- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- USDJPY provides potential trade after holding a key Fibonacci level

- Home

- News & analysis

- Forex

- USDJPY provides potential trade after holding a key Fibonacci level

News & analysisNews & analysis

News & analysisNews & analysisUSDJPY provides potential trade after holding a key Fibonacci level

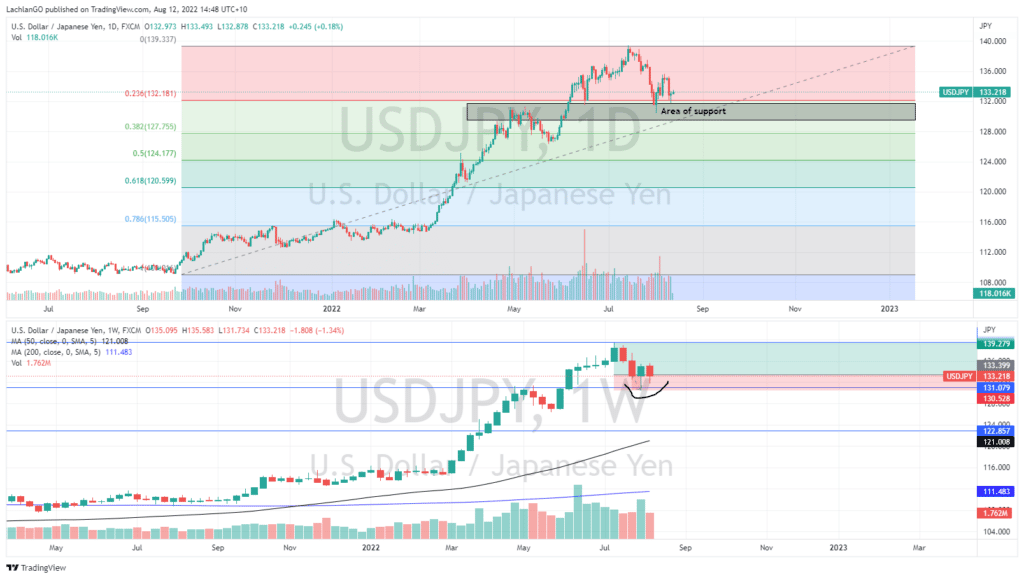

12 August 2022 By GO MarketsThe USDJPY has been in an extremely strong upward trend since September 2021. This pair’s recent price action has also been charactarised by relatively weak retracements as it has trended higher. Inflationary pressures have acted as a strong catalyst for the USD against most other currencies further aided by the Federal Reserve taking a strong stance against inflation with a series of aggressive interest rate hikes. At the same time, the JPY has remained weak as the Central Bank of Japan has refused to intervene and shift from its dovish stance.

The most recent retracement shows the potential for a good risk/reward Long trade. On the chart, it can be seen that the price has pulled back to the 23.60% Fibonacci level, which is at 132/133JPY. This area also doubles as a support zone with the prior resistance level becoming a level of support which is another sign that the trend may continue.

On the weekly chart, the characteristics of the candlesticks near the support zone also support the premise that the price may bounce. The candles have long wicks touching the support area indicating that the buyers are soaking up the supply. They have also closed near their opening price again showing how buyers are soaking up the supply.

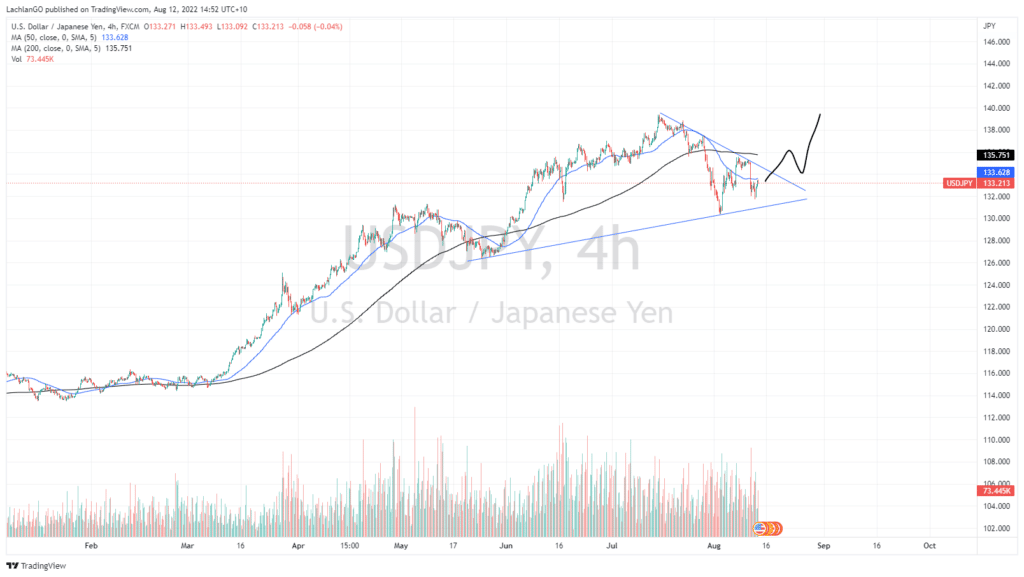

The 4-hour chart shows a consolidation of the price forming a triangle, with the potential to break out to the upside. This may provide an alternative entry signal for the same overall strategy. An important aspect to remember when trading this strategy is to ensure that price occurs with relatively high volume. Large volume indicates that buyers are regaining control over the price, and that sellers have become exhausted.

Potential risks

There are some risks with this trade. Firstly, the pair is already quite overextended with the price at multi-decade highs. In addition, with US inflation fears potentially easing and interest rate hikes priced in already, the current price may be near its peak.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Li Auto Q2 results are here

Li Auto Inc. (LI) reported its unaudited second quarter financial results on Monday. The Chinese automaker fell short of analyst estimates for the quarter. World’s 16th largest automaker reported revenue of $1.207 billion vs. $1.416 billion expected. The company reported a loss per share of -$0.04 for the quarter vs. -$0.02 loss per share e...

August 16, 2022Read More >Previous Article

Buying opportunity on the GBPAUD

Buying opportunity on the GBPAUD A short/medium term trading opportunity has arisen on the GBPAUD. The Pound has been weakening after the...

August 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.