- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

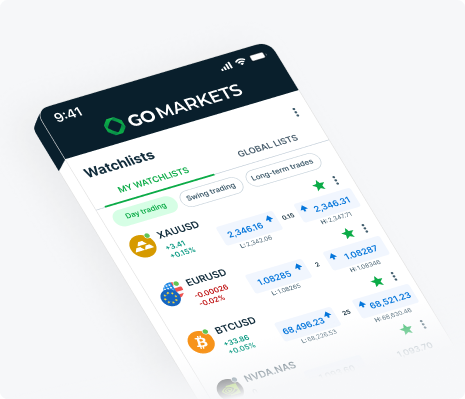

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

Open Account

CFD trading

Trade CFDs on forex, commodities, indices, and more.

Open accountTo open a CFD trading account as a Company, Trust, or SMSF, apply here.

Share trading

Invest in shares and ETFs on the Australian share market.

Open accountOpen a Personal or Company/Trust/SMSF share trading account.

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

US Election 2024

How did the US Election influence global markets?

Take advantage of expected

market volatility with a trusted broker.Excellent 4.8 out of 5

4.8 out of 5

Trump victory market gainers

Political shifts often bring a degree of uncertainty, resulting in increased market volatility.

Here are some of the big gainers as Donald Trump secured victory.

Trump victory market losers

Stay informed and monitor the markets closely, as post-election periods historically see major market fluctuations.

These were some of the biggest losers as the market reacted to the election result.Markets that move after the election

The markets to watch are major USD currency pairs, US stocks and indices, and commodities such as gold and oil.

Forex

EUR/USD, USD/JPY and GBP/USD are likely to be volatile – as investors move to price in the effects of changing policies.

Commodities

XAUUSD & Oil are likely to fluctuate in line with expectations for the country’s economic direction.

US Stocks & Indices

US stocks and indices, including the US 500 and Wall Street, are expected to experience major price movements with adjustments to corporate tax rates or regulatory environments.Reasons to trade the US Election with us

Spreads as low as 0.0 pips plus fast execution. Get a competitive pricing advantage across a choice of instruments.

$0 Commission on Gold Trades

Pay zero commission on Gold CFD trades and get low spreads from 0.06 points.

Extended hours on US Share CFDs

Trade the pre-market and after-market sessions, allowing you to take positions on US shares outside of normal market open hours.

Low-cost FX trading

Access micro, mini and standard FX contract sizes with our commission-free Standard account.

Manage your risk post-election

It’s important to check that your account is sufficiently capitalised, as well as making sure you are comfortable with your levels of exposure. Risk management strategies can protect your investments and minimise potential losses during increased market volatility.

Diversify your portfolio

A diverse portfolio involves a number of assets from a group of markets that do not share a strong correlation.

Ensure that you have exposures that reduce your overall portfolio risk, which will smooth out your PnL over high risk events such as the 2024 US Election.

Placing Stop-Loss orders

A Stop-Loss order is a market order that helps manage risk by closing your position once the asset reaches a certain price.

Historically, financial markets can experience rapid fluctuation and high volatility during the US Election. This strategy helps manage trading risk by specifying a price at which your position is closed out.Election Analysis

Evan Lucas provided regular insights and updates surrounding the election.

You can view all of Evan’s coverage on our US Election playlist.

Deposit fast and securely with 0% fees.

Ready to seize opportunity? Whether you're a new or active trader, we cater to how you trade.

Open accountMore reasons to trade with us

Deep liquidity with competitive spreads

Deep liquidity with competitive spreads

ASIC regulated broker

ASIC regulated broker

Trusted & Reliable

Trusted & Reliable

18 years of trading experience

18 years of trading experience

Award-winning client support

Award-winning client support

No deposit fees

No deposit fees

Please share your location to continue.

Check our help guide for more info.