Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

Gold's breakthrough above US$5,000 and silver's surge through US$100 signal this year could be one for the history books for metal traders (one way or another).

Quick facts

- Elevated safe-haven demand lifts Gold targets from US$5,400 to US$6,000 after early-year US$5,000 breakout.

- Artificial intelligence (AI) and data-centre infrastructure ramp-up could help drive silver and copper demand.

- Continued geopolitical uncertainty and shifting monetary policy could trigger metal volatility throughout the year.

Top 5 metals to watch in 2026

1. Gold

Gold's breakout over US$5,100 arrived three quarters ahead of some forecasts. With Bank of America quickly raising its end-of-year target to US$6,000 and Goldman Sachs projecting US$5,400, the safe-haven commodity remains the biggest asset in focus for 2026.

Key drivers:

- Central banks are currently buying an average of 60 tonnes of gold per month, compared to 17 tonnes pre-2022.

- Two Fed rate cuts are priced in for 2026, reducing the opportunity cost of holding non-yielding assets like gold.

- Trump tariff policies, Middle East tensions, and fiscal sustainability concerns are keeping safe-haven demand elevated.

- Gold's share of total financial assets hit 2.8% in Q3 2025, with room to grow as retail FOMO kicks in.

What to watch

- Jerome Powell is set to be replaced as Fed chair in May 2026. Actual policy direction post-replacement may differ from current market expectations for cuts.

- If geopolitical hedges into safe havens remain or if there is an unwinding like post- 2024 US election.

- The potential weaponisation of dollar asset holdings by European nations as a response to US tariffs.

2. Silver

Silver is the metal that has benefited the most from the 2025 AI boom, with its surge to US$112 all-time-highs to kick off 2026 (70% above fundamental value as per Bank of America signal), demonstrating its volatile potential.

Key drivers

- Industrial demand from AI infrastructure, solar, and electric vehicles (EVs), semiconductors and data centres currently has no viable substitute for silver's conductivity.

- Six consecutive years of supply deficit, with above-ground stocks depleting and recycling bottlenecks limiting secondary supply.

- Policy optics may matter. The US decision to add silver to its list of “critical minerals” has been cited as a potential factor in volatility, including around trade policy risk.

- Retail participation can amplify price moves, particularly when the demand for gold becomes “too expensive”.

What to watch

- If solar panel demand continues its trajectory, or if 2025 was the peak.

- Whether the recycling supply responds to record prices by increasing silver refining and material processing capacity.

- How exchange inventory and lease rates move as potential signals of physical tightness.

3. Copper

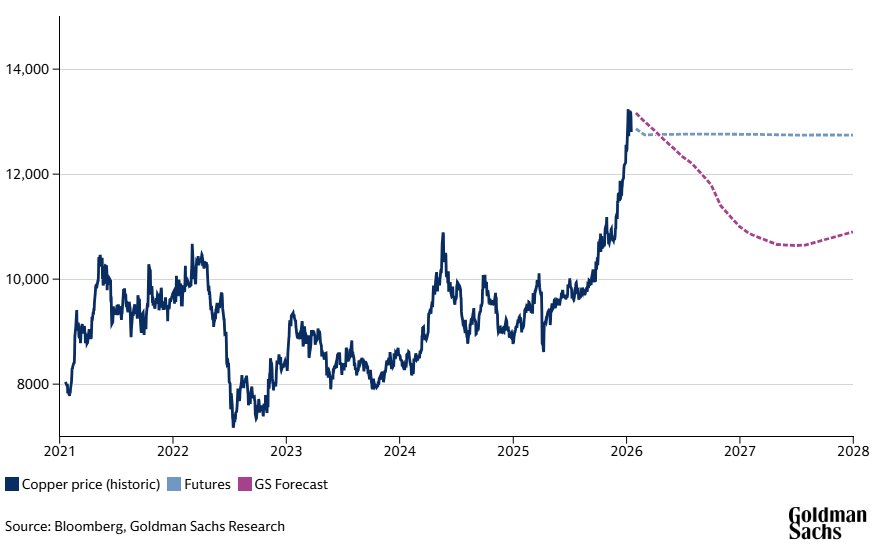

Copper's 2026 story hinges on continued data centre demand, renewable energy infrastructure growth, and China's struggling property market.

Key drivers

- Data centre copper consumption is projected to hit 475,000 tonnes in 2026, up 110,000 tonnes from 2025.

- Worker strikes in Chile and Grasberg restart delays are keeping the Copper market structurally tight.

- The US tariff decision on refined copper imports is expected in mid-2026 (15%+ currently anticipated), creating potential stockpiling and trade flow distortions.

- Goldman Sachs has forecast that power grid infrastructure and EV buildout could add "another United States" worth of copper demand by 2030.

- Current Chinese property weakness is creating demand uncertainty, potentially offsetting infrastructure spending.

What to watch

- Whether Grasberg ramps production smoothly or faces further setbacks.

- Chinese property market stimulus effectiveness.

- Actual tariff implementation timing and magnitude.

