- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- What Has Moved The Markets So Far This Week?

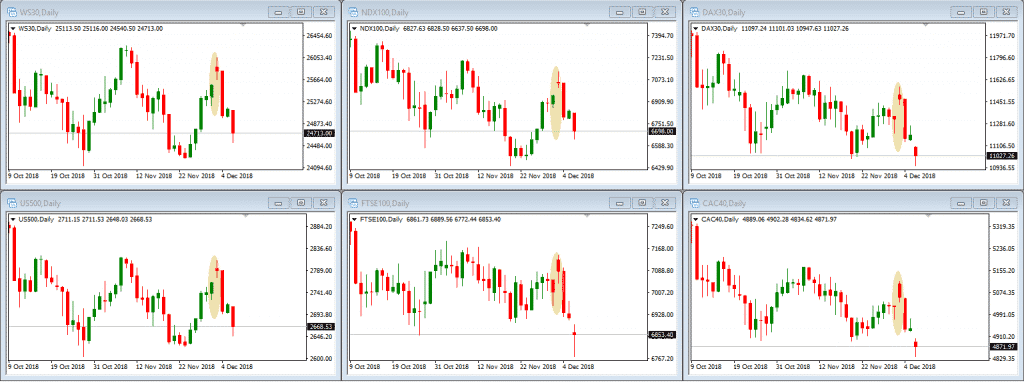

- The equity markets were flashing green again, and major equity benchmarks managed to climb sharply to the upside.

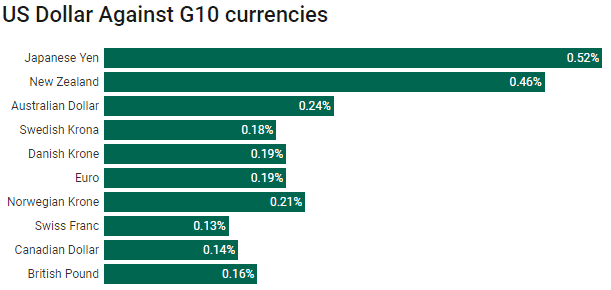

- In the FX markets, all G10 currencies appreciated against the greenback. The Japanese Yen and the Antipodeans emerged as the best performers. The British Pound struggled to keep the pace with the other G10 currencies, due to the Brexit uncertainties.

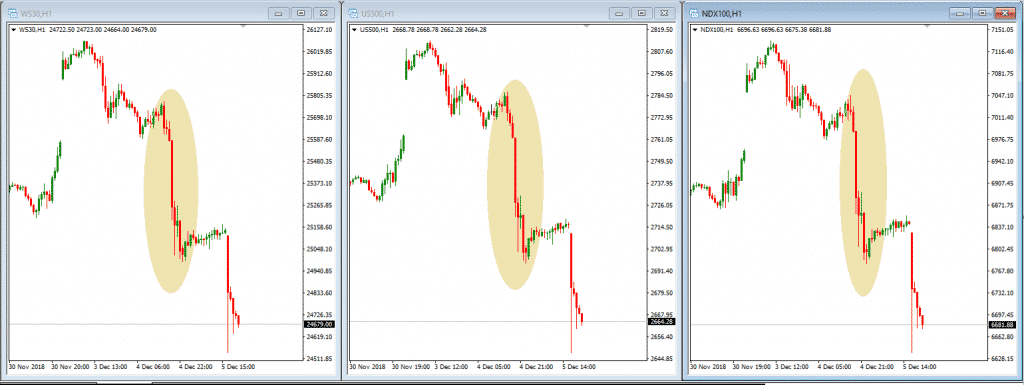

- Investors dramatically dropped riskier assets. Wall Street bled the most: The Dow Jones Average Industrial dropped 799 points (3.10%), the S&P500 fell by 90 points (3.24%), and Nasdaq Composite erased 3.8%.

