Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

20 Years Strong

Celebrating 20 years of trading excellence.

Built for traders since 2006.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for professionals and sophisticated investors.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Three data levers dominate the US markets in February: growth, labour and inflation. Beyond those, policy communication, trade headlines and geopolitics can still matter, even when they are not tied to a scheduled release date.

Growth: business activity and trade

Early to mid-month indicators provide a read on whether US momentum is stabilising or softening into Q1.

Key dates

- Advance monthly retail sales: 10 Feb, 8:30 am (ET) / 11 Feb, 12:30 am (AEDT)

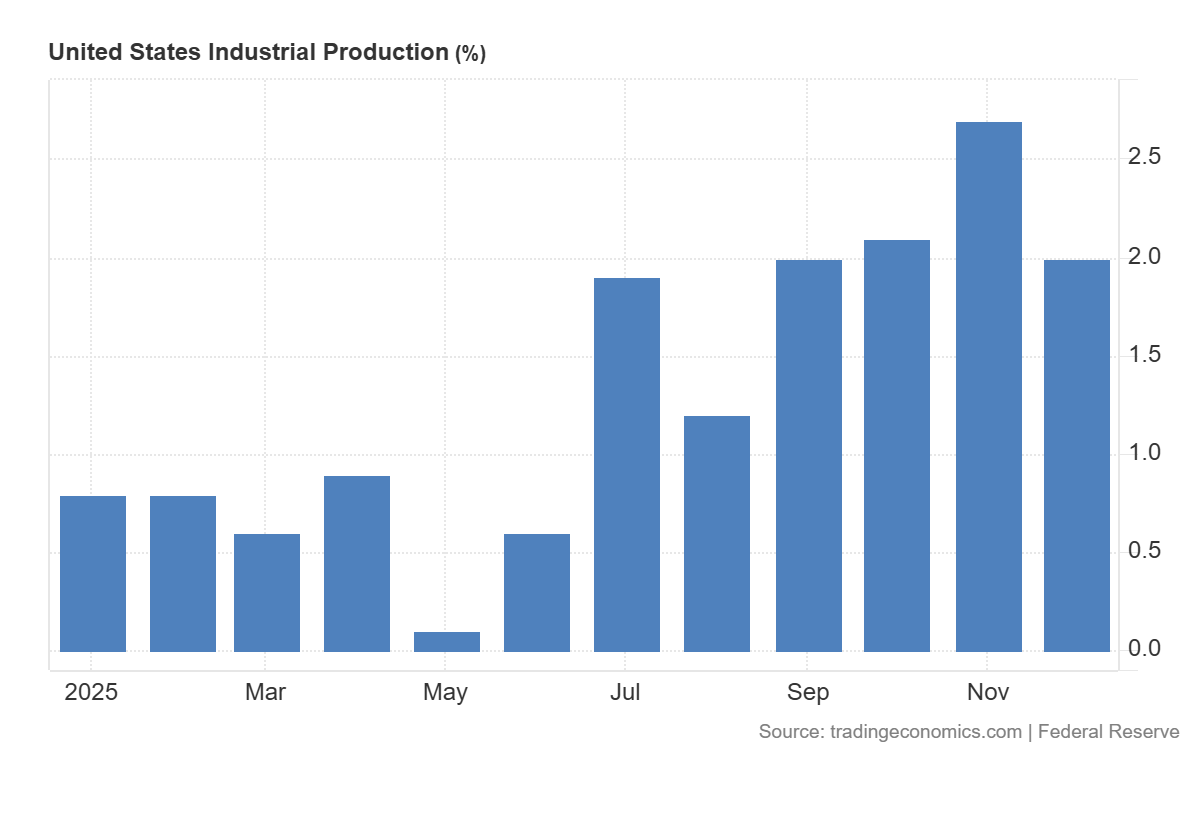

- Industrial Production and Capacity Utilisation: 18 Feb, 9:15 am (ET) / 19 Feb, 1:15 am (AEDT)

- International Trade in Goods and Services: 19 Feb, 8:30 am (ET) / 20 Feb, 12:30 am (AEDT)

What markets look for

Markets will be watching new orders and output trends in PMIs to gauge underlying demand momentum. Export and import data will offer insights into global trade flows and domestic consumption patterns. Traders will also assess whether manufacturing and services sectors remain in expansionary territory or show signs of contraction.

