- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Geopolitical Events

- Brexit- A Decisive Week

- A second referendum can be favourable for the Pound and may trade to the levels seen before the initial vote in 2016. On the other side, a No-Deal Brexit may push the Sterling pairs further to the downside.

- The news of a general election can stabilise the Pound or help the local currency to advance modestly higher until the outcome of the election is known.

News & analysis

The Parliament Vote is the pivotal stage for Brexit.

If the Brexit deal is accepted, Britain will exit the EU in an orderly way. However, if the proposed Brexit deal is rejected, there will be many uncertainties to follow. Market participants will have to wait and see how Brexit will unfold as and when more information or decisions will be made public.

If the Brexit deal is rejected, market participants will consider the following scenarios:

Revised Brexit Deal

At this stage, there are growing chances that Parliament may reject the withdrawal agreement. In the case Parliament rejects the deal; May will have to return to the EU and seek more concessions to pursue a second vote. Bearing in mind that the EU has been clear that the withdrawal deal would not be re-negotiated, material changes to the agreement are therefore unlikely.

A narrow defeat will mean that Theresa May may attempt to seek cosmetic changes from the EU that will increase the likelihood of the deal being approved in the second round. However, if a significant margin defeats her, it will hard to convince the EU to make changes that may impact the outcome of the vote.

Early Election

There are reports that the Labour Party is planning to trigger an early election “within days” if Theresa May is defeated in Parliament. If an election is not called immediately, it will then be difficult for the Labour Party to have sufficient time for an election and negotiate a better deal with the EU.

Would the PM use her power to set the date of the election in April- after the Brexit vote? This possibility has been crossing wires, as of writing.

No-Deal Brexit

If the vote is rejected across the House of Commons and no consensus can be found, Brexit will happen without a deal. No-Deal Brexit will mean that Britain will leave the European Union with no formal agreement on the terms of UK’s withdrawal or new trade relations.

Second Referendum

As the risks of a no-deal Brexit rise, the probability of a second referendum appears to increase as well. The campaign for the second referendum is crucial in determining a solid and informed outcome which means that the referendum will take time and Brexit will likely be postponed. There are higher chances that the EU will agree to delay or extend Article 50 on the basis on a second referendum rather than for more concessions on a new Brexit deal.

Britain has to obtain a unanimous vote from the EU members to extend the deadline.

No Brexit

As of writing, “No-Brexit” is making more headlines than “No-deal Brexit”. The Prime Minister strongly believes that No Brexit will let down the people who voted for Brexit and will be a catastrophe for the British democracy.

The stakes of what happens today are high. Traders who are trying to make sense of it all are finding it hard to know how Parliament will proceed should the vote be rejected. Brexit is a headache that has kept its local currency and the FTSE trapped.

The Brexit Impact on the Pound

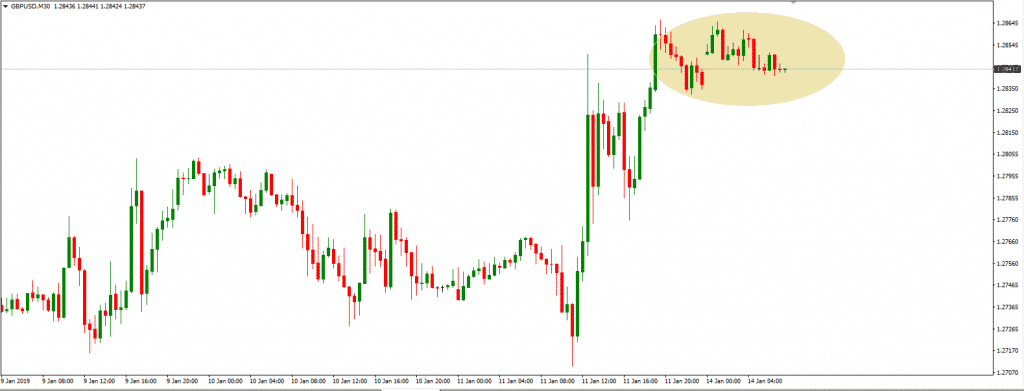

Traders are widely expecting the agreement to be rejected. After last Friday’s surge to the upside, the GBPUSD pair has gone into consolidation phrase ahead of the important vote.

GBPUSD

Source: GO MT4Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

432-202 – Biggest Defeat in Modern Times

Theresa May suffered the worst defeat in recent times in British history. The House has spoken, and Theresa May stated that the government will listen. “It is clear that the House does not support this deal, but tonight’s vote tells us nothing about what it does support.” It will be a big challenge for her to negotiate a withdrawal agr...

January 16, 2019Read More >Previous Article

Amazon Acquired Market-Cap Title

After a turbulent year for the technology giants, Amazon was crowned leader of the technology sector by market capitalisation on Monday. I...

January 8, 2019Read More >Please share your location to continue.

Check our help guide for more info.