- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Geopolitical Events

- US Trade vs the World

News & analysisUS Trade vs the World

Since Donald Trump became the President of the United States in 2016, we have heard him say a lot about the “unbelievably bad” trade agreements the world’s largest economy has with some countries around the world. We have already seen Trump attempt to renegotiate the North American Free Trade Agreement (NAFTA), which has reached a deadlock, and there is a possibility of the US scrapping the decades-old agreement between Canada and Mexico. But how does the trade balance look between the US and other nations around the world?Trade Surplus

President Trump has said that “We don’t have any good deals. In fact, I’m trying to find a country where we actually have a surplus of trade as opposed to… Everything’s a deficit.”

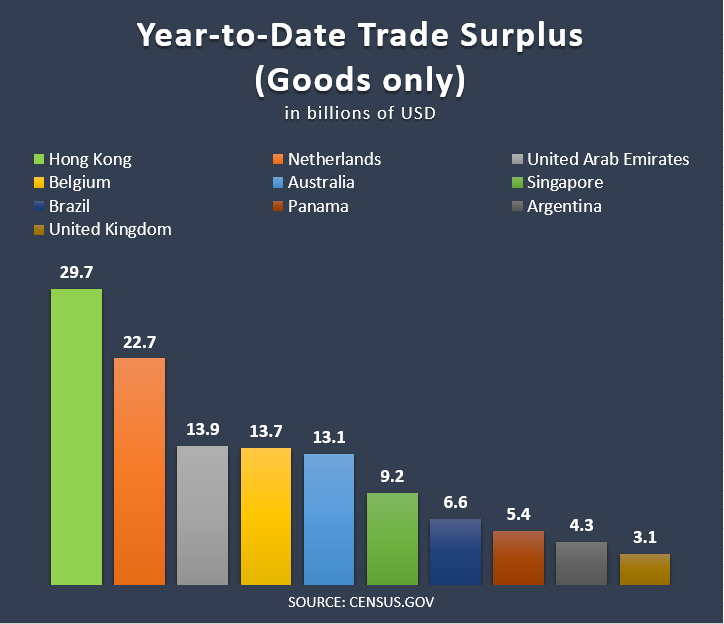

However, there are many countries which the US has a positive trade balance with. It’s largest trade surplus is with Hong Kong at $29.7 billion, followed by the Netherlands. The US exports reached nearly $37 billion with Hong Kong in 2017 (from January to November) with $6.9 billion worth of goods imported. However, some analysts are suggesting that Hong Kong’s trade with the US will suffer from the ongoing tensions between the two largest economies in the world.

Trade Deficit

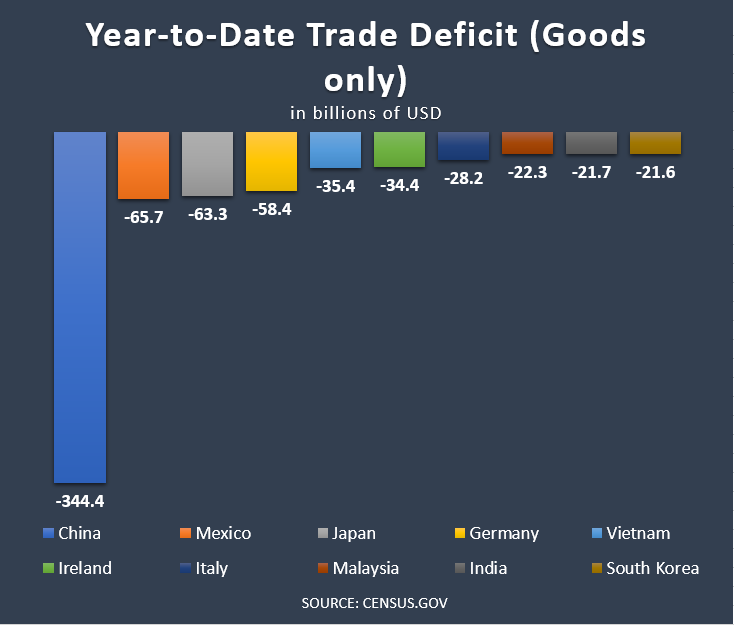

Trump has aimed some strong words towards the countries which the US has a negative trade balance with. Most of the criticism has been towards the trading relationship with China – the world’s second largest economy. He may have a point as the trade deficit stands at a whopping $344.4 billion (year-to-date). Trump said – “With China we have close to a $500 billion trade deficit, so we have to do something. I spoke to the president, I spoke to many people — we’re going to work on that very, very hard. And we’re going to do things that are the proper things to do.”

The second largest trade deficit is with one of Americas two closest neighbours – Mexico. Donald Trump has slated the NAFTA agreement in particular, which he has called a disaster for US manufacturing. However, since Trump was elected we have seen some big American companies move their production back to the US. Most recently Fiat Chrysler, the world’s eighth largest auto maker announced its plans to move production of its Ram heavy pickup trucks from Mexico to Michigan. Moving production of the Ram, which is mainly sold in the US and Canada, means that Fiat Chrysler will not be paying the high import duties which are likely to apply if the NAFTA agreement is rolled back.

Overall, we can see why Trump has been criticising the trading agreements with some countries around the world. But will he be able to change it during his presidency? His current actions would suggest that the United States’ trade policies will be changing.Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Time Ticking for Brexit

Time Ticking for Brexit By Klavs Valters In just over a year – on 29th March 2019 to be exact – Britain is scheduled to leave the European Union. It has been nearly a year since Theresa May triggered Article 50 and began the two-year process to negotiate an exit deal. As we know, the negotiations so far can’t be classed as successful. Even ...

March 18, 2018Read More >Previous Article

City of London Feeling the Brexit Effect

City of London Feeling the Brexit Effect Not a day goes by without Brexit being mentioned and we can expect more of this to continue for some time, e...

January 15, 2018Read More >Please share your location to continue.

Check our help guide for more info.