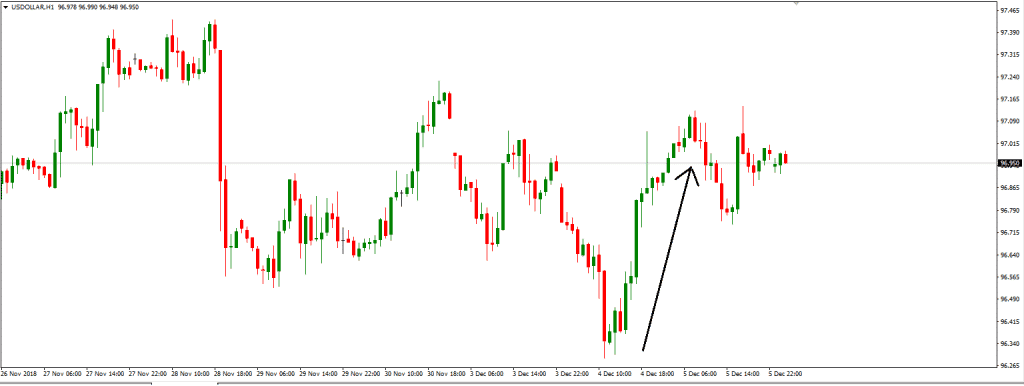

- The greenback retrieved its safe-haven status and bolstered against rival peers. The US dollar Index spiked above the 97 level before losing some bullish momentum.

- Legal advice which states that Brexit deal can be reversed using Article 50

- A motion to disclose the legal advice supported by the House of Commons

- Three Brexit defeats in the Commons

- Scottish political parties are joining forces to show their opposition.

News & analysisDecember started on a positive note, though it was short-lived. During the G20 meeting, there was more optimism in the financial markets than the market participants had anticipated. Investors were therefore hopeful that December would be promising.

Post G20 Reactions – Bullish Gaps

Monday started on a buoyant note with a few bullish gaps, and risk sentiment was revived. The dynamic in the financial markets had changed, and investors entered the last month of the year with more confidence.

(Daily Charts: WS30, NDX100, DAX30, US5OO, FTSE100, and CAC40)

Inverted Yield Curve and Trade Ambiguity

An inverted yield curve and lack of details around the trade truce deal have halted the upbeat tone in the financial markets. The yield spread between the 3-yr and 5-yr Treasuries dropped to -0.1 on Monday, triggering a massive sell-off due to rising fears of a recession. At the same time, investors were worried that a muted China regarding the ceasefire was bad news.

(Hourly Charts: WS30, NDX100 and DAX30)

(Hourly Chart: US dollar Index)Brexit

Aside from trade headlines and the fears around the inverted yield curve, Brexit news dominated the markets. A meaningful Parliament vote is scheduled on the 11th of December, and there was much new information for market participants to digest.

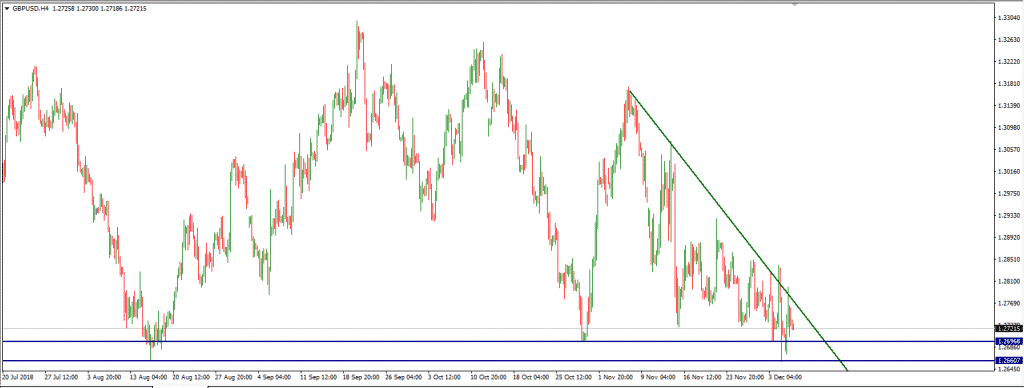

The GBPUSD pair swung up and down, depending on the headlines. Any gains appeared to have been capped by the downtrend line. The pair has also broken key support levels and dropped to August lows. It briefly attempted a break outside the descending line.

(H4: GBPUSD)Fundamentals are weak, and investors reactions seemed to be more pronounced. Sparks in the markets are either bringing relief or igniting the fears.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Preview: The European Central Bank Rate Decision

With the Brexit negations dominating the news flow over the last few weeks, you may forget there are other events taking place. On Thursday, the European Central Bank will announce its decision whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time. Why Is The Announcement Impo...

December 12, 2018Read More >Previous Article

Canada – Taking A Look At The Loonie Economy

Canada News Flying Under The Radar Canada has been a predominant feature in financial news in the recent few months, with many discussions centered a...

December 2, 2018Read More >Please share your location to continue.

Check our help guide for more info.