- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- What is Fundamental Analysis, News and Fundamental Trading?

- Home

- News & analysis

- Shares and Indices

- What is Fundamental Analysis, News and Fundamental Trading?

- Quantitative – “related to information that can be shown in numbers and amounts.”

- Qualitative – “relating to the nature or standard of something, rather than to its quantity.”

News & analysisNews & analysis

News & analysisNews & analysis

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer to gauge is the Fear and Greed index, emotions trigger actions, there is a reason why there are sellers and buyers in the market at the same time, yes it can be attributed to the way people take in information or understand the data, in a normal day, there are always winners, as there are always losers. So, with that in mind you might understand that this information or data is truly important to traders as it impacts heavily on the markets, as such that, as a trader it would be irresponsible for you to focus solely on the Technical Analysis and disregard the Fundamentals. However, you could be able to trade Fundamentals without the Technical Analysis.

What is Fundamental News? The best way to answer this, is by acknowledging that the performance of an economy is a direct result of different political, social and economic outcomes. These could differ from the release of figures of the unemployment rate to interest rates, from elections to the GDP, to geopolitical events such as the invasion of Ukraine to a countries coup or BREXIT. All of these have profound effects on the price of commodities, currencies, bonds, or securities, as it would either make the asset easily accessible or as in recent times with COVID it makes is harder to supply it when there is huge demands.

Investors are always on the lookout for small details that would help them decipher if their investments are in sound condition or if they need to do something to avoid losing their positions.

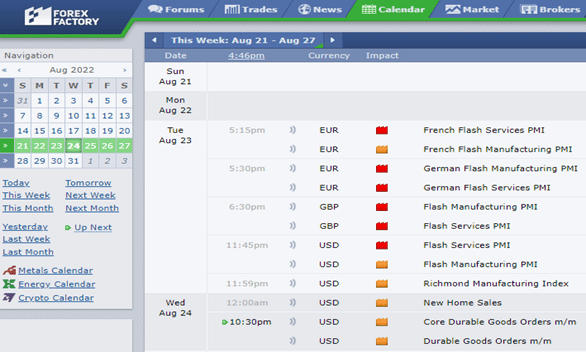

Typically, if you are trading CFDs you would look to an Economic Calendar – It’s just like a standard calendar, which provides timelines of specific reports and/or meetings which will take place in the future, from various countries around the world. You could see one here at Forex Factory. A great tool which will aid traders to set up their trades in advance or allow them to make a decision to see if it would be wise to keep a trade open during the event, or open a trade before or wait until the fact to enter the market.

As you begin to follow economic announcements, you may understand why some events—like the consumer price index—may cause markets to move. But you may wonder why it’s important to follow lesser events, like the food price index. Usually, a major event provides an indication of the state of the economy. But traders follow lesser events because they provide an indication of upcoming major announcements. For example, a jump in food prices may mean the consumer price index will jump as well. An example of an economic calendar is below.

Fundamental Analysis consists of the trader keeping track of all these factors within the reports and how they have affected the market. Fundamental analysis can also cover broader aspects of trading depending on the asset in question. The various fundamental factors can be grouped into two categories: quantitative and qualitative. The financial meaning of these terms isn’t much different from their standard definitions. Here is how a dictionary defines the terms:

In this context, quantitative fundamentals are hard numbers. They are the measurable characteristics of a business. That’s why the biggest source of quantitative data is financial statements. Revenue, profit, cash flow, assets, wages and more can be measured with great precision.

Fundamental Trading can be done in various ways depending on your availability – some reports are released late in the night or early morning depending on your perspective, which mean, you may be asleep so trading these may require a level of organisation from your part in terms of understanding how to set up pending orders, with the right risk management in place to take you out of the trade whether it has reached your desired profit limit or the amount you’d be happy to risk losing or trade the action live as you see the reaction of the price movement.

All In all Fundamental news, analysis and trading are a major facet of trading, it is also right to mention, that some fundamental traders would incorporate technical analysis from time to time to create stronger affirmations in their research.

Sources: babypips.com, https://www.contracts-for-difference.com/, https://www.investopedia.com/, www.forexfactory.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Opportunities await trading the JPY

With central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The country is Japan, and the consequence of the Central Bank of Japan’s ultra-dovish policy has been a massive weakening of its currency. Against almost all other currencies the JPY has been depreciating ag...

August 31, 2022Read More >Previous Article

Baidu beats Q2 estimates

Baidu Inc. (BIDU) reported its unaudited Q2 results on Tuesday. The Chinese technology company topped both revenue and earnings per share estimates fo...

August 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.