- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Geopolitical Events

- NAFTA Update – Have US Negotiations Progressed?

- Home

- News & analysis

- Geopolitical Events

- NAFTA Update – Have US Negotiations Progressed?

News & analysisNews & analysis

News & analysisNews & analysisIt’s been one year since the trade renegotiations on the North American Free Trade Agreement (NAFTA) between Canada, the United States and Mexico began. Since then we have seen tough rhetoric on how the agreement should look like moving forward from each country, especially the United States. But are we finally getting closer to an agreement?

About NAFTA

The North American Trade Agreement (NAFTA) came into effect on 1st January 1994 and it formed one of the World’s largest free trade zones and laid down the foundations for a strong economic growth for the United States, Canada, and Mexico. However, in recent years the agreement has come under a lot of scrutiny from the US, with President Trump calling it “the worst trade deal ever made”, which has led to renegotiations between the three nations.

Latest developments

It appears that the negotiations between the US and Mexico have been going well, with both reportedly close to agreeing on a deal in their talks to revise the NAFTA deal. However, Canada has not been part of the latest part of the discussions.

“Right now, it appears they are getting incredibly close to finishing the discussions between the U.S. and Mexico,” said Inu Manak, who has monitored the talks for the Cato Institute, a libertarian think tank in Washington.

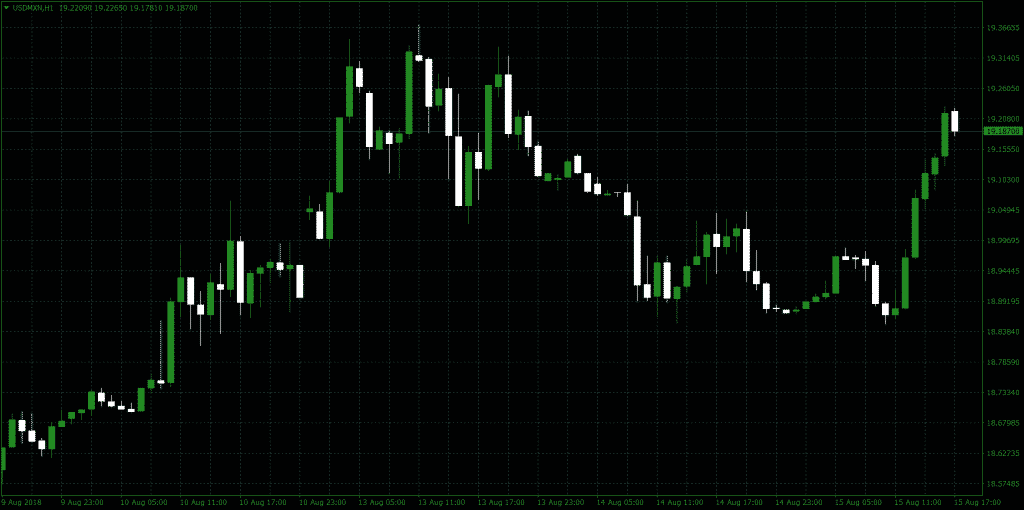

Even though the talks between the US and Mexico are going well, there will be no final deal on NAFTA unless Canada agrees to re-join the renegotiations. In a recent tweet, Donald Trump praised the new President of Mexico, however, he had a dig at Canada’s tariffs and trade barriers, threatening to tax Canadian made cars if they cannot make a deal.

In response to the President Trumps tweet, Canada Foreign Affairs Minister Chrystia Freeland said that they will not change the course of the renegotiations.

“Our focus is unchanged,” Adam Austen, a press secretary for Canada Foreign Affairs wrote in an email. “We’ll keep standing up for Canadian interests as we work toward a modernized trilateral NAFTA agreement.”

Both US and Mexico are working hard to get a deal signed by the Mexican President Enrique Pena Nieto before he departs office on 1st December to give way to the President-elect Andres Manuel Lopez Obrador. The Canadian negotiating team have been on the sidelines in the recent part of discussions but are expected to join the negotiation table soon. However, the Mexican Economy Secretary Ildefonso Guajardo said that there are currently no timeframe for when the Canadian counterparts will join the discussions. “We have to make sure that the U.S.-Mexico bilaterals are done,” Guajardo said, adding that Canadian Foreign Minister Chrystia Freeland will “hopefully” be a part of the discussions soon.

Financial markets

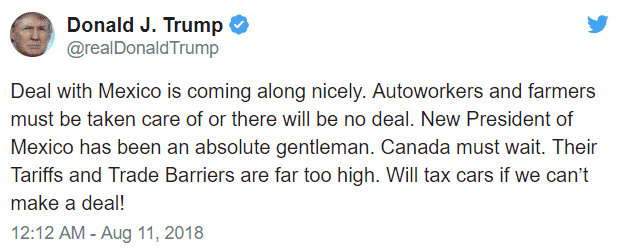

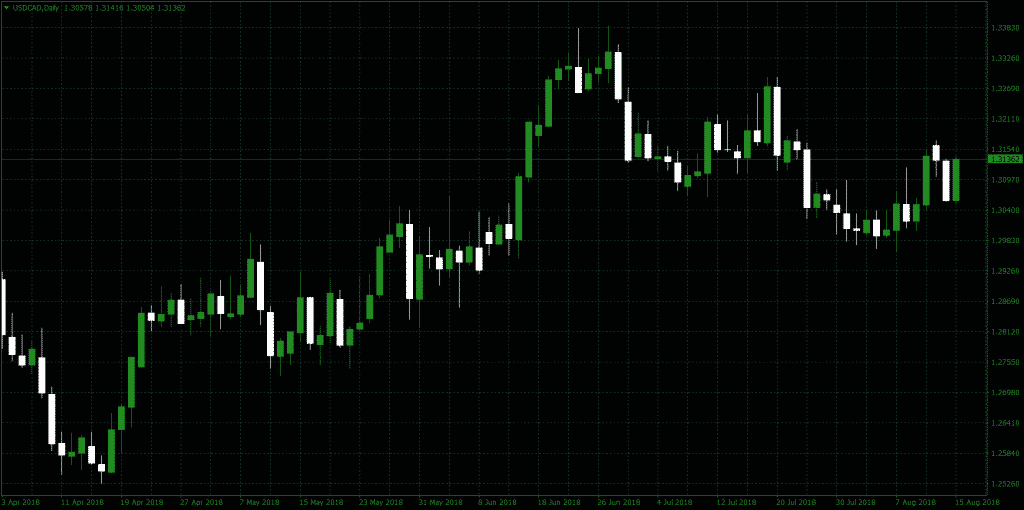

The US Dollar has strengthened by around 5% since the beginning of the year against the Canadian Dollar, currently trading at around 1.31 level. However, it has weakened by around 1.2% against the Mexican Peso. Currently trading at around 19.18 level. Further developments in the talks will certainly have an impact on the financial markets moving forward.

USDCAD – Daily Chart

USDMXN – Daily Chart

Klāvs Valters

Market Analyst

Sources: Go Markets MT4, Twitter

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Warning Signs Of An Economic Storm Front

In Economics, the difference between 10 Year and 2 Year Bond Yields is one of the leading indicators that help investors to observe any significant changes in the economy. Let's break things down a little further. Firstly, common sense dictates that if you want to make a term deposit in the bank, the rate you can get from the long-term deposit wil...

August 17, 2018Read More >Previous Article

Another Blow to the Emerging Markets

Emerging Markets (EMs) are being dragged down by the deepening crisis in Turkey. The collapse of the Turkish Lira has rattled the financial markets,...

August 15, 2018Read More >Please share your location to continue.

Check our help guide for more info.