- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Future metals: are we seeing the 2000s again?

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- Future metals: are we seeing the 2000s again?

News & analysisNews & analysis

News & analysisNews & analysisPlenty has been made of the drive towards nickel and lithium as “future metals” as the world’s “electrification” takes hold. This “electrification” has been nicknamed the “volt revolution” and when you get these kinds of technological leaps – what’s appearing to be the “winner” now doesn’t necessarily mean it will be the overall.

That is where Nickel and Lithium need to be examined.

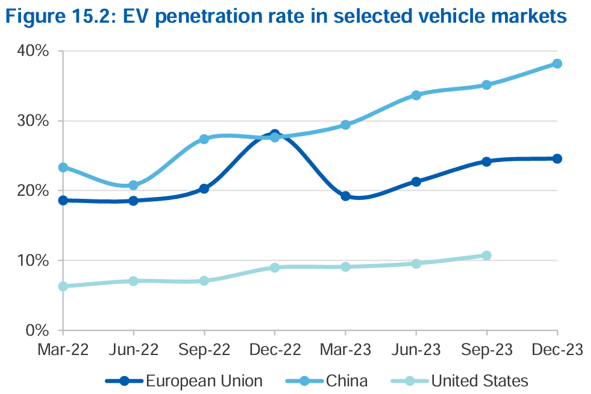

The demand for these two metals over the last 15 years has been staggering and for good reason the uptake of electronic vehicles (EVs), household batteries and the accelerated push to “net zero” have made these two metals – must haves.

However as mentioned, will the demand hold up or will these metals experience the same market translation social media went through in the late 1990s and 2000s.

Think about it what happened to market leaders Myspace and Yahoo? Think about all those search engines that lost out to Google? Or the online marketplaces that have been cannibalised by Amazon.

I raise this because although right now nickel and lithium are all the rage, there are signs they may lose out to cheaper and possibly faster technologies in the EV and battery space over the coming decades.

Nickel in particular looks to be the first one of these under pressure, and not surprising it’s from lithium itself.

The light speed advancement in cheap and safe LFP batteries (lithium iron phosphate) is staggering. In fact, they are becoming so good at holding charge and efficiency that LFP batteries have now conquered 70% of the EV mass market in China further to this – they don’t need nickel or cobalt like previous iterations.

Then there is the new manganese twist to the LFP batteries. “LMFP” uses manganese as a cathode which almost exponentially upscales the quality. These batteries are now approaching the energy density and range of standard high nickel batteries that are sold in all EVs across Europe in the US — but here is the kicker its two-thirds of the cost.

So it would appear lithium is the winner with the LMFP battery technology – Again, I am not sure as battery technology using sulphur and potassium suggests we could see another leap forward in the range and charging time of these players and they are due to hit the market in the latter half of this decade, the catch here – they don’t use lithium in anywhere near the quantities originally forecast.

Let me dig a little further – the Department of Industry and Resources anticipates that lithium prices won’t return to the peak levels seen in late 2022 until the end of 2029.

Why? Throughout most of last year a surge in lithium production chased the high prices of 2022 leading to a substantial increase in global supply.

Couple that with weaker-than-expected demand for EVs in the US and Europe balanced the market and caused prices to drop significantly.

(Source: Department of Industry and Resources)

Supply and demand being what it is prices fell throughout 2023 resulting in reduced production, particularly among some higher-cost producers.

Which brings us to the 20% increase in lithium price since the start of the year, and forecasts of further gains through to 2025 according to the same report from the Department of Industry, Resources, and Sciences.

However, from 2026 onward, lithium-ion EV batteries will face the pressure from the technologies mentioned above. The impact on lithium prices such as lithium spodumene according to the Department is prices to climb to US$1,360 per tonne by 2026 before declining to US$1,090 by 2029. The reason I want to use the department’s forecasting is it is historically conservative and directionally accurate.

So, what does this all mean? Larger lithium producers like Pilbara Minerals, Mineral Resources, and IGO are expected to remain profitable at current prices, but the outlook for marginal producers like Core Lithium and emerging players like Liontown is less certain, with questions about whether current prices are sufficient to support their projects.

It also suggests that when it comes to future metals – nickel, lithium and the like, a short term view may be the better option as picking the eventual winner in the ‘volt revolution’ is far from certain.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

FX Analysis – USD looking vulnerable after soft data

The negative dollar reaction to a modest tick-up in US jobless claims yesterday (231k versus consensus 212k) where the US Dollar Index (DXY) dropped from session highs at 105.74 to close at session lows of 105.20 seems to be telling FX traders that tells us that: a) markets are probably lacking some sense of direction in the period between pay...

May 10, 2024Read More >Previous Article

FX analysis – USD decline continues post FOMC, JPY outperforms on probable BoJ intervention

USD continued the move lower sparked by a somewhat dovish Powell in Wednesdays FOMC meeting. And ahead of today’s key NFP print. DXY did hit highs a...

May 3, 2024Read More >Please share your location to continue.

Check our help guide for more info.