- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- Share Trading Help Centre

- Home

- Share Trading Help Centre

- Web Platform user guide

- Mobile Platform user guide

- Web Platform user guide

- Mobile Platform user guide

- Pro Platform user guide,

- How long will it take for my HIN to come across to my GO Markets Securities account?

-

The transfer process can take around 3 business days once we’ve received your signed, completed form. There may be further delays as we rely on the counterparty to release your HIN over to us. You’ll be notified by email once your HIN has arrived and your trading account is ready to GO!

- I already have a HIN with GO Markets Securities but want to transfer my other HIN with another Broker. What is the process?

-

Since you already have a HIN with us and can only have one HIN per account, you can transfer your shareholdings individually over to your GO Markets Securities HIN by simply completing our share transfer form.

- How do I transfer shares from my other broker over to GO Markets Securities?

-

To transfer Individual share holdings, please complete our Stock transfer form.

- How long will it take for my shareholding to come across to my GO Markets Securities account?

-

The transfer process can take around 3 business days once we’ve received your signed, completed form. There may be further delays as we rely on the counterparty to release your shares over to us. You’ll be notified by email once your shares have arrived.

- How do I sell my Issuer Sponsored holdings?

-

To sell your Issuer shares, you must first convert your Issuer sponsored holding to your GO Markets Securities HIN.

Simply download and complete our Issuer to HIN conversion form and we’ll process your request. You’ll be notified by email once your shares are available in your portfolio. - How do I find the PID of my existing Broker?

-

PID is short for Participant Identification Number. The PID is used to identify all the different settlement participants and is required to transfer a HIN or shareholdings from one broker to another.

You can find a list of common broker PIDs here. For a full list of broker and settlement participants, please visit the ASX website. - Are there fees associated with transferring my HIN to GO Markets Securities?

-

Provided that both registration details match, there’s no charge to transfer your HIN to GO Markets Securities.

- Are there fees associated with transferring Individual Shareholdings to GO Markets Securities?

-

Provided that both registration details match, there’s no charge to transfer your Individual Shareholdings to GO Markets Securities.

- What is an Off-Market Transfer (OMT)?

-

An OMT is a transfer from one party to another resulting in a change of beneficial ownership. An example of an OMT is where you transfer your shareholding to a friend or a family member as a gift.

The fee for an Off-Market Transfer (OMT) is $27.50 incl GST per shareholding and will be charged to your Trading account.

Note: Please seek advice from your Tax accountant for any tax implications with Off Market Transfers. - Can I have multiple HINs with different brokers?

-

Yes, you can have different HINs with different brokers, but only the one HIN can be established per broker with the same account type and details.

- How do I update my address details?

-

Please complete our change of address form which can be downloaded here and return to [email protected]

- How do I change my email address for receiving trade Confirmations / Contract Notes?

-

Please email your instructions to [email protected] from your current registered email address and your request will be processed ASAP.

- Can I add more emails for trade Confirmations / Contract Notes?

-

Yes. Please email your instructions to [email protected] from your current registered email address and your request will be processed ASAP.

- How do I update my bank details for receiving Dividend payments?

-

You can nominate or change your bank details for dividend payments by completing our Income Direction form and returning it to [email protected]. You’ll be notified by email once the details are updated.

- Does GO Markets Securities offer investment advice?

-

GO Markets Securities does not provide personal advice. Any advice provided by GO Markets Securities is general in nature only and does not consider anyone’s personal objectives, financial situation or needs.

- What are Issuer Sponsored Holdings?

-

Issuer Sponsored holdings are sponsored by the Share Registry and not by a CHESS participant. Issuer sponsored holdings are identified by an SRN (Security Reference Number) which typically begins with an ‘I’. SRNs can be found in a holding statement or by calling the company’s share registry.

- What is a share registry?

-

A share registry is an organisation contracted by the listed company to record shareholding details, manage certain corporate events and Issue statements. The most common share registry is Computershare, who covers listed companies such as BHP, Afterpay and ANZ to name a few.

- Where can I find the contact details of share registries?

-

To find the share registry of a listed company, go to the ASX website and search for the ASX code or the name of the company (e.g. APT or Afterpay). The share registry details are usually found at the bottom of the page.

- Where can I get a copy of my Issuer holding statement?

-

You can contact the relevant share registry and request a copy of your Issuer holding statement.

- What is CHESS?

-

CHESS (Clearing House Electronic Sub register System) is an automated system operated and owned by the ASX. CHESS facilitates the clearing and settlement of trades and maintains the shareholding registry details. CHESS sponsored accounts are allocated a HIN (Holder Identification Number) where all your share investments are held.

