- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Trading Strategies, Psychology

- Setting Up Phone MT5 Trading Notifications For Pending Orders

- Home

- News & analysis

- Trading Strategies, Psychology

- Setting Up Phone MT5 Trading Notifications For Pending Orders

- You will not be able to adjust a “trail stop” to lock in potential profit if the trade does go in your direction

- In the event of imminent economic data, you will not know to adjust such open positions to manage risks associated with this.

- Download the MT5 app on your mobile phone

- Allow to send “notifications”. Check in phone settings that it is set up.

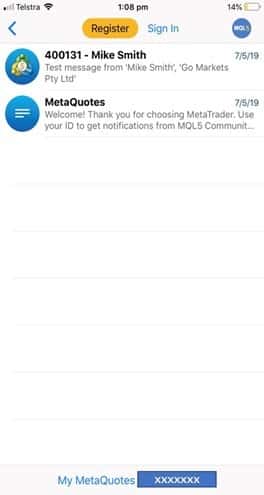

- Open the app and go to messages in settings and find your Metaquote ID at the bottom of the screen. Make a note of this (See diagram below).

- Open the MT5 platform on your PC

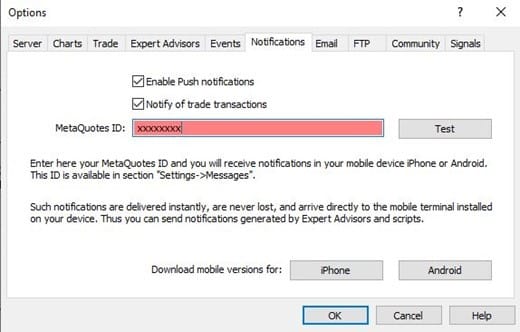

- In the tools menu, click on options and then the notifications tab.

- Enter your MetaquoteID in the pop-up box as shown below. Click on test

- You should receive a notification on phone that set up is complete and subsequently with any orders you place and that are filled.

News & analysisNews & analysis

News & analysisNews & analysisThe ability to set up phone notifications for trading activity on your MT5 platform has many advantages including of course the opportunity to “Check-in” on the market whist on the move.

It could be argued that this ability goes beyond simple convenience and in the case of “pending orders” could be viewed as an important part of risk management of trades that are opened through this method.

Pending orders revisited

Pending Orders are advanced entry orders that allow you to place an order onto the system that will be filled at a specific price level.

The key potential advantage is that you don’t have to be watching the market continuously for an order to be filled, and it can be filled at any time if the order is still active on the system.

An example could be placing a “Buy Stop” order above an identified resistance level, so if the relevant currency pair or CFD moves to this price point then the order will be filled at your chosen price (You can still place a stop loss and profit target associated with the pending order).

Although it a potentially attractive function of your Metatrader platform, one of the potential disadvantages is that without notifications set up you may not be aware that a trade has been entered until you are in a position to look at your trading platform on your PC for example.

Without this awareness of an “open” trade, the implications are:

Setting up phone notifications on your phone, is not only relatively simple but mitigates these potential disadvantages.

Setting up notifications

We will walk you through the set-up process on MT5 but is similar if you are using MT4.

Of course, feel free to contact the GO Markets team if you need additional support in setting this up at any time.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#ForexStrategy #ForexTrading #ForexTraining #ForexCourse #ForexEducation #ForexHelp #ForexAnalysis #FXSignal #MetaTrader #MetaTrader4 #MetaTrader5Next Article

Share CFDs: Know Your Costs

Many traders have the prudent approach that treats trading as you would a business. A critical component of this is to have a thorough knowledge of your expenditure in relation to your trading activity. With Share CFDs these are potentially fourfold, namely: Your cost of trading (e.g. brokerage) Your cost of holding a position The...

June 18, 2019Read More >Previous Article

Share CFDs: Know the costs.

Many traders have the prudent approach that treats trading as you would a business. A critical component of this is to have a thorough knowl...

June 13, 2019Read More >Please share your location to continue.

Check our help guide for more info.