- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Below expectations – Beyond Meat falls short in Q4

- Home

- News & analysis

- Shares and Indices

- Below expectations – Beyond Meat falls short in Q4

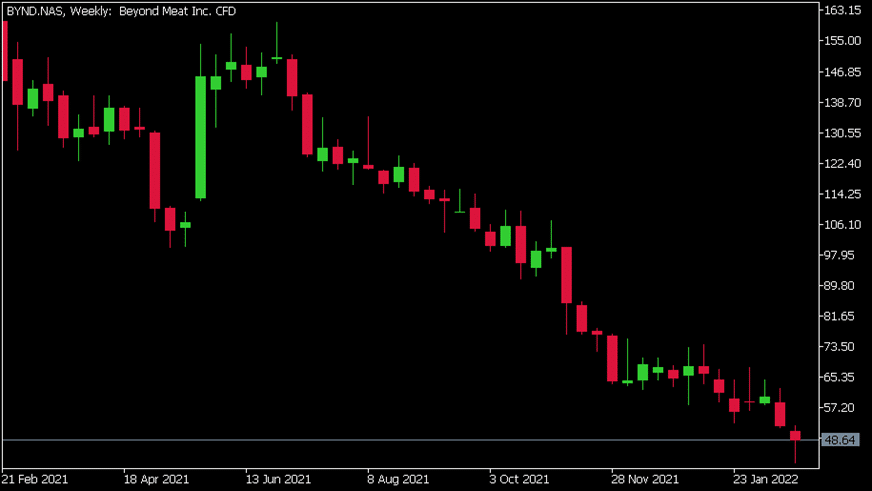

- 1 Month: -13.37%

- 3 Month: -35.14%

- Year-to-date: -24.80%

- 1 Year: -65.91%

News & analysisNews & analysis

News & analysisNews & analysisBeyond Meat Inc. reported their latest financial results for Q4 2021 after the closing bell on Wall Street today.

The US plant-based meat substitute producer company fell short of analyst expectations for the last quarter, sending the stock price lower in the after-market hours.

The company reported revenue of $100.678 million in Q4 (decrease of 1.2% year-over-year) vs. $101.044 million expected.

Loss per share reported at -$1.27 a share, way above analyst forecast -$0.70 a share.

Net revenue for 2021 at $464.7 million – an increase of 14.2% year-over-year.

“In 2021 we saw strong growth in our international channel net revenues, as well as sporadic yet promising signs of a resumption of growth in U.S. foodservice channel net revenues as COVID-19 variants peaked and declined. These gains, however, were dampened by what we believe to be a temporary disruption in U.S. retail growth, for our brand and the broader category. Despite the variability and challenges of the year, we did not deviate from building the foundation for our long-term growth. The investments we made in our team, infrastructure, and capabilities across the U.S., EU, and China, as well as extensive product scaling activities for key strategic partners, weighed heavily on operating expenses and gross margin during a fourth quarter and year that were already impacted by lower than expected volumes. However, we believe these investments will be instrumental in driving our long-term growth,” Ethan Brown, Beyond Meat CEO said in a statement following the latest financial results from the company.

“As we begin 2022, we are pleased with the progress we are making against our long-term strategy, such as the number of tests and core menu placements recently announced by our global QSR partners. Though we will continue to invest during 2022, we expect to substantially moderate the growth of our operating expenses as we leverage the building blocks we now have in place to serve our customers, consumers, and markets — bringing forward our exciting and expansive future one delicious serving at a time,” Brown added.

Beyond Meat Inc. (BYND) chart (Weekly)

Shares of Beyond Meat were up by 3.38% on Thursday at $48.64. However, the stock fell sharply in the after-hours – down by around 10%.

Here is how the stock has performed in the past year –

Beyond Meat Inc. is the 2973rd largest company in the world with total market cap of $3.10 billion.

You can trade Beyond Meat Inc. (BYND) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Beyond Meat Inc., TradingView, MetaTrader 5, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Moderna gets a boost

Moderna Inc. (MRNA) reported it latest financial numbers before the opening bell in the US on Thursday. The pharmaceutical company reported results that beat Wall Street estimates, sending the stock price higher on the day. Total revenue reported at $7.211 billion in the fourth quarter vs. $6.798 billion expected. Earnings per share at $11...

February 25, 2022Read More >Previous Article

How to identify key resistance levels

A resistance level is a key tool in technical analysis, indicating when an asset has reached a price level that market participants are unwilling to s...

February 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.