- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Trading The HK50 Index

News & analysisYou might have heard about Hong Kong in the news, recently they celebrated twenty years of “return to the motherland”. Before we discuss the HK50 index, it’s let’s briefly review the historical and political situation. You might be asking yourself, is Hong Kong a separate country or part of China?

Source: https://www.hsi.com.hk/HSI-Net/static/revamp/contents/en/dl_centre/factsheets/FS_HSIe.pdf

In the strictest sense, Hong Kong is part of China, her official name being Hong Kong Special Administrative Region of the People’s Republic of China. Confusingly, Hong Kong has her own immigration policy, money, stock exchange, postage stamps, flag, etc. This peculiar arrangement is due to the fact that Hong Kong was a British colony from 1841 to 1997. The treaty on “return” stipulated that Hong Kong would continue to operate in a different fashion than most of China, known as “One country, two systems”.

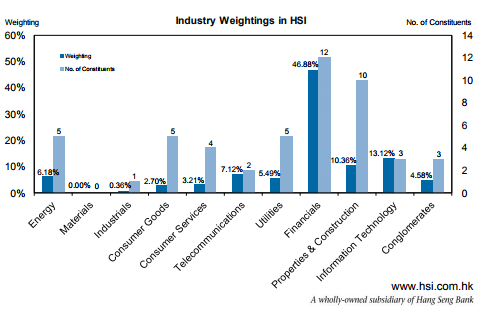

The Hang Seng 50 (HK50 on the GoTrader MT4) has a market capitalization-weighted index of 50 of the largest companies that trade on the Hong Kong Exchange. These companies cover approximately 65% of its total market capitalization. Finance represents almost half of the index. An additional quarter is weighted in information technology, properties, and telecommunications.

As you can see in the weekly view below, HK50 recently broke the 25,000 point mark for the first time in nearly two years. From an all-time high in April 2015, it was last over 25,000 in July 2015. Continuing a rally from January 2016 which saw the index drop to a five year low.

Source: Go Trader MT4 HK50

Despite the fact that the index’s constituent companies are listed in Hong Kong, 55% of the companies are based in China. A meteoric rise from 5% in 1997, 25% in 2003 and an all-time high of 59% in 2009. HK50 is tied at the hip to the Chinese economy.

How tied is HK50 to mainland Chinese companies you ask?

On Tuesday July 4th shares suffered their worst day in 2017, falling 1.5%, representing the biggest one-day percentage fall since December 15th. Tencent, one of the ten most valuable companies in the world, headquartered in nearby Shenzhen and making up nearly 11% of the composite. Tumbled 4% relating to recent negative comments around its popular one-line game products, we should continue to see growth as China’s first-quarter GDP growth hit 6.9%, the highest level since the fall.By: Samuel Hertz

GO MarketsReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

The Bank of England Rate Decision

The Bank of England on the 3rd August, will announce whether they will increase, decrease or maintain the key interest for the United Kingdom. In this article we will look ahead with some industry experts and see how the UK economy performed last quarter. Who decides the rates? Interest rates are set by the Bank of England’s Monetary Policy Co...

July 28, 2017Read More >Previous Article

Qatar Turmoil Continues

On 23rd June 2017, Saudi Arabia and its allies issued a list of demands giving Qatar 10 days to respond to their ultimatum. It has now been just over ...

July 10, 2017Read More >Please share your location to continue.

Check our help guide for more info.