Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for professionals and sophisticated investors.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Markets are navigating a familiar mix of macro and event risk with China growth signals, US inflation updates, central-bank guidance and earnings that will help confirm whether the growth narrative is broadening or narrowing.

At a glance

- China: Q4 GDP + December activity + PBOC decision

- US: PCE inflation (date per current BEA schedule)

- Japan: BOJ decision (JPY/carry sensitivity)

- Earnings: tech, industrials, energy, materials in focus

- Gold: near record highs (yields/USD/geopolitics watch)

Geopolitics remain fluid. Any escalation could shift risk sentiment quickly and produce price action that diverges from current baselines.

China

- China Q4 GDP: Monday, 19 January at 1:00 pm (AEDT)

- Retail sales: Monday, 19 January at 1:00 pm (AEDT)

- PBOC policy decision: Monday, 19 January at 12.30 pm (AEDT)

China’s Q4 GDP and December activity data, together with the PBOC decision, will shape expectations for China's growth momentum and the durability of policy support.

Market impact

- Commodity-linked FX: AUD and NZD may react if growth expectations or the policy tone shifts.

- Equities: The Shanghai Composite, Hang Seng and ASX 200 could respond to any change in how investors view demand and stimulus traction.

- Commodities: Industrial metals and oil may move on any reassessment of China-linked demand.

US

- PCE Inflation: Friday, 23 January at 2:00 am (AEDT)

- PSI: Friday, 23 January at 2:00 am (AEDT)

- S&P Flash (PMI): Saturday, 24 January at 1:45 am (AEDT)

- Netflix: Tuesday, 20 January 2026 at 8:00 am (AEDT)

The personal consumption expenditures (PCE) price index is the Federal Reserve’s preferred inflation gauge and a key input for rate expectations and (by extension) Treasury yields, the USD, and growth stocks. Markets are likely to focus on whether the reading changes the inflation path that is currently priced, rather than simply matching consensus.

Market impact

- USD: May move if rate expectations shift, particularly against JPY and EUR.

- US equities: Growth and small caps, including the Nasdaq and Russell 2000, may be sensitive if the data or interpretation challenge the current rate outlook.

- Gold futures: May be influenced indirectly via moves in Treasury yields and the USD.

Japan

Key reports

- Inflation: Friday, 23 January at 10:30 am (AEDT)

- Bank of Japan (BoJ) Interest Rate Meeting: Friday, 23 January at ~2:00 pm (AEDT)

Markets will focus on what the BOJ signals about inflation, wages and the policy path. A shift in tone can move JPY quickly and flow through to broader risk via carry positioning.

Market impact:

- JPY/USD pairs and crosses: Pairs are sensitive to any guidance change and the USD/JPY has broken above 158, but the move could reverse if the BOJ strikes a more hawkish tone.

- Japan equities and global sentiment: Could react if the dynamics shift.

- Broader risk assets: May be influenced via moves in the USD and volatility conditions.

US earnings

- Netflix: Tuesday, 20 January 2026 at 8:00 am (AEDT)

- Johnson & Johnson: Wednesday, 21 January at 10:20 pm (AEDT)

- Intel Corporation: Thursday, 22 January at 8:00 am (AEDT)

A busy week of US earnings is expected with large-cap names across multiple sectors reporting. Early results and, importantly, forward guidance may help clarify whether growth is broadening or becoming more selective.

With the S&P 500 close to the psychological 7,000 level, earnings could be a catalyst for a fresh test of highs or a pullback if guidance disappoints.

Market impact

- Upside scenario: Results that exceed expectations and are supported by steady guidance could support sector and broader market sentiment.

- Downside scenario: Cautious guidance, particularly on margins and capex, could weigh on individual names and spill into broader indices if it becomes a repeated message.

- Read-through: Early reporters in each sector may influence expectations for related stocks, especially where peers have not yet provided updated guidance.

- Bottom line: This is a week where the market may trade the forward picture more than the rear-view numbers. The key is whether guidance supports the idea of broad, durable growth, or whether it points to a more selective backdrop as 2026 unfolds.