Market sensitivities

- Stronger growth can be associated with higher yields and a firmer USD, though inflation and policy expectations often dominate the rate response.

- Softer activity can be associated with lower yields and improved risk appetite, depending on inflation, positioning, and broader risk conditions.

Payrolls data

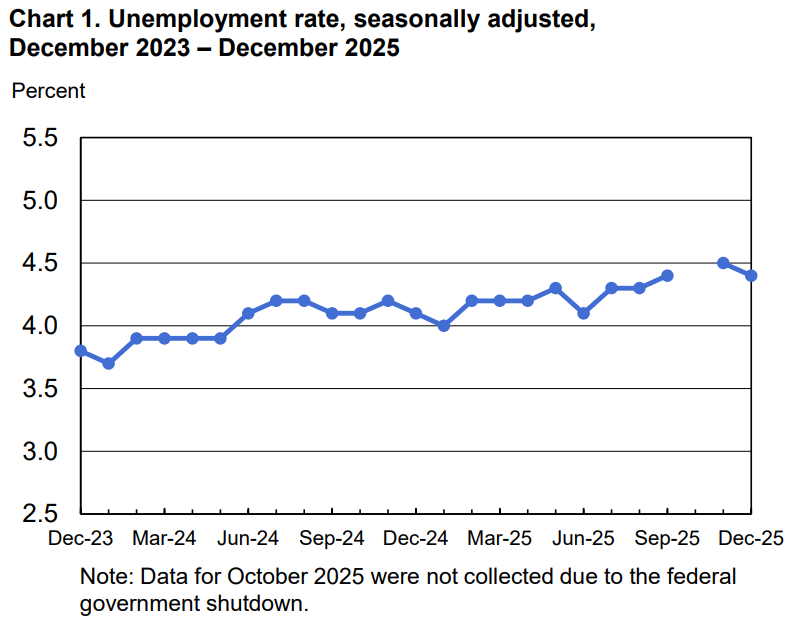

Labour conditions remain a direct input into rate expectations. The monthly NFP report, alongside the weekly jobless claims released every Thursday, is typically watched for signs of cooling or renewed tightness.

Key dates

- Employment Situation (nonfarm payrolls, unemployment, wages): 6 Feb, 8:30 am (ET) / 7 Feb, 12:30 am (AEDT)

What markets look for

Markets will focus on headline payrolls to assess the pace of job creation, the unemployment rate for signals of labour market slack, and average hourly earnings as a gauge of wage pressures. A gradual cooling can support the idea that wage pressures are easing. Persistent tightness may push out expectations for policy easing.

Market sensitivities

Payroll surprises frequently move Treasury yields and the USD quickly, with knock-on effects for equities and commodities.

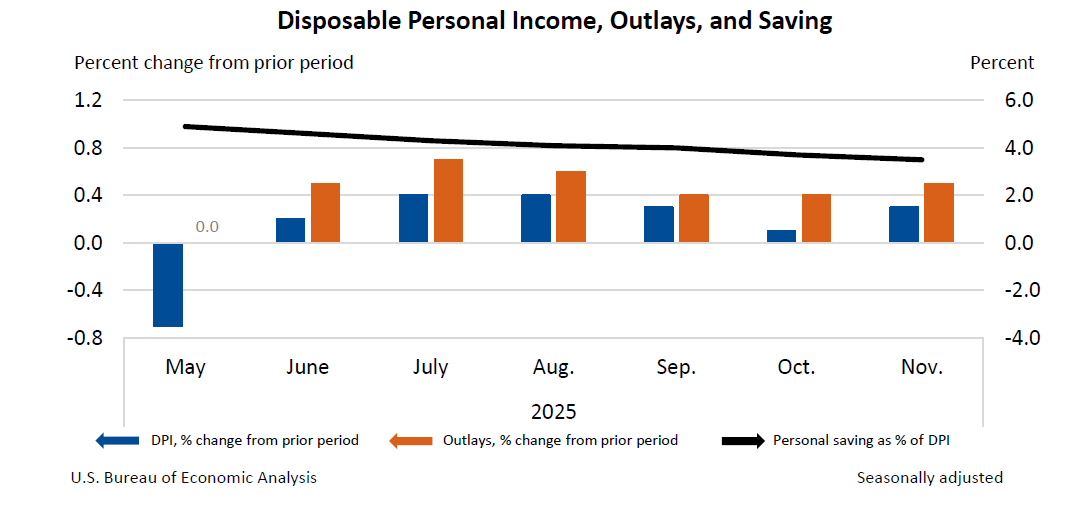

Inflation: CPI, PPI and PCE

Inflation releases remain a key input into expectations for the Fed’s policy path.

