- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Warning Signs Of An Economic Storm Front

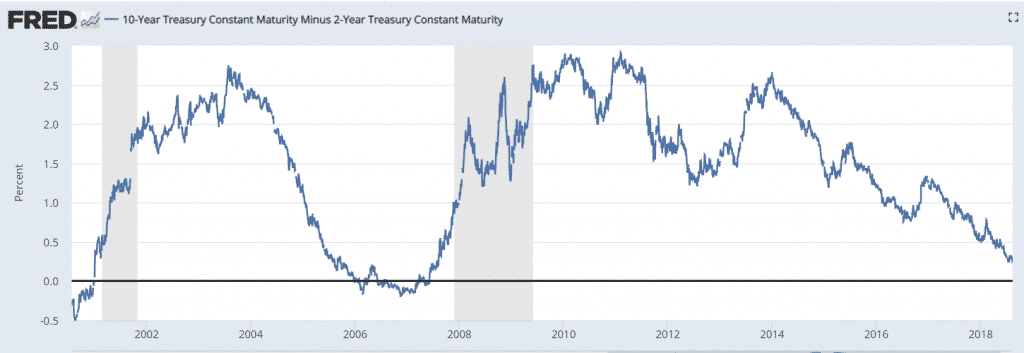

News & analysisIn Economics, the difference between 10 Year and 2 Year Bond Yields is one of the leading indicators that help investors to observe any significant changes in the economy. Let’s break things down a little further.

Firstly, common sense dictates that if you want to make a term deposit in the bank, the rate you can get from the long-term deposit will be more than short term.

Therefore, the spread between long-term and short-term return rate should always be positive, well, in most of the time. However in some historical periods, sometimes the yield spread would be “flatted” (i.e., drop close to zero) or even become negative, in some extreme cases. If that happens, where short-term returns are higher than long-term returns, this is seen as an economic overheat, and a recession is coming.

From the chart below, we can see that the current yield spread is heading towards zero. Since the Fed is guaranteed to have four rate hikes in 2018, and more increases are foreseeable in 2019, the spread is very likely to go negative sooner or later.

We’ll take a look that the previous cases of the inverted yield curve (i.e., negative yield spread)

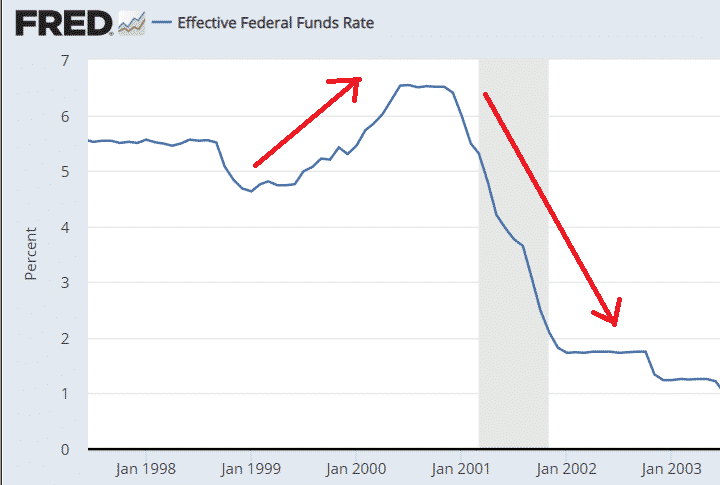

1. 2000’s Dotcom Bubble

The US Federal Reserve increased its interest rate from 4.75% to 6.5% in a brief time, between Jun 1999 to May 2000, which makes short-term yield soar rapidly and inverted yield curve occurred.

After the NASDAQ bubble burst, the Fed dropped its rates thirteen times in two years, to save its economy.

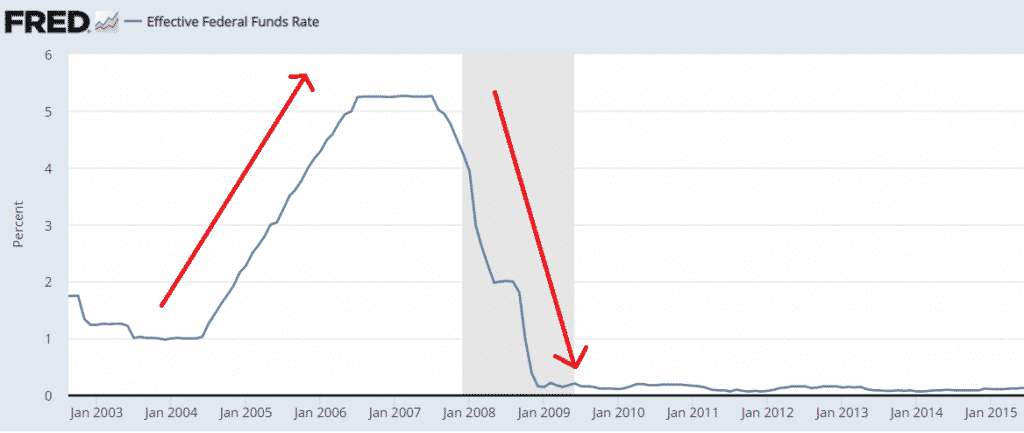

2. 2008’s Subprime Crisis

The same story happened all over again, the Fed first increased its rates 17 times, from 1% to 5.25%. At that time whole world’s economy reached its peak, there is a 6-7% average GDP growth in emerging markets, and even in advanced countries there is a 2.5% growth (which is a lot, compared with today’s growth in the UK)

However soon after the crisis triggered, the Fed dropped its rates from 5.25% to 0.00% in only one-year time and kept its zero-rate environment for almost a decade.

From the two lessons above, we can observe a similar pattern. Inverted yield curves consistently occurred near the end of the rate hike cycle, and a substantial economic recession would generally follow.

Currently, the US is in the middle of its rate hike cycle, and it seems many of the economic data reveals a sign of overheat. Take the unemployment rate as an example, last month it fell to 3.9%, which is an 18-year low. The performance of new jobs number is in one of the best periods of growths in recent history.

Although previous activity doesn’t necessarily predict future outcomes, history suggests once these figures reach their highest possible level, a turning point could be around the corner. There is a saying that lightning never strikes twice, we shall see in this case.

Lanson Chen

GO Markets Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: TradeEconomics.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

August No Ordinary Month For GBPJPY

As Brexit concerns continue to weigh heavy on Pound Sterling crosses, there's not much to discuss from a technical perspective. Evidence of an overall bearishness sentiment dominates the charts with a few corrective moves thrown in for good measure. However, sifting through the layers of Sterling sameness, I uncovered something interesting relatin...

August 20, 2018Read More >Previous Article

NAFTA Update – Have US Negotiations Progressed?

It’s been one year since the trade renegotiations on the North American Free Trade Agreement (NAFTA) between Canada, the United States and Mexico be...

August 16, 2018Read More >Please share your location to continue.

Check our help guide for more info.