Gold

Continued strength in gold may support gold equities and gold-linked ETFs relative to the broader market but geopolitical developments and policy uncertainty may influence demand for defensive assets.

A sustained reversal in gold could be interpreted by some market participants as a sign of improved risk confidence. The driver set matters, especially whether the move is led by yields, USD strength, or a fade in event risk.

The Australian Securities Exchange (ASX) is one of the world's top 20 exchanges, hosting over 2,000 listed companies worth approximately $2 trillion.

Quick Facts:

- The ASX operates as Australia's primary stock exchange, combining market trading, clearinghouse operations, and trade and payment settlement.

- It represents roughly 80% of the Australian equity market value through its flagship ASX 200 index.

- 2,000+ companies and 300+ ETFs are listed on the exchange, spanning from mining giants to tech innovators.

How does the ASX work?

The ASX combines three critical functions in one system.

As a market operator, it provides the electronic platform where buyers and sellers meet. Trading occurs through a sophisticated computer system that matches orders in milliseconds, replacing the traditional floor-based trading that once defined stock exchanges globally.

The exchange also acts as a clearinghouse, ensuring trades settle correctly. When you buy shares, the ASX guarantees the transaction completes, managing the transfer of securities and funds between parties.

Finally, it serves as a payments facilitator, processing the money flows that accompany each trade. This integrated approach reduces settlement risk and keeps the market running smoothly.

What are ASX trading hours?

The ASX operates from 10:00am to 4:00pm Sydney time (AEST/AEDT) on business days, with a pre-open phase from 7:00am.

Stocks open alphabetically in staggered intervals starting at 10:00am, followed by continuous trading until the closing auction at 4:00pm.

The exchange observes Australian public holidays and adjusts for daylight saving time between October and April, which can affect coordination with international markets.

| Phase | Sydney (AEST) | Tokyo (JST) | London (BST) | New York (EDT) |

|---|---|---|---|---|

| Pre-Open | 7:00am - 10:00am | 6:00am - 9:00am | 10:00pm - 1:00am | 5:00pm - 8:00pm* |

| Normal Trading | 10:00am - 4:00pm | 9:00am - 3:00pm | 1:00am - 7:00am | 8:00pm - 2:00am* |

| Closing Auction | 4:00pm - 4:10pm | 3:00pm - 3:10pm | 7:00am - 7:10am | 2:00am - 2:10am |

Top ASX Indices

S&P/ASX 200

This is the exchange's flagship index. It tracks the 200 largest companies by market capitalisation and represents approximately 80% of Australia's equity market.

It serves as the primary benchmark for most investors and fund managers and is rebalanced quarterly to ensure it reflects the current market leaders.

All Ordinaries Index

Commonly called the All Ords, this index covers the top 500 companies on the ASX.

It provides broader market exposure than the S&P/ASX 200, capturing roughly 80-90% of total market value.

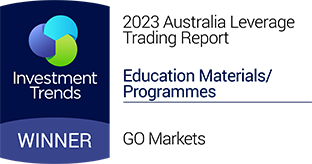

The 11 ASX sectors

The ASX also breaks down into 11 sector-specific indices, allowing investors to track performance in areas like financials, materials, healthcare, and technology.

These indices can help identify which parts of the Australian economy are strengthening or weakening.

- Financials dominates as the largest sector, driven by Commonwealth Bank, NAB, Westpac, and ANZ. These banking giants provide lending, wealth management, and insurance services across Australia.

- Materials ranks second, led by mining powerhouses BHP and Rio Tinto. This sector extracts and processes resources, including iron ore, coal, copper, and gold.

- Consumer Discretionary includes retailers, media companies, and hospitality groups that benefit when household spending rises.

- Industrials encompasses construction firms, airlines, and professional services businesses.

- Healthcare features companies like CSL, a global biotech leader, and Cochlear, which produces hearing implants.

- Real Estate features property developers and Real Estate Investment Trusts (REITs) that own and manage commercial and residential assets.

- Communication Services includes telecommunications providers like Telstra alongside media and entertainment companies.