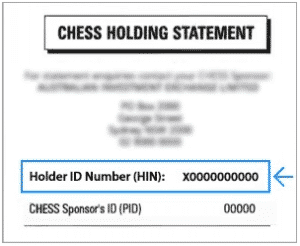

- What is a HIN?

-

HIN (Holder Identification Number) is a unique and confidential number issued by CHESS to identify an account and its registered holdings. Your HIN can be located on a CHESS statement and starts with an ‘X’. For example: X00123456789.

- What is a Corporate Action?

-

Corporate actions are decisions and events that are carried out by the company to bring material change to the organisation and its stakeholders. Some examples are rights issues, share splits, acquisitions and dividends.

- What is a Dividend?

-

A dividend is the distribution/payment portion of the company’s earnings as a reward to investors for investing into the company.

- What is a Record date?

-

A record date is the date where a registry closes its database to determine dividend eligibility.

- What is Ex-Dividend (ex div)?

-

Ex-div is when the company’s dividend allocation is specified and no longer carries the dividend value. You’ll not be entitled to the dividend if you buy shares on the ex-div date.

- What is a Broker PID (Participant Identification Number)?

-

PID is short for Participant Identification Number. The PID is used to identify all the different settlement participants and is required to transfer a HIN or shareholdings from one broker to another.

- What is the PID for GO Markets Securities?

-

GO Markets Securities’ Settlement participant is FinClear who uses the PID 3557.

- Where do my dividend payments go?

-

There are several ways to nominate the bank account for your dividend payments:

- By completing our Direct debit and credit authority form

- Contacting the share registry directly

- What is a Cash Management Account (CMA)?

-

A Cash Management Account is a type of bank account that allows you to manage your cash transactions from one portal. For example, you buy and sell shares and also use it as your everyday bank account. There’s no minimum deposit required or ongoing monthly fees and you can earn interest on your cash balance. For more information, please visit the Macquarie website.

- Is there a minimum deposit amount?

-

There is no minimum deposit amount required to open a Macquarie CMA.

- How do I fund my trading account?

-

Your trading account is linked to your Macquarie CMA. Simply deposit funds into your CMA, and once cleared the available balance will be available on your trading platform the following day.

- Can I use the funds immediately after selling my shares?

-

Yes. Once you’ve executed a sell trade, the net value will be reflected in your available balance, which can be used to place buy orders.

- When can I withdraw the funds from the sale of my shares?

-

The settlement of your sell trade occurs 2 business days after the trade date, which is known as T+2 Settlement. This is when the net amount is processed and credited to your Macquarie CMA. Please check your Macquarie account after 5pm on Settlement Day.

- Are there any fees when opening a Macquarie CMA?

-

There are no establishment fees, ongoing fees or minimum deposit requirements when opening a Macquarie CMA.

- How do I close my Macquarie CMA?

-

Please contact Macquarie directly to close your Macquarie CMA and email [email protected] to close your trading account.

- How do I fund my share trading account?

-

Your share trading account is linked to your Macquarie CMA. You’ll need to transfer funds to your Macquarie CMA and once the funds are cleared, the balance will be reflected in your trading account the following day.

- Is my identity secure with SwiftID?

-

Yes. SwiftID only hold your identity while your accounts are being processed. Their cybersecurity meets the highest standards to work with Macquarie and other vendors. For more information, please visit SwiftID’s website.

- Do I receive Interest on my CMA balance?

-

Yes. For further details, please contact Macquarie bank or visit their website.

- Do I have to create a Macquarie CMA to open a Share Trading account?

-

Yes. At this stage we are only allowing Macquarie CMA to be used for trade settlement purposes. We’re working on other funding methods to offer in the near future.

- Can I link my Everyday Bank account with my GO Markets Securities Share Trading account?

-

No. As everyday bank accounts do not typically allow third party integrations, we’re unable to offer this option.

- How much is ASX Click2Refresh data?

-

Users are defaulted with Click2Refresh L2 market data. The first 2000 clicks per month are free. Subsequent refresh/clicks are charged at $0.0165 per request. This is a pass down cost from ASX.

- How much is the subscription to ASX Live prices?

-

ASX Live prices cost $27.5 incl GST per month which will enable dynamic live pricing on your trading platforms. Please email [email protected] to subscribe.

- Can I buy Exchange Traded Funds using your platform?

-

Yes. Simply search for the ETF code or name, click Buy and enter your order details.