- Yangshan premium movements signalling real physical demand versus financial positioning.

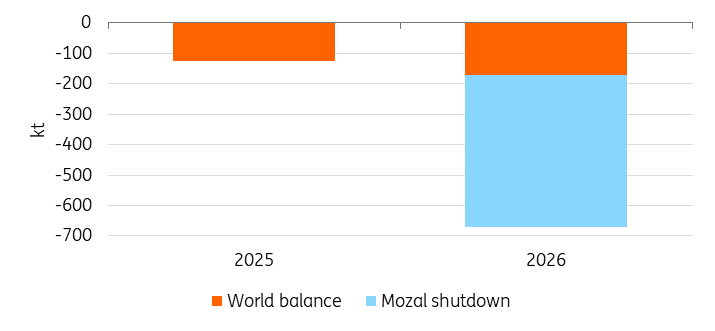

4. Aluminium

Trading near three-year highs of US$3,200, aluminium faces continued tightness into 2026 as China's capacity ceiling forces global markets to adjust.

Key drivers

- China's 45 million tonne capacity cap was reached in 2025. For the first time in decades, Chinese output cannot expand, potentially ending 80% of global supply growth.

- As copper prices increase, Reuters has reported that some manufacturers have been substituting aluminium for copper in certain applications as relative prices shift.

What to watch

- South32 has said Mozal Aluminium is expected to be placed on care and maintenance around 15 March 2026, thus removing Mozambique's 560,000 tonne significant supply.

- If Indonesian and Chinese offshore capacity additions can compensate for Chinese domestic ceiling.

- Century Aluminium's 50,000 tonne Mount Holly restart in Q2 could provide a signal for the broader industry as the smelter is expected to reach full production by 30 June 2026.

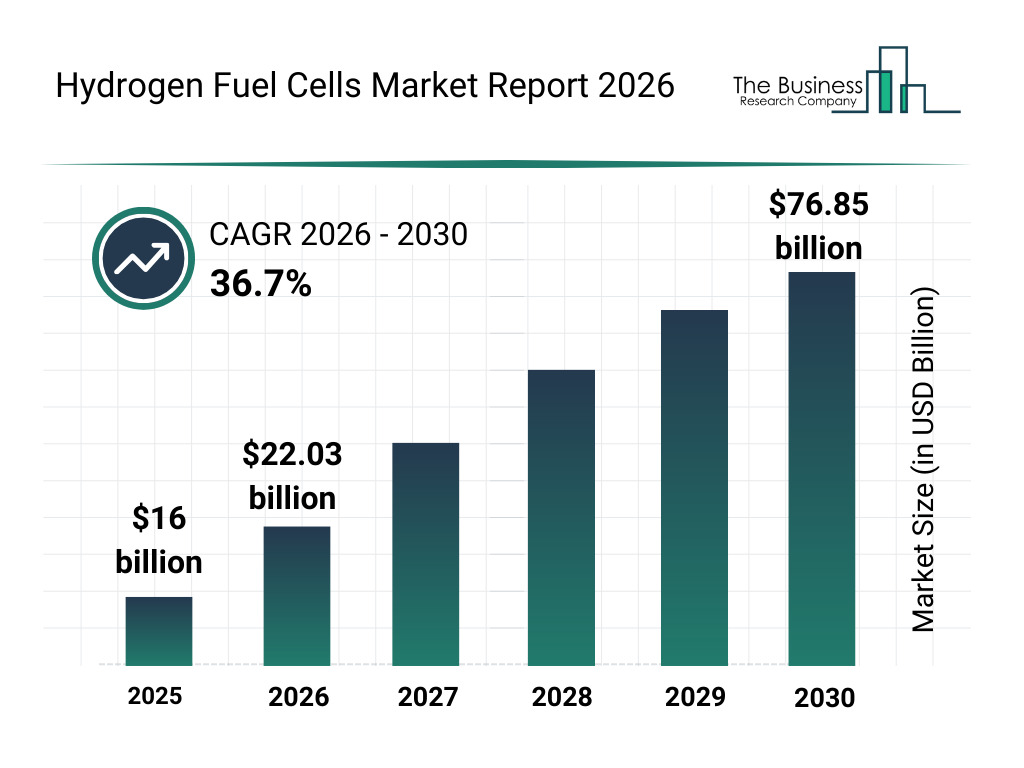

5. Platinum

Platinum's breakout above US$2,800 follows three consecutive years of supply deficit and increased adoption of hydrogen fuel cells (for which it is a vital component).

Key drivers

- The World Platinum Investment Council (WPIC) has forecast a significant supply deficit of 850,000 ounces in 2026 which could drain inventories, with limited new production coming online.

- WPIC forecasts 875,000 to 900,000 oz uptake by 2030 for heavy-duty trucks, buses, and green hydrogen electrolysers.

- Palladium-to-platinum substitution in catalytic converters is increasing in EV production.

What to watch

- Supply response from producers. Platreef and Bakubung are adding 150,000 oz, but production discipline could limit a broader ramp-up.

- US tariffs on Russian palladium could create spillover demand for platinum in EV production.

