- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- First Quarter Overview – Massive Swings and Volatility in Stock Markets

- Home

- News & analysis

- Shares and Indices

- First Quarter Overview – Massive Swings and Volatility in Stock Markets

News & analysisNews & analysis

News & analysisNews & analysisFirst Quarter Overview – Massive Swings and Volatility in Stock Markets

17 April 2018 By GO MarketsFirst Quarter Overview – Massive Swings and Volatility in Stock Markets

First quarter of the year ended with markets experiencing massive swings and volatility. Higher bond yields, revised inflation expectations and a potential trade war brought fears to the markets, making investors very sensitive to any economic data releases or changes in the markets.

Markets were comfortable to the “artificial” low interest rates for a decade.

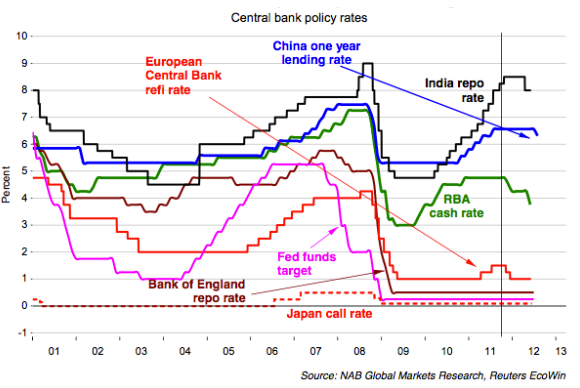

Higher bond yields rattled the markets as investors realized that the “era of low interest rates which was created artificially by quantitative easing” is coming to an end. After the financial crisis in 2008, major central banks across the world cut their base lending rates. The below graph depicts the dramatic change in interest rates after the crisis.

With a stronger global economy, central banks have started unwinding the post-GFC monetary stimulus and policymakers are ready to change their stance on interest rates which are putting pressure on the bond markets

Traders are in a fragile state of mind as higher interest rates mean that safer bonds are offering greater returns, making risky stocks less attractive.

After February’s tumble, stock markets’ volatility soared on the aggressive tariffs stance taken by President Trump. A potential trade war between China and U.S, the world’s two largest economies, are threatening the spectrum of global trade.

Even though President Trump is confident that “trade wars are good and easy to win”, it seems that he is forgetting that history is telling a different story.

Markets are swinging between risk off and risk on mode following any tit-for-tat response from the US and China. At the Boao Forum, President Xi’s speech managed to ease some concerns, but investors stay worried as the unpredictability and uncertainty around global trade could put considerable pressure on the markets.Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

World’s Largest Banks

World's Largest Banks By Klavs Valters Banks play a significant role in our day-to-day lives and as the global economy continues to expand year-on-year, they will continue to do so. Even though the United States has the largest economy by Gross Domestic Product (GDP), China dominates the list of the biggest banks in the world (by asset value), w...

May 7, 2018Read More >Previous Article

Amazon on Track to Become a $1 Trillion Company

Amazon on Track to Become a $1 Trillion Company By Klavs Valters With Apple close to becoming the first company in the world to reach $1 tril...

March 22, 2018Read More >Please share your location to continue.

Check our help guide for more info.