformed, finishing...

May 16, 2023Read More >Previous Article

GBPUSD analysis – Is the Bank of England approaching peak rates?

The Bank of England (BoE) is due to release its interest rate decision today, with markets expecting a 12th consecutive hike to take interest rates to...

May 11, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.