- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Salesforce tops estimates

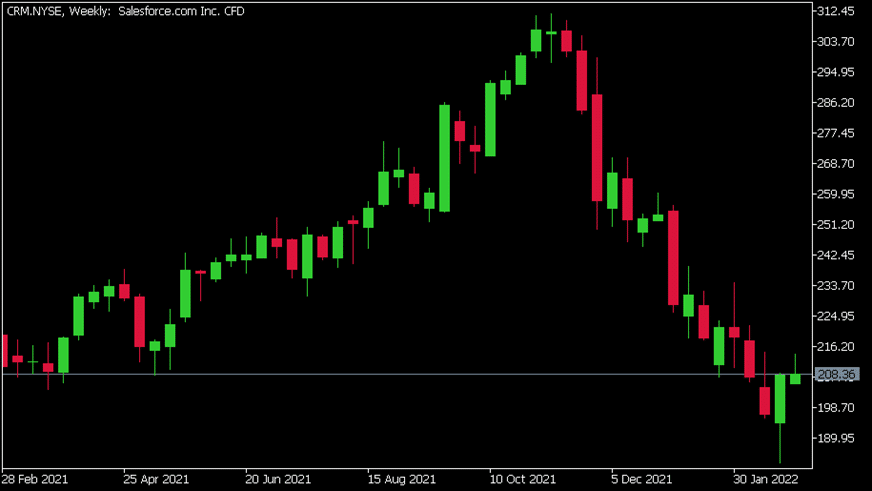

- 1 Month: -10.01%

- 3 Month: -26.69%

- Year-to-date: -17.80%

- 1 Year: -2.15%

News & analysisSalesforce.com Inc. (CRM) reported its fourth-quarter earnings results after the closing bell over Wall Street today – surpassing analyst expectations.

World’s leading customer relationship management (CRM) company reported revenue of $7.326 billion (an increase of 26% year-over-year) vs. $7.242 billion expected.

Earnings per share reported at $0.84 a share vs. $0.75 a share expected.

”We had another phenomenal quarter and full-year of financial results,” Marc Benioff, Chair and Co-CEO of Salesforce said following the latest results.

”As we continue to see tremendous demand from customers, we’re raising our FY23 re venue guidance to $32.1 billion at the high-end of range, with non-GAAP operating margin of 20%, and operating cash flow growth of 22% year-over-year,” Benioff continued.

Bret Taylor, Co-CEO of Salesforce, also commented on the strong financial results: ”With our customers’ success driving our financial success, we’re generating disciplined, profitable growth at scale quarter after quarter.”

”Our Customer 360 platform has never been more strategic or relevant in driving the growth and resilience of our customers around the world.”

Salesforce.com Inc. (CRM)

Share price of Salesforce was little changed at the end of the trading day on Wall Street Tuesday, down by 0.78% at $208.36 per share.

Here is how the stock has performed in the past year –

Salesforce.com Inc. is the 51st largest company in the world with total market cap of $205.75 billion.

You can trade Salesforce.com Inc. (CRM) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Salesforce.com Inc., TradingView, MetaTrader 5, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

NIO’s February delivery numbers are in

NIO Inc. (NIO) reported its latest delivery numbers for February on Tuesday. The Chinese electric vehicle company delivered 6,131 cars last month – an increase of 9.9% year-over-year. The deliveries in February consisted of: 1,084 ES8s – the company’s six-seater or seven-seater flagship premium smart electric SUV 3,309 ES6s – ...

March 2, 2022Read More >Previous Article

Surging commodities and high volatility the theme as the Ukraine conflict continues

US and European equity markets remained volatile as fighting between Russian and Ukraine forces continued and negotiation talks failed to result in an...

March 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.