Key dates

- Consumer Price Index (CPI): 11 Feb, 8:30 am (ET) / 12 Feb, 12:30 am (AEDT)

- Personal Income and Outlays, including the PCE price index): 20 Feb, 8:30 am (ET) / 21 Feb, 12:30 am (AEDT)

- Producer Price Index (PPI): 27 Feb, 8:30 am (ET) / 28 Feb, 12:30 am (AEDT)

What markets look for

Producer prices can act as a pipeline signal. CPI and the PCE price index can help confirm whether inflation pressures are broadening or fading at the consumer level.

How rates and the USD can react

- Cooling inflation can support lower yields and a softer USD, though market reactions can vary.

- Sticky inflation can keep upward pressure on yields and financial conditions, especially if it shifts policy expectations.

Other influencing factors

Policy and communication

There is no scheduled February FOMC meeting, but speeches and other Fed communication, as well as the minutes cycle from prior meetings, can still influence expectations around the policy path. Without a decision event, markets often react to shifts in tone, or renewed emphasis on inflation persistence and labour conditions.

Trade and geopolitics

Trade flows and energy markets can remain secondary, and the risk profile is typically headline-driven rather than linked to scheduled releases.

The Office of the United States Trade Representative has published fact sheets and policy updates (including on US-India trade engagement) that may occasionally influence sector and supply-chain sentiment at the margin, depending on the substance and market focus at the time.

Separately, volatility tied to Middle East developments and any impact on energy pricing can filter into inflation expectations and bond yields. Weekly petroleum market data from the US Energy Information Administration is one input that markets often monitor for near-term signals.

Every four years, the Olympics does something markets understand very well: it concentrates attention. And when attention concentrates, so do headlines, narratives, positioning… and sometimes, price.

The Olympics isn’t just “two weeks of sport.” For traders, it’s a two-week global marketing and tourism event, delivered in real time, often while Australia is asleep.

So, let’s make this useful.

Scheduled dates: Friday 6 February to Sunday 22 February 2026

Where: Milan, Cortina d’Ampezzo, and alpine venues across northern Italy

What matters (and what doesn’t)

Matters

- Money moving early: Infrastructure, transport upgrades, sponsorship, media rights and tourism booking trends.

- Narrative amid liquidity: Themed trades can run harder than fundamentals, especially when volume shows up but can also reverse quickly.

- Earnings language: Traders often watch whether companies start referencing demand, bookings, ad spend, or guidance tailwinds.

Doesn’t

- Medal counts (controversial statement, I know).

Why the Olympics matter to markets

The Olympics are not just two weeks of sport. For host regions, they often reflect years of planning, investment and marketing and then all of that gets shoved into one concentrated global media moment. That’s why markets pay attention, even when the fundamentals haven’t suddenly reinvented themselves.

Here are a few themes host regions may see. Outcomes vary by host, timing, and the macro backdrop.

Theme map: where headlines usually cluster

Construction and materials

Logistics upgrades, transport links, and “sustainable” builds.

Luxury and tourism

Milan’s fashion-capital status starts turning into demand well before opening night.

Media and streaming

Advertising increases as audiences surge and platforms cash in.

Transport and travel

Airlines, hotels and travel tech riding the volume, and the expectations.

For Australian-based traders, the key idea is exposure, not geography. Italian listings aren’t required to see the theme while simultaneously, some people look for ASX-listed companies whose earnings may be linked to similar forces (travel demand, discretionary spend). The connection is not guaranteed. It depends on the business, the numbers and the valuation.