- How do I place an order in the GO Markets Share Trading web platform?

-

Please visit the ‘How to’ page here for instructions and screenshots on how to place an order.

- How do I place an order in the GO Markets Share Trading mobile platform?

-

Please visit the ‘How to’ page here for instructions and screenshots on how to place an order.

- What is a Bid?

-

‘Bid’ is a term which represents the demand for a particular Security. The best bid price is the highest price that an investor is willing to pay.

- What is an Ask/Offer?

-

An ‘Ask’ or an ‘Offer’ is a term representing the supply for a particular Security. A best ask or offer price is the lowest price an investor is willing to sell.

- What is a Price step?

-

Price steps are the natural price interval movements of an ASX security. ASX securities have different price steps depending on the price range they are trading in.

Price step table

Example:Price Range Price Step 0.001c to 0.099c 0.001c 0.10c to $1.995 0.005c $2.00 to max 0.01c Security Share price Price step (-) Price step (+) MEI 0.057c 0.056c 0.055c 0.054c 0.058c 0.059c 0.06c LEL 0.42c 0.415c 0.41c 0.405c 0.425c 0.43c 0.435c BHP $47.85 $47.84 $47.83 $47.82 $47.86 $47.87 $47.88 - What does a Market to Limit order mean?

-

A Market-to-Limit order executes as a market order at the current best price. If the order is only partially filled, the remainder is submitted as a limit order with the limit price equal to the price at which the filled portion of the order executed.

- Why are my “Market to limit orders” getting rejected?

-

You may be placing your Market to limit orders during the auction phases, such as the Pre-open and the Pre CSPA. Please place limit orders during the auction phases and once the market is open, you’ll be able to place Market to limit orders.

- Is there a minimum value for buying shares?

-

The minimum value you can buy shares at is $500 (brokerage additional). This is known as the minimum marketable parcel rule. There is no minimum to place a sell order.

- What is the maximum order value I can place on a single order?

-

The maximum order value per order is set to $200,000. To place an order greater than $200,000 simply place multiple orders. E.g. to place an order in BHP worth $250,000, you will need to place 2 orders (1x $200,000) + (1 x $50,000).

- Why can’t I place orders too far away from the current market price?

-

To keep an orderly market, orders should be placed at or within current market prices. You can place orders that are within 50% away, but there are no guarantees that your order will not get purged if the price fluctuates.

- What order types are available?

-

The order types available are:

- Limit – An order instruction to buy or sell a stock at a specific price

- Market to Limit – A market order that converts to a limit order at the best opposing price on entry

- What is an Auction phase?

-

During this phase, orders can be entered, but they are not immediately matched (Bids and Asks orders can overlap). When the auction closes, an equilibrium price is calculated by the overlapping bids and offers where the orders are traded at the matched price. Only limit orders can be placed during these phase.

- What time does the ASX market open and close?

-

Normal trading hours for ASX are between 10:00AM and 04:00PM AEST.

Click here to view the equity market phase table. - What are Staggered Group opening times?

-

During the open phase (from 9:59:45 to 10:09:15) securities open in staggered stages based on the starting letter of their ASX code. This allows time for investors to prioritise and place their orders accordingly.

Refer to the Opening Phase Table for the different group opening times. - When would an order typically get rejected?

-

An order would typically get rejected if:

- You enter a price that is too far away from the current market price

- You try to sell stock you don’t own

- There are insufficient funds in your CMA to place a buy order

- Your buy order exceeds $100,000 in value

- The order breaches Market Integrity rules

- What markets/products can I trade?

-

GO Markets Securities offers DMA access to all ASX shares including LICs and ETFs.

- Are shares purchased through GO Markets Securities CHESS sponsored?

-

Yes. All shares bought through GO Markets Securities are CHESS sponsored and registered to your HIN.

- Can I trade in Exchange Traded Funds (ETFs)?

-

Yes. Simply enter the ETF code or name, click “Buy” or “Sell” and enter your order details.

- Are there any charges for amending or cancelling my orders?

-

Only during permitted times can you amend or cancel any unfilled orders. Once the order is fully filled, the trade is booked to your account and a contract note is sent to you. Fully filled orders cannot be amended or cancelled.

- How long are my orders valid for?

-

There are 3 different order validity options to place your orders.

- Good till Cancel – unfilled orders will remain active until cancelled or purged by the ASX

- Good for Day – Unfilled orders will be purged by the end of the day

- Good till Date – unfilled orders will remain active until the specified date or purged by the ASX

- What is a purged order?