- The pace of hydrogen infrastructure investment and heavy-duty vehicle adoption rates in Europe, China, and US.

- Chinese jewellery demand could come into play. Just a 1% substitution from gold could widen the platinum deficit by 10% of the global supply.

You can trade Gold, Silver, and other Commodity CFDs, including energies and agricultural products, on GO Markets.

FX markets enter an important window with a Federal Reserve policy decision and press conference, US ISM activity data, German inflation releases, China PMIs, and Australian labour figures all due.

Quick facts

- The upcoming Fed policy decision and press conference are closely watched for guidance on the potential timing of rate cuts, with implications for US Treasury yields and USD direction.

- Broad USD selling has intensified over the last 48 hours. The move has coincided with renewed tariff rhetoric and heightened sensitivity to FX intervention narratives.

- ISM Manufacturing PMI is scheduled for Monday, 2 February, with ISM Services PMI on Wednesday, 4 February, providing timely insight into US growth momentum.

- German CPI, euro area GDP and unemployment, China PMIs, and Australian labour data provide regional context, particularly for EUR and AUD crosses.

USD/JPY

What to watch

The Federal Reserve decision and subsequent press conference are key events influencing US Treasury yields.

Any shift in tone around inflation progress, economic risks, or rate cut timing expectations may affect yield differentials and near-term USD sensitivity.

Recent broad USD weakness, reinforced by tariff-related headlines and intervention sensitivity, has added downside pressure to the USD.

On the JPY side, Japan inflation signals, including Tokyo CPI, are relevant as indicators of domestic price trends and potential policy direction.

Key releases and events

- Thu 30 Jan: Japan Tokyo CPI (January)

- Thu 30 Jan: Federal Reserve policy decision and press conference

- Mon 2 Feb: US ISM Manufacturing PMI

- Wed 4 Feb: US ISM Services PMI

Technical snapshot

USDJPY has broken lower from its recent consolidation zone, with downside range evident over the last 48 hours. Price has moved down to the 200-exponential moving average (EMA) and is testing a level not seen since October 2025.

EUR/USD

What to watch

The Fed decision and press conference may influence EUR/USD primarily through USD moves linked to Treasury yield reactions.

On the EUR side, German CPI will show inflation trends, while euro area flash GDP and unemployment data inform the regional growth outlook.

Key releases and events

- Thu 29 Jan: Germany CPI (preliminary)

- Thu 29 Jan: Eurozone flash GDP, Q4 2025

- Thu 30 Jan: Federal Reserve decision and press conference

- Fri 30 Jan: Eurozone unemployment rate

Technical snapshot

EURUSD has extended above a prior resistance level, with expanded daily ranges and strong momentum. Price action in other USD crosses suggests the move may be reflecting USD weakness, rather than a material shift in euro area fundamentals.

EUR/AUD

What to watch

Alongside euro area growth numbers, Australian employment data may influence near-term EUR/AUD sensitivity ahead of the RBA policy decision next week.

China's official PMIs remain relevant, as shifts in Chinese activity expectations can influence AUD via commodity demand and regional risk sentiment.

Key releases and events

- Thu 29 Jan: Australia Labour Force, Detailed (Dec 2025), 11:30am AEDT

- Fri 31 Jan: China official Manufacturing and Non-Manufacturing PMIs

- Tue 4 Feb: RBA policy decision

Technical snapshot

EUR/AUD has decisively broken below its prior support zone, with price now testing levels not seen since April 2025. Momentum remains negative, consistent with a renewed downside phase rather than consolidation.

Bottom line

The Fed decision and press conference, US PMI data, German inflation releases, China PMIs, and Australian labour figures are clustered in a short window.

Markets will be watching whether the USD weakness evident over the last 48 hours extends further.

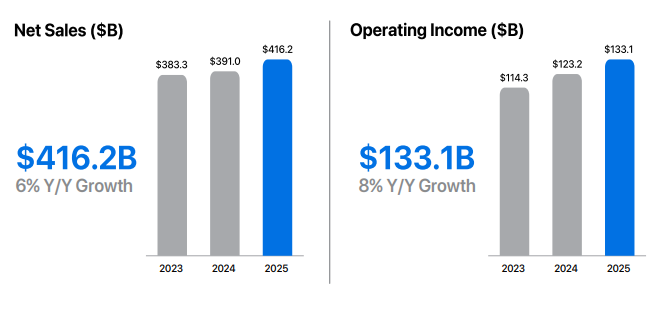

Expected earnings date: Thursday, 29 January 2026 (US, after market close) / early Friday, 30 January 2026 (AEDT)

Key areas in focus

iPhone

The iPhone remains Apple’s largest revenue driver. Markets are likely to focus on unit demand, product mix (including higher-end models), and any signals on upgrade momentum and regional trends.

Services

Investors are likely to focus on growth across areas such as the App Store, iCloud, Apple Music and other subscriptions, alongside any commentary on average revenue per user (ARPU). The size and engagement of Apple’s installed base remain central to overall performance.