- Energy tracks oil and gas producers (many renewable energy companies typically fall under utilities).

- Consumer Staples covers essential goods providers like supermarkets and food producers.

- Information Technology includes software developers and IT services firms.

- Utilities covers electricity, gas, and water suppliers, including renewable energy.

| ASX Symbol | Sector | Top Stocks | % of ASX 200 |

|---|---|---|---|

| XFJ | Financials | CBA, NAB, ANZ | 33.4% |

| XMJ | Materials | Orica, Amcor, BHP | 23.2% |

| XDJ | Consumer Discretionary | Harvey Norman, Crown | 7.4% |

| XNJ | Industrials | Qantas, Transurban | 7.4% |

| XHJ | Health Care | ResMed, CSL and Cochlear | 7.1% |

| XRE | Real Estate | Mirvac, LendLease, Westfield | 6.7% |

| XTJXIJ | Communication Services | Telstra, Airtasker | 3.7% |

| XEJ | Energy | Santos, Woodside | 3.6% |

| XSJ | Consumer Staples | Woolworths, Westfarmers | 3.4% |

| XIJ | Information Technology | Dicker Data, Xero | 2.5% |

| XUJ | Utilities | AGL, APA Group | 1.4% |

Top ASX companies

Three companies consistently lead the S&P/ASX 200 by market capitalisation.

Commonwealth Bank (Mkt cap: A$259 bln)

Commonwealth Bank holds the top position on the ASX as Australia's biggest lender.

Founded in 1911 and fully privatised by 1996, CBA offers retail banking, business lending, wealth management, and insurance.

Its performance often signals the health of the domestic economy.

BHP Group (Mkt cap: A$241 bln)

BHP Group stands as the world's largest mining company.

Its diversified portfolio spans iron ore, copper, coal, and nickel operations globally.

It serves as a bellwether for Australian commodity markets.

CSL Limited (Mkt cap: A$182 bln)

CSL Limited leads the Australian healthcare sector as a global biotech firm.

Established in 1916, CSL develops treatments for rare diseases and manufactures influenza vaccines.

The company demonstrates Australian innovation competing on the world stage.

ASX top 20 companies:

The ASX's role in Australia's economy

The ASX serves as a vital mechanism for capital formation in Australia. It tends to provide price signals that reflect market expectations.

When share prices rise, it suggests optimism about economic conditions. Falling markets may indicate concerns about future growth.

Australian companies raise funds through initial public offerings and follow-on share sales on the ASX, using proceeds to expand operations, fund research, or pay down debt.

Investors in these shares benefit from potential capital gains and dividend income. Many Australians build retirement savings through superannuation funds that invest heavily in ASX-listed companies.

Employment in financial services also depends partly on a healthy stock market. Brokers, analysts, fund managers, and supporting roles exist because of active capital markets.

Key takeaways

The ASX functions as a market operator, clearinghouse, and payments facilitator, providing the infrastructure that enables capital formation and supports retirement savings for millions of Australians.

Its flagship index, the S&P/ASX 200, tracks the 200 largest companies and captures about 80% of market capitalisation, while the All Ordinaries index covers the top 500.

Financials and Materials dominate the exchange, led by Commonwealth Bank, BHP, and CSL, reflecting Australia's strength in banking and resources.

You can trade the S&P/ASX 200 Index CFD and over 230 ASX Share CFDs on GO Markets.

US earnings season is where the market gets its cleanest burst of new information. For Australians, it usually lands while the country is asleep. This is not just “US company news”. It is the scoreboard for the Nasdaq, the S&P 500, and risk appetite more broadly, with spillover into SPI futures, the AUD, and sector mood at the ASX open.

What this guide covers

- The four-wave rhythm (why volatility often clusters around common predictable months)

- The order of play (banks → tech → retailers) and what each group tends to reveal

- Before market open (BMO) vs after market close (AMC)

- The few lines markets care about (surprise vs expectations, and the forward reset)

- How earnings information can flow through to Australia via futures, FX, and sector sentiment

US earnings season basics

Earnings season is the 4 to 6-week window after each quarter when most US-listed companies report a new set of numbers and a new story.

