- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Will the CHF/JPY reach 150?

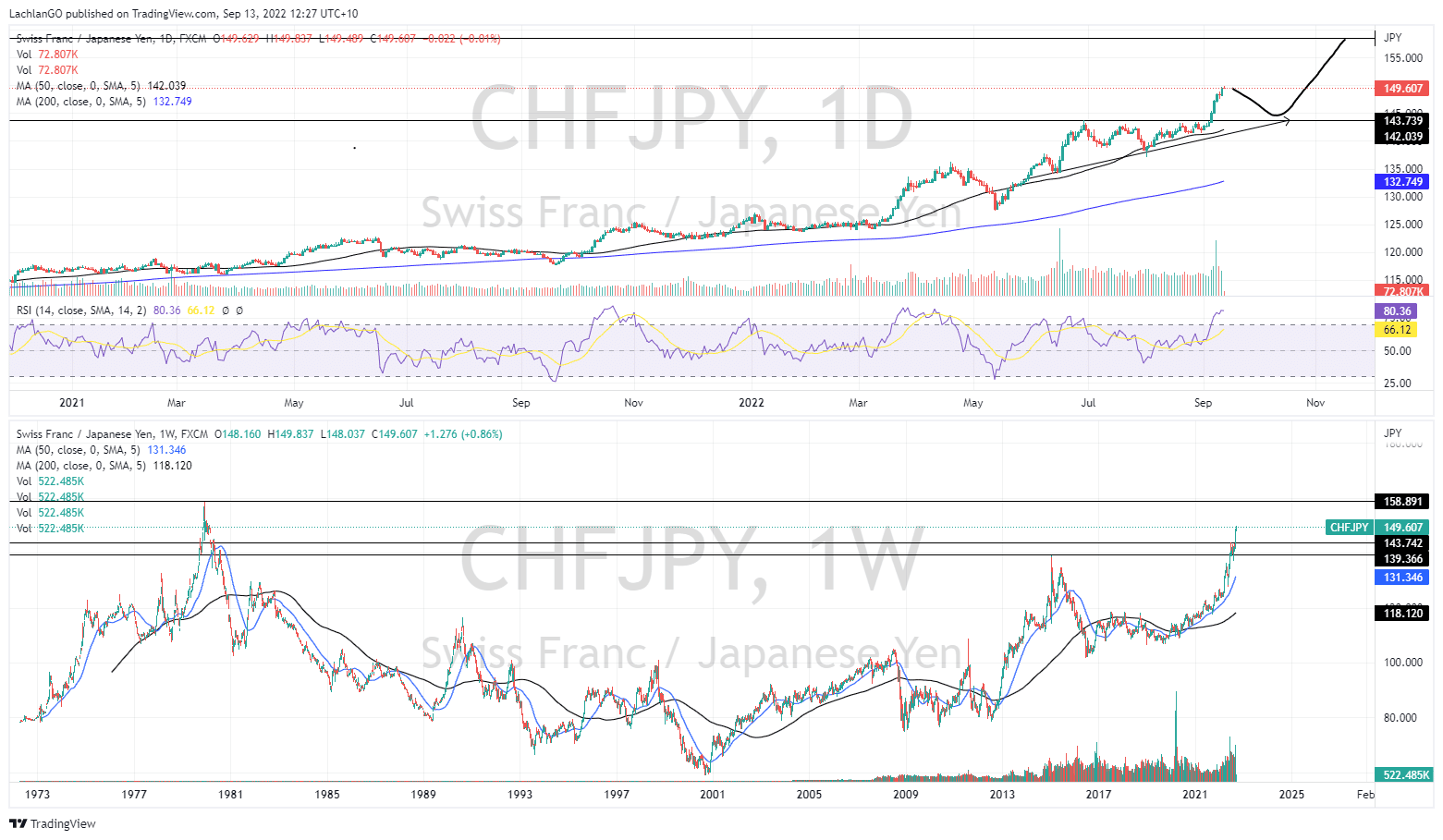

News & analysisThe CHF has moved almost parabolically against the JPY and is almost touching 150, which would mark a 40 year first.

With the Bank of Japan indicating its need to maintain current interest rate levels which are already among the lowest in the western world, the currency has been severely weakened. Statement that has come from some of its members indicate that there is no intention to adjust their Dovish policy even while the JPY continued to be smashed from pillar to post.

The CHF on the other hand been one of the stronger currencies outside of the USD as the countries, especially in recent months. With relatively low inflation and high volatility in the region the CHF has stood up well against most other currencies and been a source of stability. Therefore, the pair represents a trading opportunity by taking advantage of extremes of both a strong and weak currency.

The chart shows the pair has moved almost parabolically on the weekly timeframe. The price is currently at multi decade highs, with the 149.75 price the highest it has been since 1980. Whilst the 150 level is not a specific resistance point, it poses as a psychological level that may prove difficult to break out of.

On the daily chart, the recent break above 140 required 3 months of consolidation before it broke above the level. Since then, the breakout has largely been without any retracement or pullback. Therefore, it would not be unexpected for the price to pullback, especially as it gets closer to the 150 level. The RSI is also supporting a pullback as it is in highly overbought territory at 80. If it does retrace then it may bounce off the recent support level at 142/143, and then rise target of 158 may become possible.

If the Bank of Japan does decide to change its tune in regard to its dovish policy, then this trade does have the potential to go the other way with the JPY increasing in value very quickly, although at this stage there is nothing to indicate that this will occur.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

NZDJPY showing a potential buy?

The NZDJPY like most currencies against the JPY has been in a strong uptrend for over 2 years. With the Central Bank of Japan remaining dovish in its monetary policy the currency has taken a beating against most other currencies and as other Central Banks have acted against rising inflation. The NZD has been able to take adva...

September 15, 2022Read More >Previous Article

Kroger tops estimates for Q2 – the stock is up

The Kroger Company (KR) released its latest financial results for Q2 on Friday. The American grocery supermarket chain reported revenue of $34.638 ...

September 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.