Wearables, home and accessories

This segment includes products such as Apple Watch, AirPods, Beats headphones, home-related devices, and accessories. Investors are likely to watch revenue trends in this segment as an indicator of discretionary consumer demand.

Cost and margin framework

Management has flagged tariff and component cost pressures in prior commentary. Markets may remain sensitive to gross margin commentary and any signals of incremental cost pressure or mitigation strategies.

What happened last quarter

Apple’s most recent quarterly update (fiscal Q4 2025) highlighted record September-quarter revenue and EPS, alongside record Services revenue and continued emphasis on installed-base strength.

The prior update also included discussion of holiday-quarter expectations and cost headwinds (including tariffs), which have influenced expected margins and management guidance.

Last earnings key highlights

- Revenue: US$102.5 billion

- Earnings per share (EPS): US$1.85 (diluted)

- iPhone revenue: US$49.03 billion

- Services revenue: US$28.75 billion

- Net income: US$27.5 billion

How the market reacted last time

Apple shares rose in after-hours trading following the release, as investors assessed the results against analyst expectations and management’s holiday-quarter commentary, including tariff-related cost pressures and regional demand considerations.

What’s expected this quarter

Bloomberg consensus points to year-on-year EPS growth, with markets also focused on the revenue outcome and gross margins, given the scale and importance of the holiday quarter for Apple’s earnings profile.

Bloomberg consensus reference points (January 2026):

- EPS: about US$2.65

- Revenue: about US$138 billion

- Full-year FY2026 EPS: about US$8.1

*All above points observed as of 26 January 2026.

Expectations

Sentiment around Apple may be sensitive to any disappointment on holiday-quarter revenue, Services momentum, or margin commentary, given the stock’s large index weight and the importance of this reporting period.

Listed options were implying an indicative move of around ±3% to ±4% based on near-dated, at-the-money options-implied expected move estimates observed on Barchart at 11:00 am AEDT on 25 January 2026. Implied volatility was approximately 29% annualised at that time.

These are market-implied estimates (not a forecast) and may change. Actual post-earnings price moves can be larger or smaller.

What this means for Australian traders

Apple’s earnings can influence near-term sentiment across major US equity indices, particularly Nasdaq-linked products, with potential spillover into the Asia session following the release.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Asia-Pacific markets head into the week with Australia’s CPI as the key domestic catalyst, Japan’s month-end inflation and activity data keeping JPY and equities in focus, and China’s official PMI providing an important read on regional growth momentum.

Quick facts

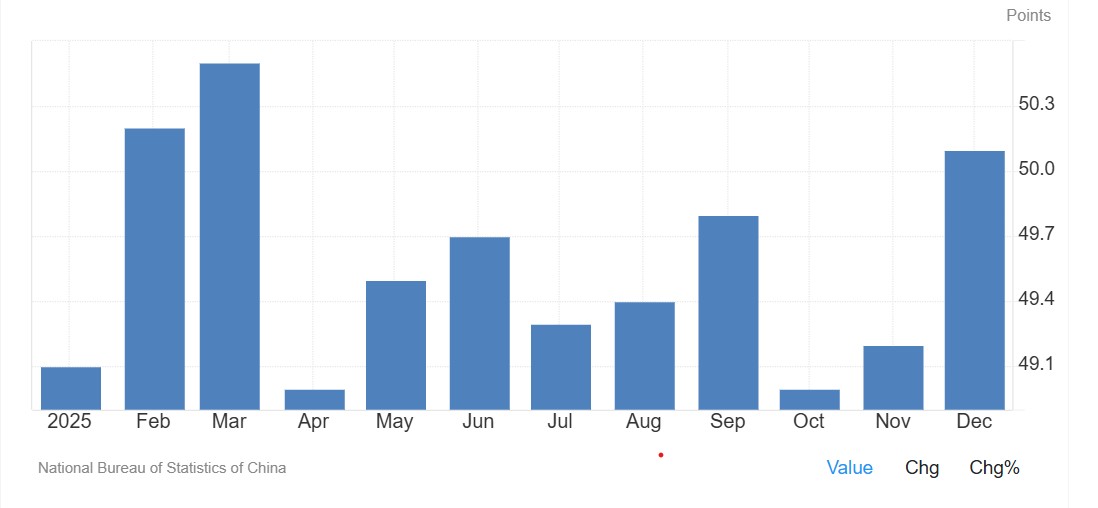

- China: NBS manufacturing PMI rose to 50.1 in December 2025. Consensus for Saturday’s release is 50.2.

- Australia: CPI, Australia (Dec) is the key local catalyst, with implications for rate expectations and AUD pricing.

- Japan: Tokyo CPI and month-end labour/activity data keep USD/JPY and Nikkei futures in focus following last week’s BoJ meeting.

- Global backdrop: US earnings momentum, US CPI expectations and geopolitical developments remain secondary but relevant drivers for Asia-Pacific risk sentiment.

China

Attention turns to China’s official PMI after December’s improvement saw the PMI move back above 50—a level commonly interpreted as expansion in the survey, though month-to-month readings can be volatile.

