- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Uber posts better-than-expected Q4 results – the stock is rising

- Home

- News & analysis

- Shares and Indices

- Uber posts better-than-expected Q4 results – the stock is rising

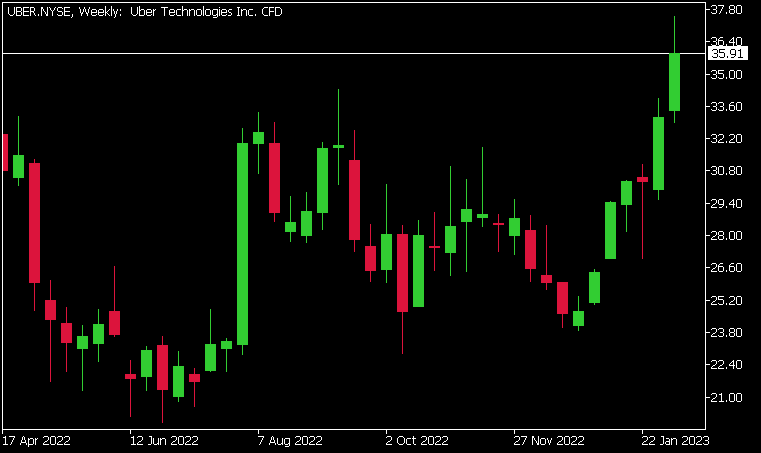

- 1 month: +26.77%

- 3 months: +35.37%

- Year-to-date: +45.33%

- 1 year: -10.57%

- Wedbush: $38

- Needham: $54

- Wolfe Research: $42

- Wells Fargo: $46

- Piper Sandler: $33

- Truist Securities: $60

- Cowen & Co.: $70

- Morgan Stanley: $54

- Mizuho: $46

- UBS: $36

- Barclays: $54

News & analysisNews & analysis

News & analysisNews & analysisUber posts better-than-expected Q4 results – the stock is rising

9 February 2023 By Klavs ValtersUber Technologies Inc. (NYSE:UBER) announced Q4 2022 financial results before the market open on Wall Street on Wednesday.

The US company posted better-than-expected results for the quarter, beating both revenue and earnings per share (EPS) forecasts.

Uber reported revenue of $8.607 billion (up by 47% year-over-year or 59% in constant currency) vs. $8.513 billion estimate.

EPS reported at $0.29 per share for the quarter. Analysts were expecting a loss per share of -$0.154.

It’s the first time since Q4 2021 that the company has reported higher-than-expected EPS.

CEO and CFO commentary

”We ended 2022 with our strongest quarter ever, with robust demand and record margins,” Dara Khosrowshahi, CEO of Uber.

”Our global scale and unique platform advantages position us well to accelerate this momentum into 2023.”

“In 2022, we significantly exceeded our profitability outlook, with an incremental margin of 10%,” Nelson Chai, CFO of the company added.

”Our outlook for a Gross Bookings and Adjusted EBITDA step up in Q1 builds on that progress, and sets us up for yet another record year.”

Stock reaction

Share price of Uber rose by around 2% on Wednesday and was trading at around $35.91 a share – the highest level since April 2022.

Stock performance

Uber stock price targets

Uber is the 204th largest company in the world with a market cap of $71.61 billion.

You can trade Uber Technologies Inc. (NYSE:UBER) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Uber Technologies Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Airbnb sets a new Q4 record – the stock is up

Airbnb Inc. (NASDAQ:ABNB) announced Q4 2022 and 2022 full year financial results after the market close in the US on Tuesday. World’s second largest travel company reported revenue of $1.902 billion (up by 24% year-over-year), beating analyst estimate of $1.861 billion. The revenue reported was the highest for a Q4 in Airbnb’s history. ...

February 15, 2023Read More >Previous Article

Where to next for the USDJPY?

The stronger-than-expected US non-farm employment change data release last week saw the DXY climb strongly higher, beyond the 103 price level. With ma...

February 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.