The ASX shortlist

The ASX shortlist is simply a way to organise the local market by exposure, so you can see which parts of the index are most likely to pick up the spillover. It is not a forecast and it is not a recommendation, it is a framework for tracking how a narrative moves from headlines into sector pricing, and for separating genuine theme exposure from names that are only catching the noise.

Wesfarmers (WES): broad retail exposure that gives a read on the local consumer.

Flight Centre (FLT): may offer higher exposure to travel cycles across retail and corporate.

Corporate Travel Management (CTD): business travel sensitivity, and it often reacts to conference and event demands.

The Aussie toolkit

The Olympics compresses attention, and when attention compresses, a handful of instruments tend to register it first while everything else just picks up noise. The whole point here is monitoring and discipline, not variety.

FX: the fastest headline absorber

Examples: EUR/USD, EUR/AUD, with AUD/JPY often watched as broader risk-sentiment signals.

What it captures: how markets are pricing European optimism, global risk appetite, and where capital is leaning in real time

Index benchmarks: the sentiment dashboard

Examples (index level): Euro Stoxx 50, DAX, FTSE, S&P 500.

What it can capture: whether a headline is broad enough to influence wider positioning, or whether it stays contained to a narrow theme.

Commodities: second order, often the amplifier

Examples: copper (industrial sensitivity), Brent/WTI (energy and geopolitics), gold (risk/uncertainty).

What it can capture: the bigger drivers (USD, rates, growth expectations, weather and geopolitics) with the Olympics usually acting as the wrapper rather than the engine.

Put together, this is not a prediction, and it is not a shopping list. It is a compact map of where the Olympics story is most likely to show itself first, where it might spread next, and where it sometimes shows up late, after everyone has already decided how they feel about it.

Your calendar is not Europe’s calendar

For Aussie traders, the Olympics is a two-week, overnight headline cycle. Much of the “live” information flow is likely to land during the European and US sessions. However, there are three windows to keep in mind.

Watch this space.

In the next piece, we’ll build the Euro checklist and map the volatility windows around Milano–Cortina so you can see when the market is actually pricing the story, and when it is just reacting to noise.

For over 110 years, the Federal Reserve (the Fed) has operated at a deliberate distance from the White House and Congress.

It is the only federal agency that doesn’t report to any single branch of government in the way most agencies do, and can implement policy without waiting for political approval.

These policies include interest rate decisions, adjusting the money supply, emergency lending to banks, capital reserve requirements for banks, and determining which financial institutions require heightened oversight.

The Fed can act independently on all these critical economic decisions and more.

But why does the US government enable this? And why is it that nearly every major economy has adopted a similar model for their central bank?

The foundation of Fed independence: the panic of 1907

The Fed was established in 1913 following the Panic of 1907, a major financial crisis. It saw major banks collapse, the stock market drop nearly 50%, and credit markets freeze across the country.

At the time, the US had no central authority to inject liquidity into the banking system during emergencies or to prevent cascading bank failures from toppling the entire economy.

J.P. Morgan personally orchestrated a bailout using his own fortune, highlighting just how fragile the US financial system had become.

The debate that followed revealed that while the US clearly needed a central bank, politicians were objectively seen as poorly positioned to run it.

Previous attempts at central banking had failed partly due to political interference. Presidents and Congress had used monetary policy to serve short-term political goals rather than long-term economic stability.

So it was decided that a stand-alone body responsible for making all major economic decisions would be created. Essentially, the Fed was created because politicians, who face elections and public pressure, couldn’t be relied upon to make unpopular decisions when needed for the long-term economy.

How does Fed independence work?

Although the Fed is designed to be an autonomous body, separate from political influence, it still has accountability to the US government (and thereby US voters).

The President is responsible for appointing the Fed Chair and the seven Governors of the Federal Reserve Board, subject to confirmation by the Senate.

Each Governor serves a 14-year term, and the Chair serves a four-year term. The Governors' terms are staggered to prevent any single administration from being able to change the entire board overnight.

Beyond this “main” board, there are twelve regional Federal Reserve Banks that operate across the country. Their presidents are appointed by private-sector boards and approved by the Fed's seven Governors. Five of these presidents vote on interest rates at any given time, alongside the seven Governors.

This creates a decentralised structure where no single person or political party can dictate monetary policy. Changing the Fed's direction requires consensus across multiple appointees from different administrations.