Consensus suggests a rise to 50.2; if met, it may help reinforce the view that growth momentum is stabilising into early 2026.

Key release

- Sat 31 Jan: NBS manufacturing and non-manufacturing PMI (Jan)

How markets may respond

- Regional equities and risk: Sustained PMI readings above 50 could support broader Asia risk appetite and materials-linked sectors. A reversal below 50 may temper recent optimism.

- AUD spillover: China-sensitive assets, including the AUD and materials stocks on the ASX, may react alongside domestic CPI outcomes.

Japan

Following last week’s BoJ meeting, focus shifts to Tokyo CPI and month-end activity data. These releases late in the week may shape near-term expectations around Japan’s inflation trajectory and the tone of the dataflow.

Key events

- Thu 29 Jan: Tokyo CPI (Jan) (medium sensitivity)

- Fri 30 Jan: Japan unemployment (Dec), retail sales (Dec), industrial production (Dec) (medium sensitivity)

How markets may respond

- USD/JPY: Month-end inflation and activity data can drive front-end rate repricing, with USD/JPY remaining a key transmission channel.

- JP225 (Nikkei futures): The contract has recently traded in a defined range. Market participants may monitor the ~54,250 area on the upside and ~52,250 on the downside as reference points, with price action around these levels often used to gauge whether the range is persisting.

Australia

Australia’s week is dominated by the CPI release. The outcome may influence rate expectations, with the next scheduled RBA decision still in the balance.

ASX 30 Day Interbank Cash Rate Futures imply around a 56% probability of a cash-rate increase at the next scheduled RBA decision (implied pricing can change quickly and is not a forecast).

AUD pricing is likely to remain sensitive alongside broader global risk conditions.

Key release

- Wed 28 Jan: CPI, Australia (Dec) (high sensitivity)

How markets may respond

- ASX 200: Rate-sensitive sectors may react more to the policy implications than the headline CPI number, particularly given recent strength in materials.

- AUD/USD: CPI outcomes may influence whether AUD/USD sustains around/above its current zone or drifts back toward prior trading ranges.

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

The Tesla earnings release can act as a barometer for both global EV demand and capital-intensive innovation across automation and energy systems.

Vehicle deliveries and margins are likely to be the primary near-term drivers of sentiment. Investors will also be watching updates across adjacent initiatives that may influence longer-term growth expectations.

Autonomy and software (FSD)

Tesla’s “Full Self-Driving” (FSD) is a branded advanced driver-assistance feature sold in some markets and requires active driver supervision; availability and capabilities vary by jurisdiction.

Further rollout and any expansion of autonomy-linked services remain subject to regulatory approvals and continued evolution of the underlying technology.

Energy generation and storage

Solar, Powerwall and Megapack remain a key focus, particularly given the segment’s recent growth contribution.

Robotics (Optimus)

Optimus remains early stage, with no disclosed revenue contribution to date. It may become more relevant to Tesla’s longer-term AI and automation aspirations.

Expectations remain delicately balanced between near-term margin pressure, the impact of demand and interest rate movements, and longer-term product and platform developments.

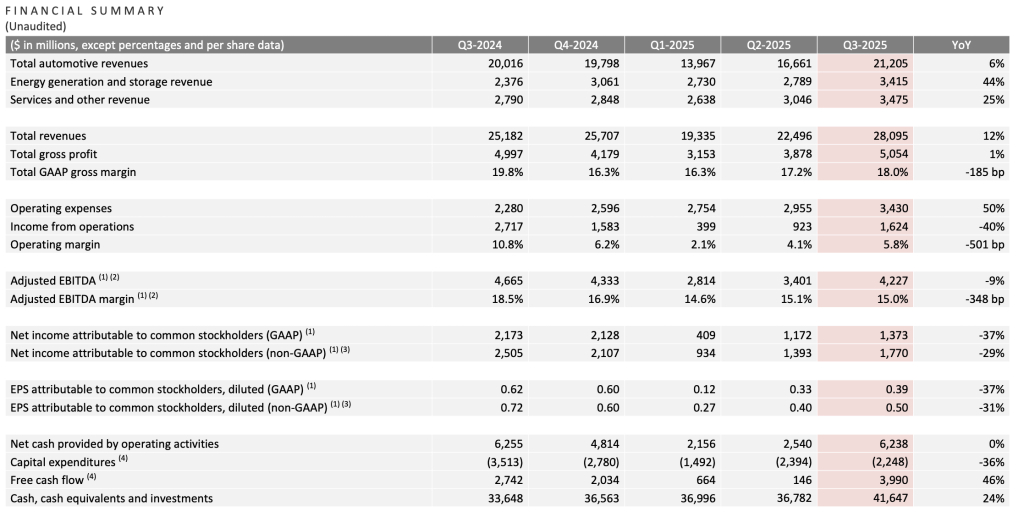

What happened last quarter?

In Q3 2025 (September quarter), Tesla reported mixed results versus consensus expectations. Revenue and deliveries reached record levels, while earnings and margins remained under pressure amid pricing and cost dynamics.

