- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Largest Crude Oil Reserves in the World

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Largest Crude Oil Reserves in the World

- Capital: Caracas

- Official language: Spanish

- Population: 31,568,179

- Gross Domestic Product: $92 billion

- Currency: Petro (PTR), Bolivar Soberano (VES)

- Capital: Riyadh

- Official language: Arabic

- Population: 33,000,000

- Gross Domestic Product: $759 billion

- Currency: Saudi Riyal (SAR)

- Capital: Ottawa

- Official language: English and French

- Population: 37,067,011

- Gross Domestic Product: $1,9 trillion

- Currency: Canadian Dollar (CAD)

- Capital: Tehran

- Official language: Persian

- Population: 81,672,300

- Gross Domestic Product: $413 billion

- Currency: Iranian Rial (IRR)

- Capital: Baghdad

- Official language: Arabic and Kurdish

- Population: 37,202,671

- Gross Domestic Product: $233 billion

- Currency: Iraqi dinar (IQD)

News & analysisNews & analysis

News & analysisNews & analysis

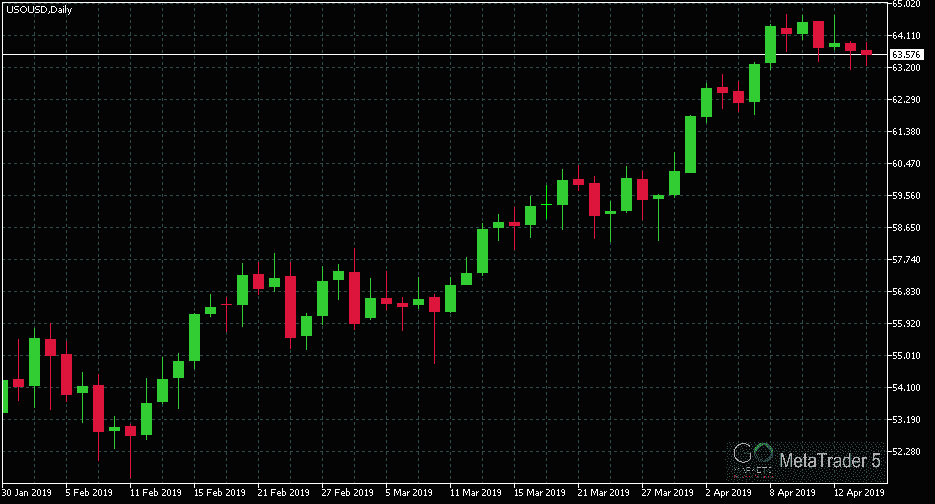

We have seen the price of crude oil (USOUSD) rise by about 43% since the beginning of the year, from around $44 per barrel to $63 per barrel at the time of writing this. It reached the highest level since November 2018 last week, on the 9th April to be exact, when it was trading at around $64.71 per barrel. In this article, we will take a look at the countries who have the largest crude oil reserves in the world.

USOUSD – Daily

Venezuela

At number one, we have a country which has been in turmoil in the last few months – Venezuela. Economic and social crisis have hit the South American nation and things are not looking to get better any time soon. However, it does top the list as the country with the largest crude oil reserves in the world at 300 billion barrels. Worth pointing out that it was the 15th largest crude oil exporter at $26,4 billion barrels making it up 2.3% of the world total.

Saudi Arabia

The next on the list is Saudi Arabia, which was actually the top crude oil exporter in the world last year with $182 billion worth of oil exports which was around 15,9% of the total crude oil exports in the world. The middle eastern country is highly reliant on its oil exports and its proven oil reserves amount to around 266 billion barrels.

Canada

At number three we have the North American nation of Canada with crude oil reserves of around 169 billion barrels with 95% of these reserves are in the oil sands deposits in the western province of Alberta. Canada was the 4th largest crude oil exporter last year with $68,9 billion worth of exports, making it up 5.8% of the total.

Iran

The Islamic Republic of Iran is at number four with 158 billion worth of proven oil reserves. Iran was the 8th largest crude oil exporter in the world with $45,7 billion, which was around 4% of the world total.

Iraq

The last one on our list of countries with the largest crude oil exporters is Iraq with 142 billion barrels. Iraq was the 3rd biggest crude oil exporter in 2018 with $91 billion worth of exports which made up 7.9% of the total. Iraq was one of the founding member Organization of the Petroleum Exporting Countries (OPEC) with Iran, Kuwait, Saudi Arabia, and Venezuela when it was established back in 1960. Iraq’s economy is highly depended on oil with oil production accounting for 2/3 of the country’s GDP.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Oil CFDs, Forex and Derivatives carries a high level of risk.

Sources: IMF, CIA, MetaTrader 5

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

ASX200: the Top 5

GO Markets recently announced the addition of ASX (Australia Securities Exchange) Share CFDs to the product offering, increasing the number of instruments available to its clients to over 250, which also includes Forex, Commodities, Indices. The latest addition will enable clients to trade multiple assets from one single platform. In this article...

April 17, 2019Read More >Previous Article

Are You Just ‘Interested’ OR REALLY Committed to Becoming the Trader You Can Be?

Look, we get it… the thought of making money from the financial markets is appealing to the newcomer (and even experienced trader). Appealing enough...

April 15, 2019Read More >Please share your location to continue.

Check our help guide for more info.