- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- US stocks continued moving up overnight with the technology sector outperforming

- Home

- News & analysis

- Shares and Indices

- US stocks continued moving up overnight with the technology sector outperforming

News & analysisNews & analysis

News & analysisNews & analysisUS stocks continued moving up overnight with the technology sector outperforming

23 March 2022 By GO MarketsThe US technology sector rose again last night and worked back the losses from the previous day of trading as the market came to grips with the Federal Reserve’s announcement surrounding interest. Tesla was a standout performer and has seen a huge rise in the last week rising more than 20% and rising 7.91% overnight. The Nasdaq moved up 1.95%. The Dow Jones was slightly weaker as commodities had mixed results, although the index was still up by 0.74% and the S&P 500 finished the session up 1.13%.

In Europe, banks and financial stocks helped power the FTSE to a solid day up 0.5% and the DAX ended up 1% with similar strength shown in the financial sector as they look to benefit from rising interest rates.

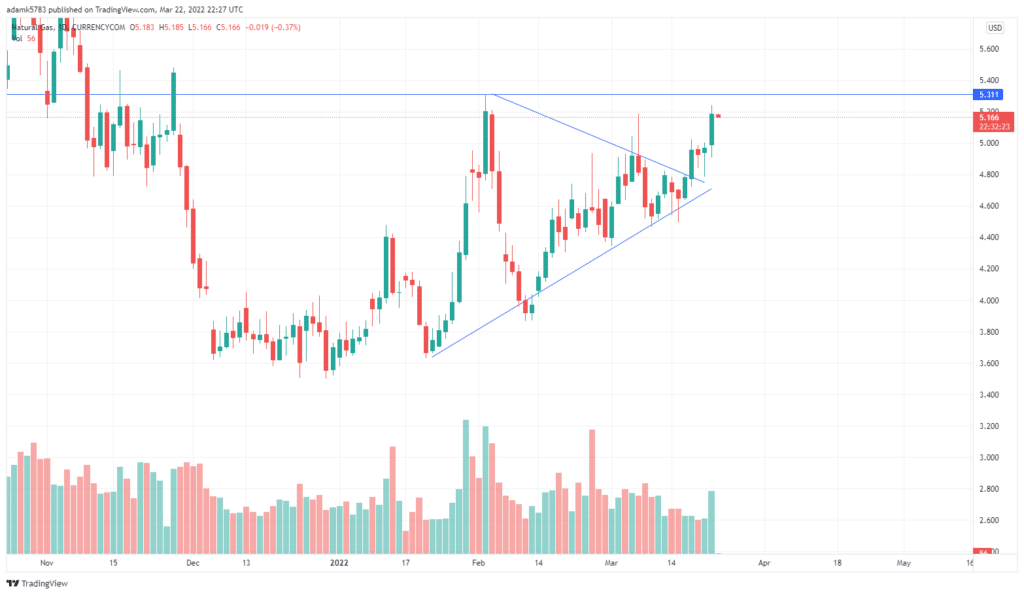

Commodities

Commodities saw relatively mixed results across the board. Gold was down 0.75% to 1920.80 as it continues to consolidate after pulling back from the highs a fortnight ago. Brent Crude Oil fell back 1.59% to USD 114.48. The commodity took a breath after rising 17.89% in the preceding three days. Natural gas has seen a breakout of its consolidation as it broke above $5.00. The spot price finished up 4.35% at $5.185.

Natural Gas daily chart

Cryptocurrency

Bitcoin had another solid session with the BTC/USD pair at $42,650 at 10.31 pm GMT. Bitcoin has continued its rally from the previous week which is up a combined total of 12.56%. Ethereum has performed even better with a 4.92 rise overnight and an 18.63% increase over the last two weeks. The price of ETH/USD is currently sitting just above $3000 at $3002.71 at 10.36 pm GMT.

FOREX

The AUD/USD has continued its move up. The price has broken out of its channel and is approaching $0.75. The EUR/USD, after selling down early in the day, the price was able to recover and then finish the day up 0.12% at $1.1029 as it continues its rally from the lows of two weeks ago. The USD/JPY is rocketing along as it approaches its long-term resistance at 125 JPY. Overnight the price broke through 120.00 JPY and closing at 120.092JPY, a 1.08% increase.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Oil spikes again on fears of supply shortages

US indices retraced overnight as the market took a step back to assess the recent rally. The Nasdaq finished down 1.32%, the Dow Jones Index was down 1.29% and the S&P 500 was 1.23% in the red. Despite the selling, the session was still a far cry from recent sell-offs. In Europe, the DAX slumped 1.31% after showing some strength early in the...

March 24, 2022Read More >Previous Article

Powell indicates higher interest rates to come as Oil jumps again

US indices were down today as Jerome Powell indicated that the Federal Reserve is going to increase interest rates at a higher and faster rate than cu...

March 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.