Tesla said it was navigating a challenging pricing environment while continuing to invest for long-term growth (as referenced in the shareholder communications cited below).

Last earnings key highlights

- Revenue: ~US$28.1 billion

- Earnings per share (EPS): ~US$0.50 (non-GAAP, diluted)

- Total GAAP gross margin: ~18.0%;

- Operating margin: ~5.8%

- Free cash flow (FCF): ~US$4.0 billion

- Vehicle deliveries: ~497,099 units, up ~7% year on year (YoY)

How did the market react last time?

Tesla shares were volatile in after-hours trading, with attention focused on margins relative to revenue.

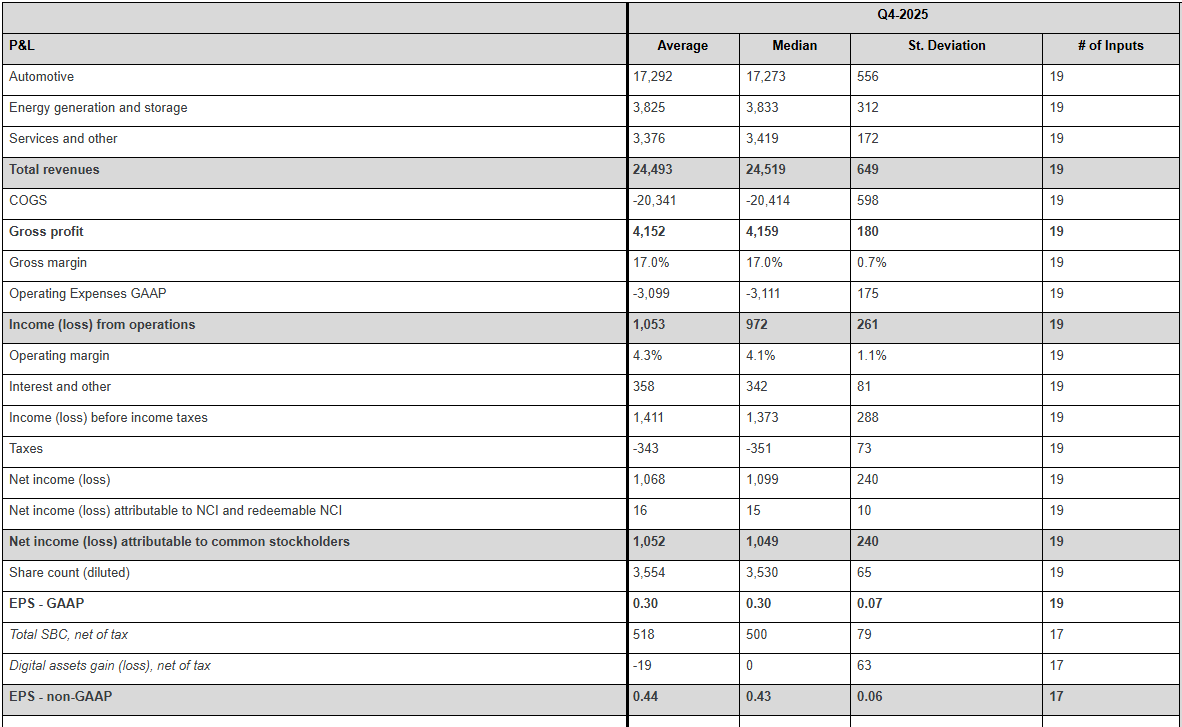

What’s expected this quarter?

As of mid-January 2026, third-party consensus estimates (Bloomberg) indicated continued focus on revenue growth alongside profitability and margin resilience. These are third-party estimates, not company guidance, and can change.

Key consensus reference points include:

- Revenue: market expectations ~US$27 billion to US$28 billion

- EPS: consensus clustered near US$0.55 to US$0.60 (adjusted)

- Deliveries: market estimates ~510,000 to 520,000 vehicles

- Margins: focus on whether automotive gross margin stabilises near recent levels or trends lower

- Capital expenditure (capex): focus on spending discipline and efficiency rather than acceleration

*All above points observed as of 16 January 2026.

Key areas markets often focus on include:

- Profit margin trajectory, and whether cost efficiencies are offsetting pricing pressure

- Delivery volumes relative to consensus expectations

- Pricing strategy and evidence of demand elasticity across regions

- Capex and implications for future FCF

- Progress in energy storage and non-automotive revenue streams

- Commentary on AI, autonomy and longer-term investment priorities

Expectations

Market sentiment could be described as cautiously optimistic, with investors weighing revenue momentum against margin concerns.

Price has pulled back into a range following a brief test of recent highs in December. Given the recent range-bound price action, deviations from consensus across key earnings metrics may prompt a larger move in either direction.

Listed options were pricing an indicative move of around ±5.5% based on near-dated options expiring after 28 January and an at-the-money (ATM) options-implied expected move estimate.

Implied volatility (IV) was about 47.7% annualised into the event, as observed on Barchart at 11:30 am AEDT on 16 January 2026 (local time of observation).

