- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Geopolitical Events

- World Economic Forum: Buzzword – Populism

- “Brazil’s Bolsonaro is the Face of Populism at the Davos Forum”

- “Merkel encourages multilateralism in the face of populism…”

- “Chrystia Freelans decries the rise of populism…”

- “Is Davos listening? Populist wind blows over…”

- “Business leaders concerned about the rise of US nationalism, populism…”

- The United States is not in attendance due to the shutdown related to the funding of the Wall. President Trump is taking a hard line on immigration and trade.

- The United Kingdom is trapped with Brexit. Theresa May abstained from the forum as Brexit uncertainties linger. The UK leaving the European Union is the notable example of the rise of populism based on the desire to regain control over immigration and national sovereignty.

- France is being rattled by the “yellow vests” protests which initially begun because of the fuel tax hikes and mean well. However, as it lingers through more than two months, there are concerns that it has given rise to populist strategies in French

- US Rising rates and the Fed

- Trade tensions

- The rout in oil markets

- Populist parties

News & analysis

The word Populism is probably the buzzword at the World Economic Forum this year. The headlines this week were heavily dominated by the concerns of the rise of populism around the globe.

This year, three Western Leaders are not present, and the reason behind it is tilted towards the issue of populism. This is actually a “Strong Message” for the financial markets.

Is Populism a headwind for Economic Growth and the Markets?

The IMF recently flagged how policies need to be adjusted to face the slowing global growth amid rising risks and has called for multilateral cooperation to tackle protectionism and trade tensions. The message echoed the fears of the rise in populism in the markets.

The concept of populist parties and economic growth can be complexed as the effects need to be assessed on the short-term and long-term basis.

Populist political parties sometimes come with a fiscal spending policy that stimulates the economy in the short-term, similar to the outperformance of the US economy. The Trump administration has boosted growth, business and consumer confidence and reduced unemployment through various policies such as tax cuts.

However, populist parties often come with protectionism measures and anti-immigration policy which is a hindrance for long-term economic growth. Domestic economies are not able to reap the benefits that normally come with globalization which means that trade restrictions and labour immobility can create a stagflationary environment.

The US is the example of how the US economy bolstered during the first two years of Trump’s presidency mostly driven by fiscal spending, but the growth is expecting to slow down due to the gridlock in Washington.

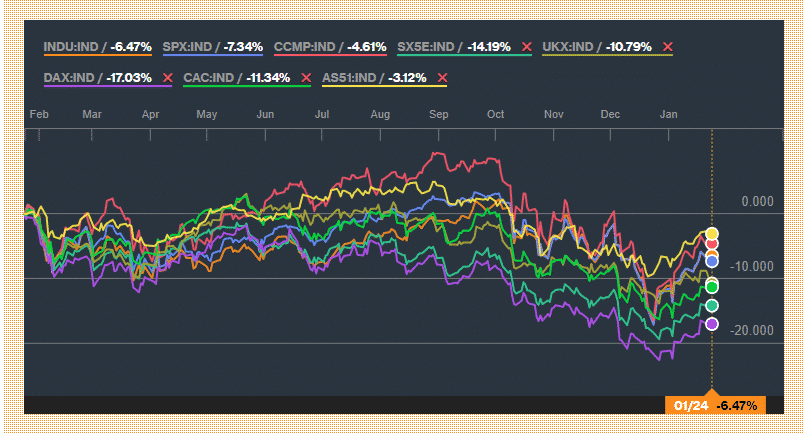

Similarly, the spread in populist parties has prompted market angst in the European markets. European shares have been underperforming compared to the global markets. The % change for a year shows that the fall in major European equities – Euro Stoxx 50, FTSE100, the Dax and the CAC 40 is deeper compared to the US or Australian equity benchmark.

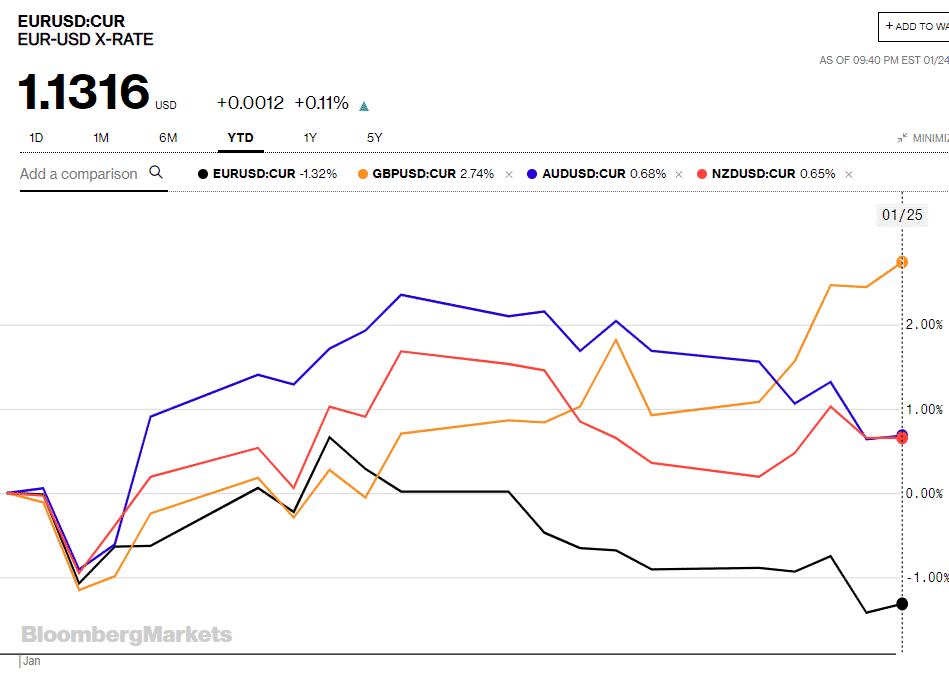

Source: BloombergThe shared currency is also under pressure. A look at the graph below shows that since the beginning of the year, major currencies are in the green against the US dollar compared to the Euro. A combination of weak data, domestic political challenges and a rise in populism are weighing heavily on the Eurozone outlook.

Populism and Emerging Countries

The list of headwinds that the Emerging markets have to deal with over the past year is long:

Without any doubt, we saw EM crashing last year on the three main points listed above. Populism is another significant point to monitor. Emerging economies are the ones who benefitted the most from globalization. Trade barriers can have a big impact, and EMs rely heavily on exports to developed countries.

Populism is among the most significant risks to the financial markets which are increasing the risk of triggering a crisis.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

A Busy End of the Month

US Government Shutdown President Trump has agreed to temporarily end the shutdown, putting an end to the most extended shutdown in US history. The three-week pause initially lifted investor sentiment and helped Asian stocks push higher on Monday’s open. It is reported that the shutdown cost the economy $11 billion, which includes approximatel...

January 29, 2019Read More >Previous Article

Margin Call Podcast – S1 E2: Tom Williams | GO Markets Head of Trading

Tom Williams (@TomW_GOMarkets) is the GO Markets Head of Trading. He started out as a dealer and broker in the excitement-driven city of Londo...

January 25, 2019Read More >Please share your location to continue.

Check our help guide for more info.