- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Apple Inc. and Amazon.com, Inc

- Earnings Per Share (adjusted): $2.55 (up by 4% from the year-ago quarter)

- Quarterly Revenue: $58.3B (up by 1% from the year-ago quarter)

- Earnings Per Share (adjusted): $5.01 (down by 19% from the year-ago quarter)

- Quarterly Revenue: $75.45B (up by 26% from the year-ago quarter)

News & analysisApple Inc. and Amazon.com, Inc

The last two of the five most prominent technology companies, Apple Inc. (AAPL) and Amazon (AMZN), which form part of the FAANG group, have reported interesting quarterly earnings and highlighted their actions during this unprecedented uncertainty.

Apple Inc.

The company missed on earnings estimates but reported better-than-expected revenue:

iPad, iPhone, and Mac all reported a decrease (year-on-year) of 10%, 7%, and 3%, respectively. The shortfall was compensated by strong performance in the services and wearables category. The pandemic-induced environment has driven revenue for Services to an all-time high and a quarterly record for Wearables.

Net sales by category: Three Months Ended March 28, 2020

$ (in millions)

Three Months Ended March 30, 2020

$ (in millions)

iPhone $28,962 $31,051 Mac 5,351 5,513 iPad 4,368 4,872 Wearables, Home and Accessories 6,284 5,129 Services 13,348 11,450 Total Net Sales $58,313 $58,015 The current crisis has made the stock cheaper, and as widely expected, the board has also authorised an increase to the existing share repurchase program despite the uncertain environment. However, investors took note of an increase of only $50B compared to the forecasted amount of $75B-$100B.

In the month of April, the company’s share price substantially pared the losses seen since February 2020. Its stock price rallied by more than 20% this month and is currently trading at $293.80.

After the release of the results, the company’s share price fell by around 2% in after-hours trading.

Source: BloombergAmazon.com, Inc.

Amazon, the leading e-commerce retailer, has also reported its first quarterly earnings after the bell on Thursday:

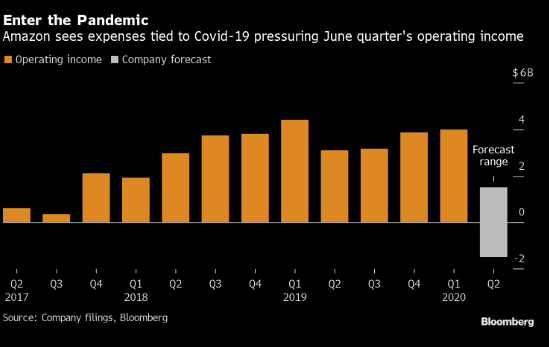

While the founder and CEO provided an upbeat outlook of how Amazon has navigated through the current crisis with the availability and adaptability of different products from online shopping to Amazon Web Series to Prime Video and Fire TV, many investors focused on the company’s intentions to use Q2 operating profit for COVID-related expenses:

“If you are a shareowner in Amazon, you may want to take a seat, because we’re not thinking small. Under normal circumstances, in this coming Q2, we would expect to make some $4 billion or more in operating profit. But these are not normal circumstances. Instead, we expect to spend the entirety of that $4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe.”

The company’s share price rose by nearly 30% in April, pairing all the losses made towards the end of February and in March. As of writing, the share is currently trading at $2,474.

Source: BloombergAfter the release of the results, the company’s share price tumbled by around 5% in after-hours trading.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Tyson Foods & Skyworks Earnings Reports

Tyson Foods & Skyworks Earnings Reports Tyson Foods and Skyworks are among the two major earnings results released on Monday. The meat processor reported its quarterly results before the open while Skyworks Solutions issued its reports after market close. Tyson Foods, Inc. (NYSE: TSN) Tyson Foods is one of the largest processors and mark...

May 5, 2020Read More >Previous Article

FX Trading choices: Open positions and economic data release

Market sentiment towards a currency pair, and hence price, changes when new information comes into the market. The most common situation that creat...

April 24, 2020Read More >Please share your location to continue.

Check our help guide for more info.