The case for Fed independence: Nixon, Burns, and the inflation hangover

The strongest argument for keeping the Fed independent comes from Nixon’s time as president in the 1970s.

Nixon pressured Fed Chair Arthur Burns to keep interest rates low in the lead-up to the 1972 election. Burns complied, and Nixon won in a landslide. Over the next decade, unemployment and inflation both rose simultaneously (commonly referred to now as “stagflation”).

By the late 1970s, inflation exceeded 13 per cent, Nixon was out of office, and it was time to appoint a new Fed chair.

That new Fed chair was Paul Volcker. And despite public and political pressure to bring down interest rates and reduce unemployment, he pushed the rate up to more than 19 per cent to try to break inflation.

The decision triggered a brutal recession, with unemployment hitting nearly 11 per cent.

But by the mid-1980s, inflation had dropped back into the low single digits.

Volcker stood firm where non-independent politicians would have backflipped in the face of plummeting poll numbers.

The “Volcker era” is now taught as a masterclass in why central banks need independence. The painful medicine worked because the Fed could withstand political backlash that would have broken a less autonomous institution.

Are other central banks independent?

Nearly every major developed economy has an independent central bank. The European Central Bank, Bank of Japan, Bank of England, Bank of Canada, and Reserve Bank of Australia all operate with similar autonomy from their governments as the Fed.

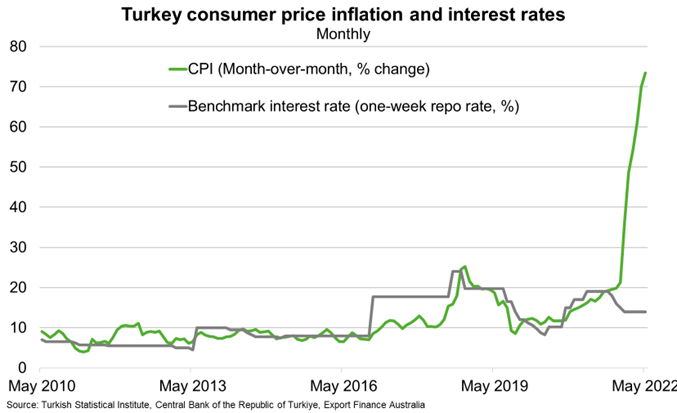

However, there are examples of developed nations that have moved away from independent central banks.

In Turkey, the president forced its central bank to maintain low rates even as inflation soared past 85 per cent. The decision served short-term political goals while devastating the purchasing power of everyday people.

Argentina's recurring economic crises have been exacerbated by monetary policy subordinated to political needs. Venezuela's hyperinflation accelerated after the government asserted greater control over its central bank.

The pattern tends to show that the more control the government has over monetary policy, the more the economy leans toward instability and higher inflation.

Independent central banks may not be perfect, but they have historically outperformed the alternative.

Why do markets care about Fed independence?

Markets generally prefer predictability, and independent central banks make more predictable decisions.

Fed officials often outline how they plan to adjust policy and what their preferred data points are.

Currently, the Consumer Price Index (CPI), Personal Consumption Expenditures (PCE) index, Bureau of Labor Statistics (BLS) monthly jobs reports, and quarterly GDP releases form expectations about the future path of interest rates.

This transparency and predictability help businesses map out investments, banks to set lending rates, and everyday people to plan major financial decisions.

When political influence infiltrates these decisions, it introduces uncertainty. Instead of following predictable patterns based on publicly released data, interest rates can shift based on electoral considerations or political preference, which makes long-term planning more difficult.

The markets react to this uncertainty through stock price volatility, potential bond yield rises, and fluctuating currency values.

The enduring logic

The independence of the Federal Reserve is about recognising that stable money and sustainable growth require institutions capable of making unpopular decisions when economic fundamentals demand them.

Elections will always create pressure for easier monetary conditions. Inflation will always tempt policymakers to delay painful adjustments. And the political calendar will never align perfectly with economic cycles.

Fed independence exists to navigate these eternal tensions, not perfectly, but better than political control has managed throughout history.

That's why this principle, forged in financial panics and refined through successive crises, remains central to how modern economies function. And it's why debates about central bank independence, whenever they arise, touch something fundamental about how democracies can maintain long-term prosperity.