-

Orders that are placed in the market can be purged (cancelled) by the Exchange for several reasons. An example of when the ASX will purge orders for a Security is an ex-dividend announcement. This allows investors to re-evaluate their order and re-do their if required.

- When does my Buy or Sell trade settle?

-

The settlement cycle for shares is 2 days after the trade date, which is commonly known as a ‘T+2 Settlement’. For buy trades, funds will be debited from your Macquarie CMA bank account in T+2.

For sell trades – the proceeds will be credited to your nominated bank account in T+2. - What is a Limit order?

-

A Limit order is an instruction to place the order at a specific price. A buy limit order can be placed at the current market price or lower, and a sell limit order can be placed at the current market price or higher.

- You can place Limit orders only

- Orders are not immediately matched

- You can place Limit orders only

- Orders are not immediately matched

- When the auction closes, an equilibrium price is calculated by the overlapping bids and offers where the orders are traded at the matched price

Share Trading Help Centre

Get the help you need to enjoy the best possible experience with GO Markets ASX Share Trading.

Share Trading Help Centre

Get the help you need to enjoy the best possible experience with GO Markets ASX Share Trading.

How-to guides

Platform user guides

Learn more about the platform’s features and abilities. For your preferred version, download:

Shares by GO Markets:

TradeCentre:

Forms

Please return all completed and signed forms to [email protected]

Macquarie Third Party Authority

Link your existing Macquarie Cash Management Account to your GO Markets account by completing our Third Party Authority form. Please include a copy of your bank statement along with this form when sending it to us.HIN Transfer

Transfer your HIN from another Broker to GO Markets at no cost. During the online account opening process, you can select Transfer my existing HIN and enter your existing broker details. Complete our HIN Transfer form, sign and return to our email. You’ll be notified by email once your HIN has arrived.Share Cost Price Update

Update your share cost price to accurately manage your shareholding portfolio.HIN Transfer + Share Cost Price Update

Transfer your HIN and update your share cost price in one form.Stock Transfer

Transfer individual stocks from another broker to GO Markets at no cost. Complete our Stock Transfer form, sign and return to our email. YOu’ll be notified by email once the stocks are transferred.Income Direction Authority

Nominate or change your bank details for dividend payments by completing our Income Direction Authority form. You’ll be notified by email once the details are updated.Issuer to HIN Conversion

To sell your Issuer shares, you must first convert your Issuer sponsored holding to your GO Markets Securities HIN.

Simply download and complete our Issuer to HIN Conversion form and we’ll process your request. You’ll be notified by email once your shares are available in your portfolio.Authorised Operator

Please use this form to authorise GO Markets Securities Pty Ltd (GO Markets) to provide information about your Share Trading account to a nominated Authorised Operator.Change of Address

Your CHESS Registration address is used to record all your Share investments and is used by the Share registries to send you Statements. Update your CHESS registration address using our Change of Address form. You’ll be notified by email once the address is updated.Off Market Transfer

An OMT is a transfer from one party to another resulting in a change of beneficial ownership. An example of an OMT is where you transfer your shareholding to a friend or a family member as a gift.The fee for an Off-Market Transfer (OMT) is $27.50 incl GST per shareholding and will be charged to your Trading account.

Note: Please seek advice from your Tax accountant for any tax implications with Off Market Transfers.

Frequently asked questions

Account Maintenance

General

Funding

Trading

Rate Card

Service Cost incl GST Details Brokerage Fee $7.70 per trade Below $100,000 Brokerage Fee 0.05% per trade Above $100,000 Phone orders $22.00 per order Telephone 03 8566 7680 Pro trading platform incl live prices and market depth $82.50 per month Customisable web based widgets trading platform. Platform provided by FinClear Mobile Trading Platform Nil Shares by GO Markets Securities Web Trading Platform Nil Shares by GO Markets Securities ASX Streaming Data (Retail) $27.5 per Month Contact [email protected] to subscribe ASX Streaming Data (Professional) $121 per Month Contact [email protected] to subscribe ASX Delayed Data Nil ASX Snapshot Level 1 Data NIL for the first 2,000 refresh/clicks per user, per month. Subsequent refresh/clicks are charged at $0.011 per Request ASX Snapshot Level 2 Data (Depth and Course of Sales) NIL for the first 2,000 refresh/clicks per user, per month. Subsequent refresh/clicks are charged at $0.0165 per Request ASX Market Announcement Real-time PDF Download and Headline $55.00 per Month ASX Market Announcement Delayed PDF Download and Headline Nil Off Market Transfer fee $27.50 per security SRN requests $22.00 per holding Bookings Correction $27.50 per security Manual bookings $11.00 per trade Cash – Dishonour fee $55.00 per failed trade Insufficient funds to settle a Buy trade Stock – Initial fail fee $275.00 per failed trade Insufficient holdings to settle a Sell trade Stock – subsequent fail fee $100 or 0.10% capped at $5,000 per security per day (subject to change) Insufficient holdings to settle a Sell trade. [NP1] [GG2] PID list