These are market-implied estimates and may change. Actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Tesla’s earnings may influence near-term sentiment across US growth and technology indices, with potential flow-through to broader risk appetite.

For Australian markets, any read-through is often framed through supply chain sensitivity. Market participants may look to related sectors such as lithium and rare earth producers linked to EV inputs are one potential channel, alongside broader sentiment impacts from Tesla’s innovation commentary.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

Intelligent Cloud (Azure)

Azure remains Microsoft’s primary earnings swing factor. Markets are watching to see whether any growth reflects demand strength or capacity constraints, and how AI-related workloads are impacting margins.

Productivity and Business Processes

Microsoft 365, Office, and LinkedIn are sources of recurring revenue for Microsoft. Growth, pricing discipline, and client churn remain the key variables that markets will be watching.

Personal Computing

Windows, devices, and gaming are more cyclical. Stabilisation of PC demand and gaming engagement remain secondary sources of revenue but are still noteworthy.

Artificial intelligence

Approaches around the monetisation of Microsoft’s AI play are still developing. Trends in enrolment and infrastructure cost are expected to be key factors.

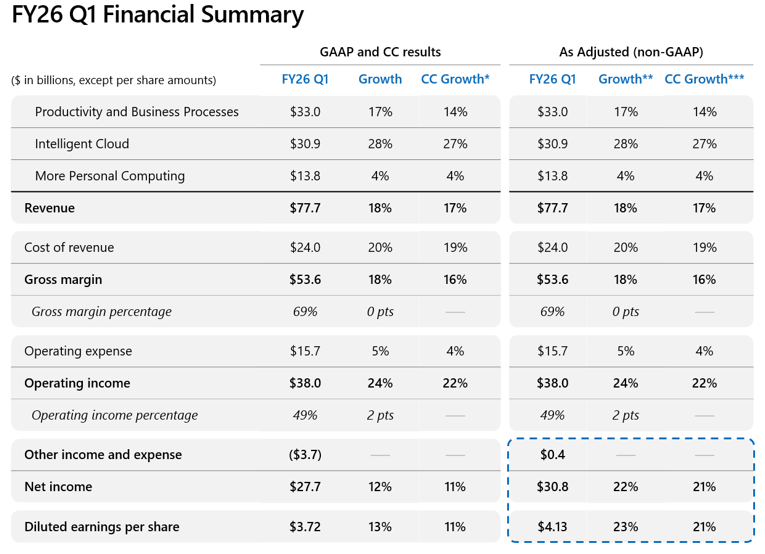

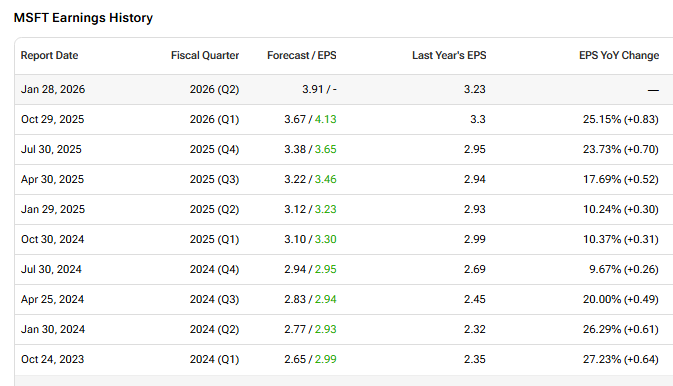

What happened last quarter

Microsoft reported results ahead of consensus, supported by steady cloud demand and resilient enterprise software revenues.

Azure and other cloud services' growth remained a central focus, alongside commentary on AI-related investment and capacity.

Last earnings key highlights:

- Revenue: US$77.7 billion

- Earnings per share (EPS): US$3.72 (GAAP) and US$4.13 (non-GAAP adjusted)

- Intelligent Cloud revenue: US$30.9 billion

- Azure and other cloud services: up 40% year on year

- Operating income: US$38.0 billion

How the market reacted last time

Microsoft shares fell in after-hours trading following the release, despite the beating of headline numbers, as investors focused on AI investment intensity, capacity constraints and related implications for future margins.

What’s expected this quarter

Bloomberg consensus points to continued revenue growth led by cloud services, alongside broadly stable margins despite elevated capex.

Bloomberg consensus reference points (January 2026):

- Revenue: about US$68 to US$69 billion

- EPS: about US$3.10 to US$3.20 (adjusted)

- Azure growth: mid-to-high 20% year on year (YoY) (constant currency)

- Operating margin: expected to remain broadly stable

- Capex: expected to remain elevated, reflecting AI and cloud build-out

*All above points observed as of 16 January 2026.

Expectations

Sentiment appears cautious. Microsoft can remain sensitive to any cloud, margin, or guidance disappointment, particularly where investors interpret investment intensity as open-ended.

Price action traded within an established range of US$472 and US$490 recently, but has moved below this in the last week.

Listed options were pricing an indicative move of around ±2% based on near-dated options expiring after 28 January and an at-the-money options-implied ‘expected move’ estimate.

