- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Geopolitical Events

- New sanctions imposed on North Korea

News & analysisNew sanctions imposed on North Korea

by United Nations (UN) Security Council

North Korea has been slapped with new sanctions after the detonation of a hydrogen bomb, an even more powerful nuclear weapon than the atomic bomb. The new resolutions widely adopted by the international community show the urgency of restricting North Korea’s ability to funds its weapons programs. Sanctions were imposed in the past but these fresh sanctions are much harsher.

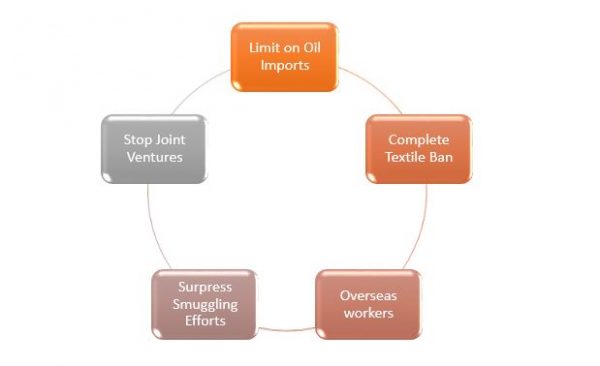

The US submitted 2 drafts of sanctions whereby they proposed a complete ban on oil in the first draft. After a few negotiations and backing from China and Russia, the second draft was less drastic but unanimously adopted by the UN members. It includes the following new resolutions:

China, being the main ally for supplying North Korea with oil for military purposes, has agreed to put a cap on crude oil and refined petroleum products after rejecting a full embargo proposal. A complete textile ban which accounts around $760 million of North Korea’s exports revenue was maintained and combined with the previous sanctions on their exports such as iron, coal, seafood, and other minerals. The United States strongly believe that the combined measures will account for 90% of their exports reported in 2016. The new sanctions also prohibit countries from recruiting North Koreans and approving new and existing joint ventures.

Warning from North Korea following new sanctions

North Korea immediately condemned the act and warned the United States of the “greatest pain and suffering” following the toughest-ever sanctions. Kim Jong-un’s foreign ministry also mentioned that they“will make absolutely sure that the United States pays due price if measures restricting its oil supply and textiles exports were passed”.

North Korea accused the United States of manipulating the UN members and persuading them into adopting illegal and unlawful sanctions against them.

The following days will be crucial. Markets might revert to safer asset classes with these new escalated tensions.

Stay with us for more live updates!!!!

By: Deepta Bolaky

GO MarketsReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Are we 5 weeks away from a US Government shutdown?

Are we 5 weeks away from a US Government shutdown? …and what does this mean for the markets? President Donald Trump has had a few admittedly less-than-stellar weeks. Topping off his widely condemned remarks following the Charlottesville, Virginia events, he went on to attack his Republican colleagues in the House and Senate. Recent polling...

September 20, 2017Read More >Previous Article

Europe’s Bond-Buying Program

The European Central Bank (ECB) engaged into a €2 trillion bond buying program to promote economic growth and drive inflation up in the Eurozone. It...

September 7, 2017Read More >Please share your location to continue.

Check our help guide for more info.