- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Bank of Japan opts for negative interest rate, but Yen soars

- Home

- News & analysis

- Shares and Indices

- Bank of Japan opts for negative interest rate, but Yen soars

News & analysisNews & analysis

News & analysisNews & analysisJust days before Japan’s unexpected negative rate announcements, the country’s central bank chief Haruhiko Kuroda was quoted in an interview where he said he was optimistic about the Japanese economy.

In the same interview, he iterated that while he closely monitors the stock markets, he was not overly concerned that the current turmoil in financial markets would have any severe impact on the real economy. He ended by saying that he saw a much improved future for Japan over the course of the next year.

However, only a few days after this interview and in a desperate move to save his country’s worsening economic conditions, the Bank of Japan (BOJ) surprised the world by announcing a negative interest rate policy for the first time in its history.

Under this policy, effective from 16thof Feb 2016, Japanese banks have to pay 0.1% to BOJ for their marginal excess reserves that they kept at the central bank.

Why Negative Rates?

The decision to turn to negative rates came after BOJ was unsuccessful in restoring Japan’s economy following many rounds of stimulus packages and easing monetary policies. By bringing the rates down to negative territory, Mr. Kuroda is hoping to put more pressure on banks to increase their lending activities in order to prop up the economy. Also, BOJ is anxiously hoping to be able to motivate corporate Japan to get their massive cash holdings to work or to even move those funds overseas in search for better yields. Capital outflows will inherently push the yen lower against other currencies; a consequence that BOJ is greatly fond of.

Also, BOJ is hoping to motivate corporate Japan to get their massive cash holdings to work or to even move those funds overseas in search for better yields. Capital outflows will inherently push the yen lower against other currencies; a consequence that BOJ is greatly fond of.

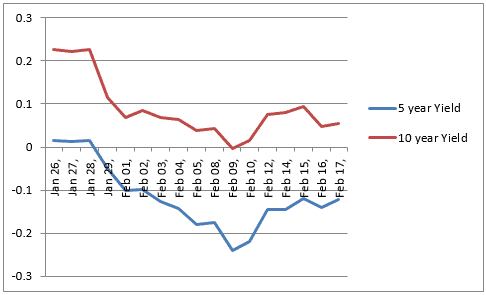

Japan’s 5 and 10 year government bond yields The FX market’s unexpected reaction

Every FX trader knows that interest rates have a direct impact on currencies. So when the interest rate goes up (down), the currency with higher (lower) interest rate will appreciate (depreciate) against those with unchanged or lower (higher) interest rates. According to this theory, now that the BOJ are pursuing negative rates, we should see the yen posting significant declines. This theory worked, but only very temporarily.

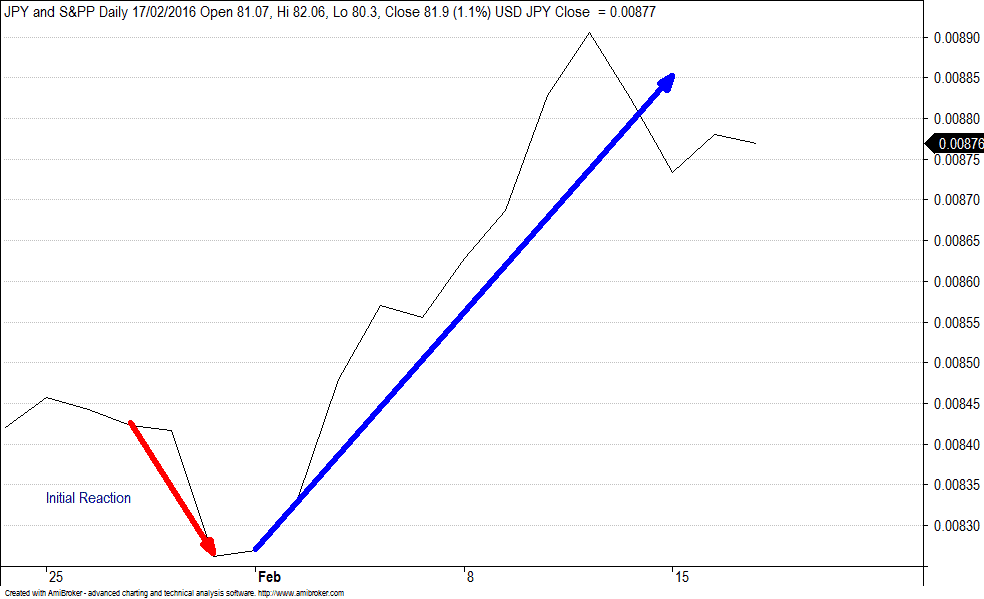

The red arrow in the graph below shows the yen reaction after the news broke out. As you can see, the initial reaction was to a lower yen.