Broker CHESS PID ASX Settlement Participant GO Markets Securities 3557 FinClear CommSec 1402 Commsec CMC Markets 2662 CMC Markets SelfWealth 1136 OpenMarkets Morrison Securities Pty Limited 1088 Morrison Securities Macquarie Equities Limited 2442 Macquarie Equities NABTrade 1227 Wealthub Securities Bell Potter Securities Limited 2552 Bell Potter Superhero 1336 OpenMarkets ThinkMarkets 3557 FinClear *Information as at 21/08/2021. For a full list of broker and settlement participants, please visit the ASX website.

Equity Market Phases

Refer to table below for the different phases the market goes through on a single trading day. Different phases also determine the type of orders that can be placed. For example, a Market to Limit order will fail when placed outside the open phase. The Trading days are Monday to Friday except for the non-trading days defined by the ASX here.

MARKET PHASES TIMES (AEST)

DESCRIPTION Pre-open 7am – 10am Pre-opening takes place from 7:00 am to 10:00 am, Sydney time. During Pre-opening: Open 9:59:45 – 10:09:15 Staggered Group opening. When the auction closes, an equilibrium price is calculated by the overlapping bids and offers where the orders are traded at the matched price. Normal Trading 10am – 4pm Normal Trading takes place from 10:00 am to 4:00 pm, Sydney time. Orders are entered in a Price/Time Priority where orders are matched in a continuous basis. Pre CSPA 4pm – 4:10pm Between 4:00 pm and 4:10 pm Sydney time, the market is placed in Pre-CSPA (Closing auction). During Pre-CSPA: Closing Single Price Auction 4:10pm The Closing Single Price Auction takes place between 4:10* pm and 4:12 pm, Sydney time. *Random + 60 secs Adjust 4:12pm – 4:42pm The Adjust takes place from 4.12 pm to 4:42 pm, Sydney time. During this phase:

* Orders can be cancelled; certain amendments are allowed* No new orders can be placed in the MarketAdjust ON 4:42pm – 6:50pm This state is the same as the ADJUST session state. Purge Orders 6:50pm – 6:59pm Orders that are expired orders, too far from market etc will be centrally inactivated/purged. System Maintenance 6:59pm – 7pm Administration/system adjustment session state. Close 7pm – 7:30pm No Trading Messages may be entered or amended in ASX Trade and no matching or Auctions take place. System Unavailable 7:30pm – 2:25am The system processes the night batch during this session state – this involves the update and addition of securities. Close 2:25am – 7:00am No Trading Messages may be entered or amended in ASX Trade and no matching or Auctions take place. Opening Phase Table

The opening phase is staggered – this is divided into 5 groups based on the starting letter of their ASX code. This allows investors to organise and prioritise their orders accordingly. Refer to the table below for opening times for each group. Groups Open phase times random Starting letter of ASX code Stock can open between Group 1 10:00:00 AM +/- 15 Seconds A to B e.g. APT, BAP, BHP 9:59:45 to 10:00:15 Group 2 10:02:15 AM +/- 15 Seconds C to F e.g. CBA, DEG, FPH 10:02:00 to 10:02:30 Group 3 10:04:30 AM +/- 15 Seconds G to M e.g. GMG, KSL, MQG 10:04:15 to 10:04:45 Group 4 10:06:45 AM +/- 15 Seconds N to R e.g. NHF, PPH, RIO 10:06:30 to 10:07:00 Group 5 10:09:00 AM +/- 15 Seconds S to Z e.g. S32, VAL, Z1P… 10:08:45 to 10:09:15 Something else we can help with?

Our dedicated support staff are here to assist. If you have a question or need help, please contact us at [email protected] or on 1800 942 950.

For questions about products or subscriptions, please contact [email protected]

We’re here to help

Call 1800 942 950 or email us to talk about opening a trading account.

Contact us Monday to Friday, 8:30am to 5:30pm AEDT.

Please share your location to continue.

Check our help guide for more info.