- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Short Term Break Out on the S&P500

News & analysisThe S&P 500 has been battered and bruised in one of the worst first half of the years in history. However, there are some signs that it may be turning.

A short term long buying opportunity on the SPY looks to be apparent. With the recent bullish sentiment due to the market believing that much of the forecast slowing growth and interest rate hikes have been prices into the market already.

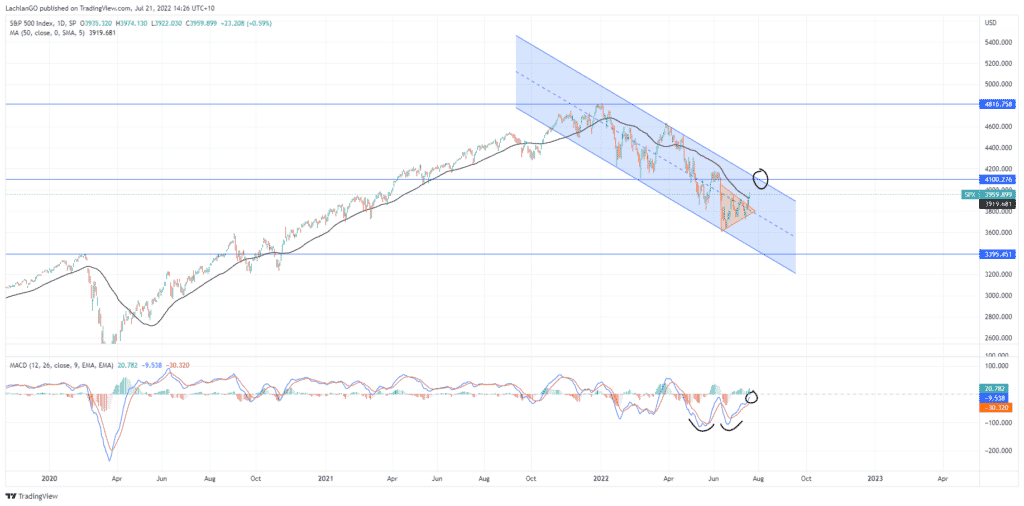

The trading opportunity is a technical breakout of a wedge pattern on the daily chart. Firstly it is important to recognise that the S&P500 is still in a longer term down trend. This can be seen on the chart below. Since December 2021 the SPX has been in a downward channel making a series of lower highs and lower lows. Therefore it is important to understand that this opportunity will be against the longer general trend of the market.

The Chart

On the chart the wedge at the bottom of the channel has broken to the upside. Without this break it could’ve been possible that this would’ve formed into a bear flag. However on the contrary, it looks to have developed into a reversal pattern, as the price has coiled. Furthermore, and importantly, the price has broken above the 50 day average. This is also supported by the MACD. The MACD is not just showing a crossover. To add support to the reversal, the MACD is showing a double bottom pattern of exhaustion as it looks to break over the zero line for the first time since April.

A conservative target would be the convergence of the next level of resistance and also the top line of the channel. This is a 4100 target. If the index can break through 4100 level and continue to rise to 4230. As stated previously the second move up will likely face a large amount of resistance as it is fighting the general trend and against a fairly strong resistance point.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Is the AUDUSD ready to reverse?

Recent History The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and recession fears have seen investors turn to the USD whilst at the same time taking off risk from the AUD. The AUD's drop has also been further is largely due to a decrease in the price of commodities...

July 21, 2022Read More >Previous Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from bet...

July 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.