However, this didn’t last long and the Japanese currency began to reverse its course soon after the initial reaction (the blue arrow).

In a matter of 17 trading days after BOJ’s announcements, the yen appreciated by 5.7% (measure from close to close and as at 17 of Feb 2016) against USD.

JPY and S&PP Daily Have we seen this before?

Kuroda is not the only central bank governor who has seen his currency fly after introducing negative rates. European Central Bank’s Mario Draghi saw the euro appreciating by some 5.1% from 2nd of December 2015 when he cut a key rate further into negative territory.

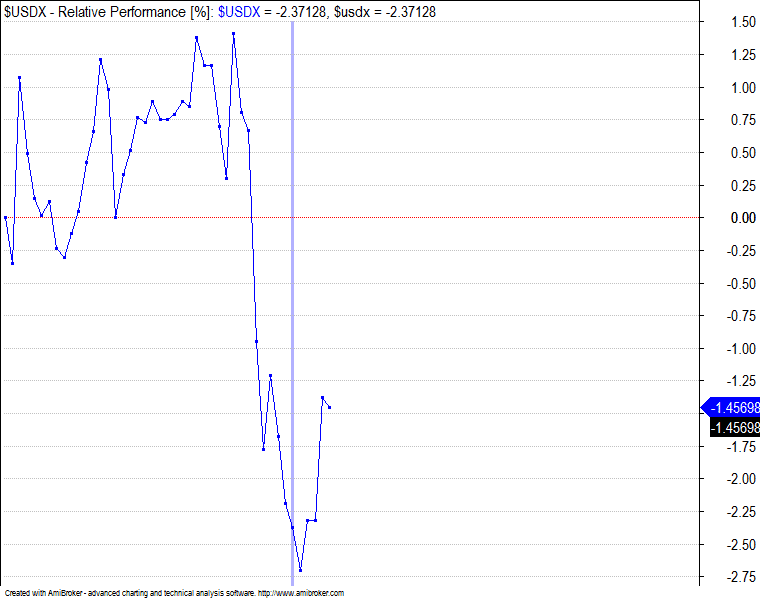

It is interesting to note that, whilst cutting rates has not clearly worked for yen and euro, increasing rates have not worked for the U.S. dollar either. As we discussed previously, increasing rates should push the currency with higher interest rates higher.

However, the graph below shows the USD index has actually lost value since the US Federal Reserve increased the interest rates for the first time since the GFC, on 16 December 2015.

US Dollar index performance since December 15, 2015 When nothing works

Part of the reason why the FX market does not behave, goes back to the point that we are living in a rather unusual era. First there was the GFC, then we had zero interest rates coupled with hundreds of billion dollars in liquidity aids (which arguably created over inflated asset prices) and now, because none of the previous measures have been very effective, we are going into a negative interest rate era. Something the market is not overly accustomed to.

The combination of the above plus the current turmoil in the financial markets have made many worry about the effectiveness of central banks policies in stabilizing the markets and in restoring economic growth.

Therefore, the way market prices the asset classes these days is widely different from what policy makers want to see.

Ramin Rouzabadi (CFA, CMT) | Trading Analyst Ramin is a broadly skilled investment analyst with over 13 years of domestic and international market experience in equities and derivatives.

With his financial analysis (CFA) and market technician (CMT) background, Ramin is adept at identifying market opportunities and is experienced in developing statistically sound investment strategies.

Ramin is a co-founder of exantera.com which is a financial website dedicated to risk analysis and quantitative market updates.

Connect with Ramin: Twitter | LinkedIn | Ramin’s posts

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Trading Opportunities from Japan's Shock Interest Rate Decision

This is only Part 2 of a 3-part series containing a full 21 page analysis, highlighting the global opportunities as a result of the introduction of negative interest rates in Japan. Click here to access the full analysis. ...

February 25, 2016Read More >Previous Article

Bank of Japan opts for negative interest rate, but Yen soars

Just days before Japan’s unexpected negative rate announcements, the country’s central bank chief Haruhiko Kuroda was quoted in an interview where...

February 24, 2016Read More >Please share your location to continue.

Check our help guide for more info.