- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Baidu beats Q2 estimates

- 1 month +2.82%

- 3 months -1.72%

- Year-to-date -7.29%

- 1 year -12.15%

- Benchmark $270

- Citigroup $223

- Barclays $235

- JP Morgan $125

- Mizuho $285

- HSBC $180

News & analysisBaidu Inc. (BIDU) reported its unaudited Q2 results on Tuesday. The Chinese technology company topped both revenue and earnings per share estimates for the quarter.

Revenue reported at $4.424 billion for Q2 (down by 5% year-over-year) vs. $4.395 billion expected.

Earnings per share at $2.36 per share for the quarter vs. $1.59 per share estimate.

Robin Li, CEO of Baidu: “Despite a challenging macro environment caused by Covid-19, Baidu Core generated RMB23.2 billion in revenues in the second quarter, while Baidu AI Cloud revenues maintained rapid growth momentum of 31% year over year and 10% quarter over quarter.”

“Apollo Go further solidified its position as the world’s largest autonomous ride-hailing service provider. Apollo Go completed 287K rides in the second quarter, and accumulated one million rides on July 20, becoming an important alternative means of people’s everyday travel in the Yizhuang region of Beijing. Moreover, in a momentous landmark, Apollo Go became the first provider to offer fully driverless ride-hailing services – i.e. completely without human drivers present in the car – on open roads in Chongqing and Wuhan, allowing us to further scale up our operations at an accelerated pace,” Li added.

“Baidu Core delivered a non-GAAP operating margin of 22% in the second quarter, up from 17% in the first quarter of 2022, as we continued to optimize our costs and enhance operational efficiency,” said Rong Luo, CFO of the company.

“Going forward, we remain committed to quality revenue growth and sustainable business models,” Luo concluded.

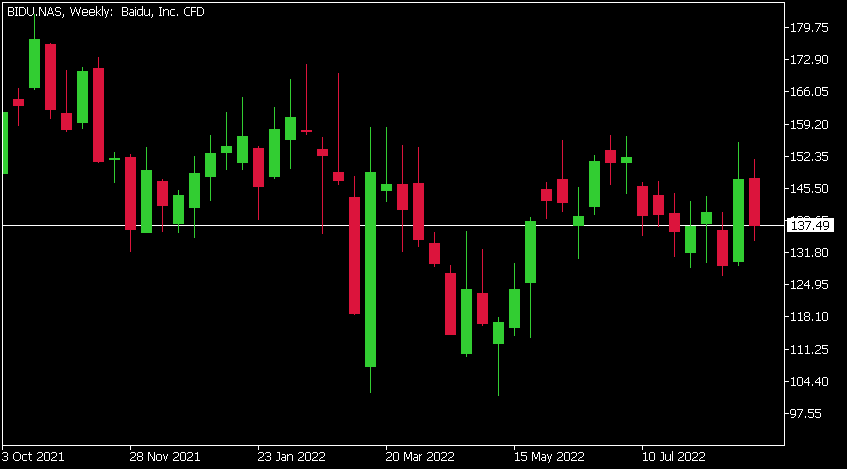

Baidu Inc. (BIDU) chart

Shares of Baidu were down by around 7% on Tuesday at $137.49 per share.

Here is how the stock has performed in the past year:

Baidu price targets

Baidu Inc. is the 334th largest company in the world with a market cap of $47.08 billion.

You can trade Baidu Inc. (BIDU) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Baidu Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

What is Fundamental Analysis, News and Fundamental Trading?

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer to gauge is the Fear and Greed index, emotions trigger actions, there is a reason why there are sellers and buyers in the market at the same time, yes it can be attributed to the way people take in i...

August 31, 2022Read More >Previous Article

Is the price of wheat ready to bounce?

The price of wheat is finally starting to show positive signs after an aggressive sell off that has been ongoing since May 2022. There is ho...

August 30, 2022Read More >Please share your location to continue.

Check our help guide for more info.