Implied volatility was about 33.5% annualised into the event as observed on Barchart at 11:00 AEDT on 16th January 2026.

These are market-implied estimates and may change; actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Microsoft’s earnings may influence near-term sentiment across US technology indices, particularly the Nasdaq, with potential spillover into global equity risk appetite and, in turn, the ASX.

As a major technology stock, and with Tesla (TSLA) also scheduled to report after the US close on the same day, volatility in Nasdaq-linked products may increase while futures markets remain open.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Expected earnings date: Wednesday, 28 January 2026 (US, after market close) / early Thursday, 29 January 2026 (AEDT)

Key areas in focus

Advertising (Family of Apps)

Advertising remains Meta’s dominant revenue driver. AI-driven ad targeting, Reels monetisation, and engagement efficiency can be important contributors to revenue growth and may support advertiser outcomes, noting results can vary by advertiser, format, and market conditions.

User engagement and monetisation

Engagement trends across Facebook, Instagram, WhatsApp, and Threads remain closely watched as indicators that can influence monetisation assumptions and medium-term expectations.

Artificial intelligence

Meta views AI as a foundation for content discovery, advertising performance, and the development of generative tools. Markets may continue to evaluate whether AI-driven gains offset the level of infrastructure and data centre investment required to support these projects.

Reality Labs

Reality Labs remains loss-making. Management continues to frame AR/VR and metaverse-related platforms as long-term strategic investments, while acknowledging continued operating losses and a drag on earnings performance.

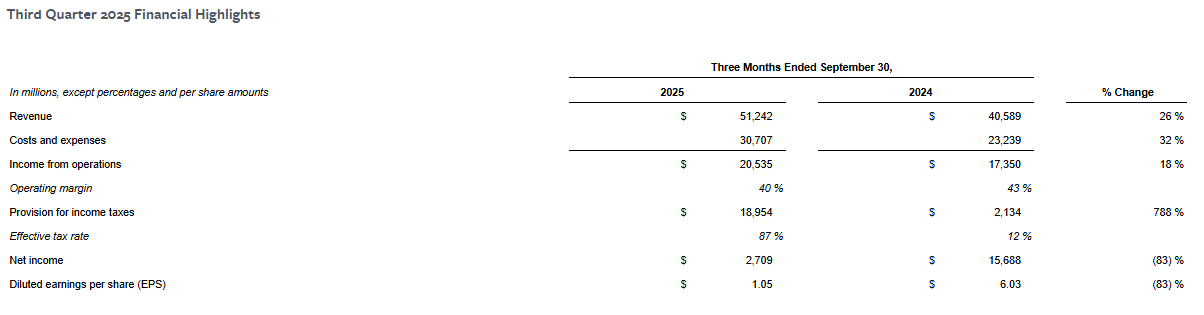

What happened last quarter

Meta’s most recent quarterly update highlighted strong revenue growth alongside ongoing investment themes.

The company’s reported (GAAP) net income and EPS reflected a one-time, non-cash income tax charge disclosed in the earnings materials, while management commentary also emphasised cost discipline and investment priorities.

Operating margins expanded year-on-year, despite elevated AI-related investment.

Last earnings key highlights

- Revenue: US$51.24 billion

- Earnings per share (EPS): US$1.05 (GAAP)

- Advertising revenue: US$50.08 billion

- Operating margin: 40%

- Reality Labs operating loss: about US$4.43 billion

How the market reacted last time

Meta shares fell in after-hours trading after the release. Commentary at the time highlighted strong top-line outcomes, alongside investor focus on the outlook for spending and the pace of AI and infrastructure investment.

What’s expected this quarter

Bloomberg consensus points to continued year-on-year revenue growth, led by advertising, with operating margins expected to remain elevated despite ongoing AI and infrastructure expenditure.

Bloomberg consensus reference points (January 2026)

- Revenue: about US$41 to US$43 billion

- EPS: about US$4.80 to US$5.10 (adjusted)

- Advertising growth: high-teens year on year (YoY)

- Operating margin: expected to remain above 40%

- Capital expenditure (capex): elevated, reflecting AI and data centre investment

*All above points observed as of 23 January 2026.

Expectations

Sentiment around Meta Platforms may be sensitive to any disappointment around advertising demand, margin sustainability, or the scale of ongoing investment in AI and Reality Labs.

Recent price action suggests that some market participants appear to be pricing in a relatively constructive earnings outcome, which can increase sensitivity to negative surprises.

Listed options were pricing an indicative move of around ±3% based on near-dated options expiring after 28 January and an at-the-money options-implied ‘expected move’ estimate.

Implied volatility was about 31% annualised into the event, as observed on Barchart at 11:00 am AEDT on 23 January 2026.

These are market-implied estimates and may change. Actual post-earnings moves can be larger or smaller.

What this means for Australian traders

Meta’s earnings may influence near-term sentiment across US technology indices, particularly the Nasdaq, with potential spillover into broader global equity risk appetite and index-linked products traded during the Asia session after the release, which can be volatile and unpredictable following earnings events.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.