- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- The US Dollar and Gold

News & analysisInvestors generally piled-up in the Gold and the US dollar as those assets are viewed as safe-haven during times of crisis or uncertainties- be it economical, political or policy uncertainties. 2020 has been a year of extreme uncertainty and volatility which saw the world battling an unprecedented and paralleled health and economic crisis in modern times.

Gold

With the passing months and fears of second waves of an outbreak, the predominant uncertainty for the markets is when will the world recover from both crises. In such an environment of doubt, investors are either hedging or seeking safety from volatile investments with haven assets like the gold.

The precious metal has been on a tremendous rally since the pandemic rattled the markets. Aside from the economic and health crisis, geopolitical tensions, massive stimulus packages and the uncertainty on the US election have fuelled the rally in gold. The XAUUSD pair has even traded around the elevated levels seen during the financial crisis and reached a high of $2,075 in the month of July.

Source: GO MT4Since August, the XAUUSD pair has been trading within a range as investors digested some positive vaccines updates, improving economic data and easing lockdown restrictions. The indecisiveness of investors is reflected by the Doji candle on the monthly chart found at the top of the upside trend which suggested a sign of possible reversal of price direction.

Source: GO MT4Technical Bearish Signal

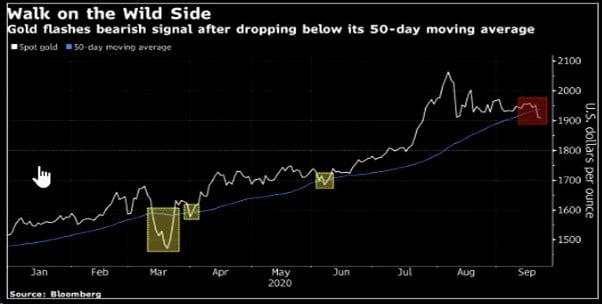

Recently, the gold has plummeted and flashed a bearish signal after dropping below its 50-day moving average. The move has flagged further potential downside risks for the precious metal. Generally, the gold is quoted in dollar terms and moves in the opposite direction with the US dollar. As the greenback gathers strength, the XAUUSD pair is struggling to firm to the upside despite the geopolitical and economic uncertainties.

Most importantly, the pair broke the key psychological level of $1,900 to trade around the $1,865 level on Wednesday. Even though gold may be poised for further downside dragged by the strengthening dollar, the precious metal remains at elevated levels.

Traders are to keep monitoring geopolitical headlines, central banks decisions, inflation levels, and leading economic data for fresh trading impetus.

The US Dollar

At the start of the pandemic, investors rushed to the mighty dollar when they were confronted with the scale of the crisis. However, as the outbreak furiously spread across the globe, the US soon emerged as the country hit the hardest. The crippling effect of the pandemic on the US economy has caused the US dollar to lose its haven status and its preference over its peers. Also, while the US was battling a political deadlock, the European Union has shown an unprecedented sense of unity which prompted investors to shift their focus away from the greenback to riskier currencies.

Source: GO MT4However, the US dollar made an impressive comeback this week. As Europe grappled with a second wave of an outbreak which may give rise to further lockdown restrictions, the US dollar is seen rising over the virus fears. At the same time, a rout in the technology sector and a fragile risk sentiment in the stock market has helped the greenback to regain its safe-haven status. Major US equity benchmarks retreated sharply by more than 1.5% on four occasions since the end of August.

Technical Bullish Signal

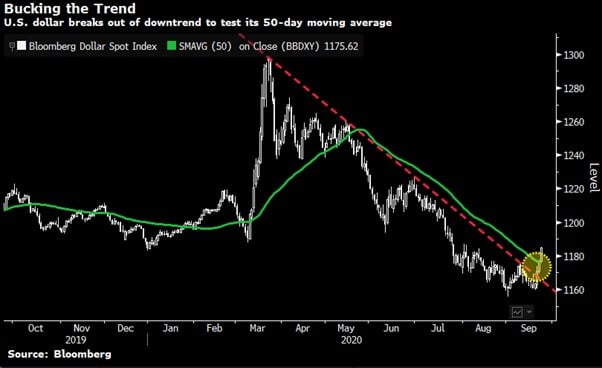

On the technical side, the US dollar index broke out of its bearish downtrend to test the 50-day moving average on the back of its haven status amid the financial market volatility.

Recently, central banks have been more dovish which has also provided some support to the US dollar. We have seen more central banks looking at negative interest rates and other easing monetary policies as viable options. At such inflection point for the US dollar and the Gold, the guidance from central banks and governments will continue to drive the action in those haven assets while investors await news and updates on the vaccine front.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Inner circle Video – Using Autochartist for trade set ups and risk management

We were privileged this week to welcome back Autochartist CEO Ilan Azbel, who presented a highly charged, informative and exciting session for those who are interested in using this powerful trading tool to assist with your decision making. You can watch the video below and if you need help in adding Autochartist to your client portal please con...

September 27, 2020Read More >Previous Article

Inner Circle Recording: Precious metals – Current status and outlook

In this session we explored Current state of precious metals after the significant run up in price over the last few months. We examined: -. The fou...

August 20, 2020Read More >Please share your location to continue.

Check our help guide for more info.