- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

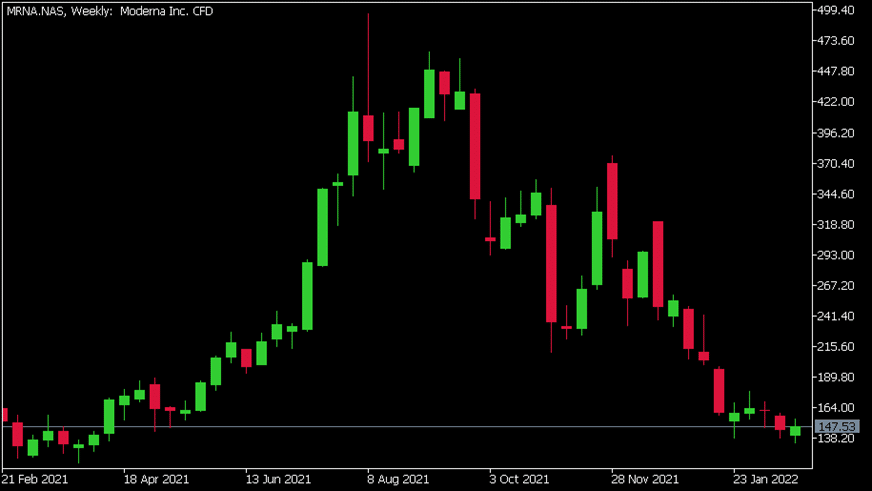

- Moderna gets a boost

- 1 Month: +0.18%

- 3 Month: -45.54%

- Year-to-date: -41.38%

- 1 Year: +0.34%

News & analysisModerna Inc. (MRNA) reported it latest financial numbers before the opening bell in the US on Thursday.

The pharmaceutical company reported results that beat Wall Street estimates, sending the stock price higher on the day.

Total revenue reported at $7.211 billion in the fourth quarter vs. $6.798 billion expected.

Earnings per share at $11.29 per share vs. estimate of $9.96 per share.

Stéphane Bancel, CEO of Moderna commented on the last year’s performance following the latest results: “In 2021, we delivered 807 million doses with approximately 25% of those doses going to low- and middle-income countries, and we will continue to scale in 2022 to help end the COVID-19 pandemic. Moderna has experienced exponential growth and we have more than doubled the size of our team over the last year with a global team of 3,000. We also have announced plans to scale to 21 commercial subsidiaries across the world, including four new locations in Asia and six new locations in Europe. We continue to expand and advance our industry-leading mRNA pipeline with 44 programs in development. We look forward to clinical readouts from our therapeutics development candidates later in 2022 in rare genetic diseases and oncology. We are entering 2022 with a remarkable team and strategic priorities to continue advancing mRNA vaccines and therapeutics to impact human health.”

Moderna Inc. (MRNA) chart (Weekly)

Share price of Moderna surged by over 10% during Thursday, trading at $147.53 per share.

Here is how the stock has performed in the past year –

Moderna Inc. is the 274th largest company in the world and 21st largest pharmaceutical company with a total market cap of $59.54 billion.

You can trade Moderna Inc. (MRNA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Moderna Inc., TradingView, MetaTrader 5, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

GOLD and how it moves in times of crisis

For years, gold has been considered a store of value. As a physical commodity, it cannot be printed like money, and its value is not impacted by interest rate decisions made by a government. Because gold has historically maintained its value over time, it serves as a form of insurance against adverse economic events. When an adverse event occur...

February 25, 2022Read More >Previous Article

Below expectations – Beyond Meat falls short in Q4

Beyond Meat Inc. reported their latest financial results for Q4 2021 after the closing bell on Wall Street today. The US plant-based meat substitut...

February 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.