Calendar rhythm and clustering

Earnings does not arrive as a smooth drip. It typically arrives in four recurring waves. Most US reporting clusters around January, April, July, and October. Each wave covers the prior quarter, which is why markets spend the lead-up period building expectations, then reprice quickly as numbers and guidance hit.

The sequence is familiar: banks open, tech dominates the middle, retailers close. That order matters because each group updates a different part of the macro story. If you only track one set of reports, make it the Magnificent 7 — here’s the Mag 7 earnings calendar for 2026 (Aussie-friendly timing)

.png)

Time zones: the two windows

For Australians, the key is when the first move hits.

- AMC (after market close): often Sydney and Melbourne morning, sometimes near the ASX open

- BMO (before market open): often late night, with the initial reaction while Australia sleeps

Daylight saving shifts timings, but the pattern is usually consistent: two windows, often with different liquidity conditions.

How the market digests an earnings event

Earnings is rarely a single reaction. It is a sequence.

- Headline release (EPS and revenue versus consensus)

- Immediate price discovery (often in after-hours or pre-market liquidity)

- Call and Q&A (guidance, margins, and demand tone get tested)

- Next US cash session (follow-through, reversals, broader positioning)

- Australia opens into the aftershock (futures, FX, and sector mood already set)

Translation: volatility often clusters around reporting windows because the calendar can concentrate new information and repricing.

1. Expectations: the scoreboard the market uses

Markets do not price “good” or “bad” in isolation. They price the gap versus expectations, then adjust the forward story. That is why the same quarter can look strong on paper and still disappoint if it lands below what the market had already baked in.

Most headlines boil down to three checks. First, actual results versus consensus. Second, actual results versus what the company previously guided. Third, quality and durability. That tends to show up in margins, the mix across segments, and whether cash flow backs up the earnings number.

2. Guidance: the forward reset

Guidance is where the narrative can change without the quarter changing. A company can deliver the past cleanly, then move the goalposts for what comes next. That forward reset is often what drives the bigger repricing.

In practice, guidance usually lands in a few buckets. Revenue or EPS outlook sets the top-line and earnings path. Margin outlook tells you how confident management is about costs and pricing. Capex language signals how heavy the investment cycle is likely to be. Capital return talk, including buybacks, is a read on balance sheet posture and priorities.

Translation: markets trade forward narratives. Guidance is the mechanism.

3. The call: where tone can add context

Prepared remarks are polished. The call is where the market stress-tests the story. The Q&A is where the edges show up, because that is where analysts push on the parts that matter and management has to answer in real time.

Listen for the tells. Demand language can shift from broad to patchy. Pricing can move from power to pressure. Margin confidence can sound steady or start to carry caveats. And the “we are not breaking that out” moments matter too. What management avoids can be as informative as what it highlights.

4. Holding through the print

Some traders choose to reduce exposure if they’re holding through results, because gaps can occur and stops may not execute at expected levels. A practical risk lens is to consider an adverse gap scenario and assess whether the position size sits within your risk tolerance. If the position only “works” at a size that would be hard to tolerate in a gap, that is useful information too.

5. Trading the headline versus the aftermath

It can help to be clear on what is being traded:

- Trading the print can be high variance

- Trading the trend after can be cleaner

If exposed overnight from Australia, having a plan before the market prints can reduce reactive decisions. “I will figure it out at the open” often becomes another way of saying “I will react”.

Bottom line: this is the week where boring risk management beats clever narratives.

Mag 7: See what the market’s priced in ahead of earnings and what could trigger a repricing

Glossary (quick definitions)

- EPS: earnings per share

- Consensus: the market’s compiled estimate set

- Guidance: management’s forward-looking outlook ranges/comments

- Margins: profitability as a percentage of revenue

- Capex: capital expenditure (investment spend)

- BMO/AMC: before market open / after market close (US reporting labels)

- After-hours / pre-market: trading sessions outside regular US cash hours

- Correlation: how tightly assets move together (often rises in macro or de-risking periods)