- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- USDJPY – Bank of Japan Policy Decision & the 10-yr JGB Yield

- Home

- News & analysis

- Forex

- USDJPY – Bank of Japan Policy Decision & the 10-yr JGB Yield

News & analysisNews & analysis

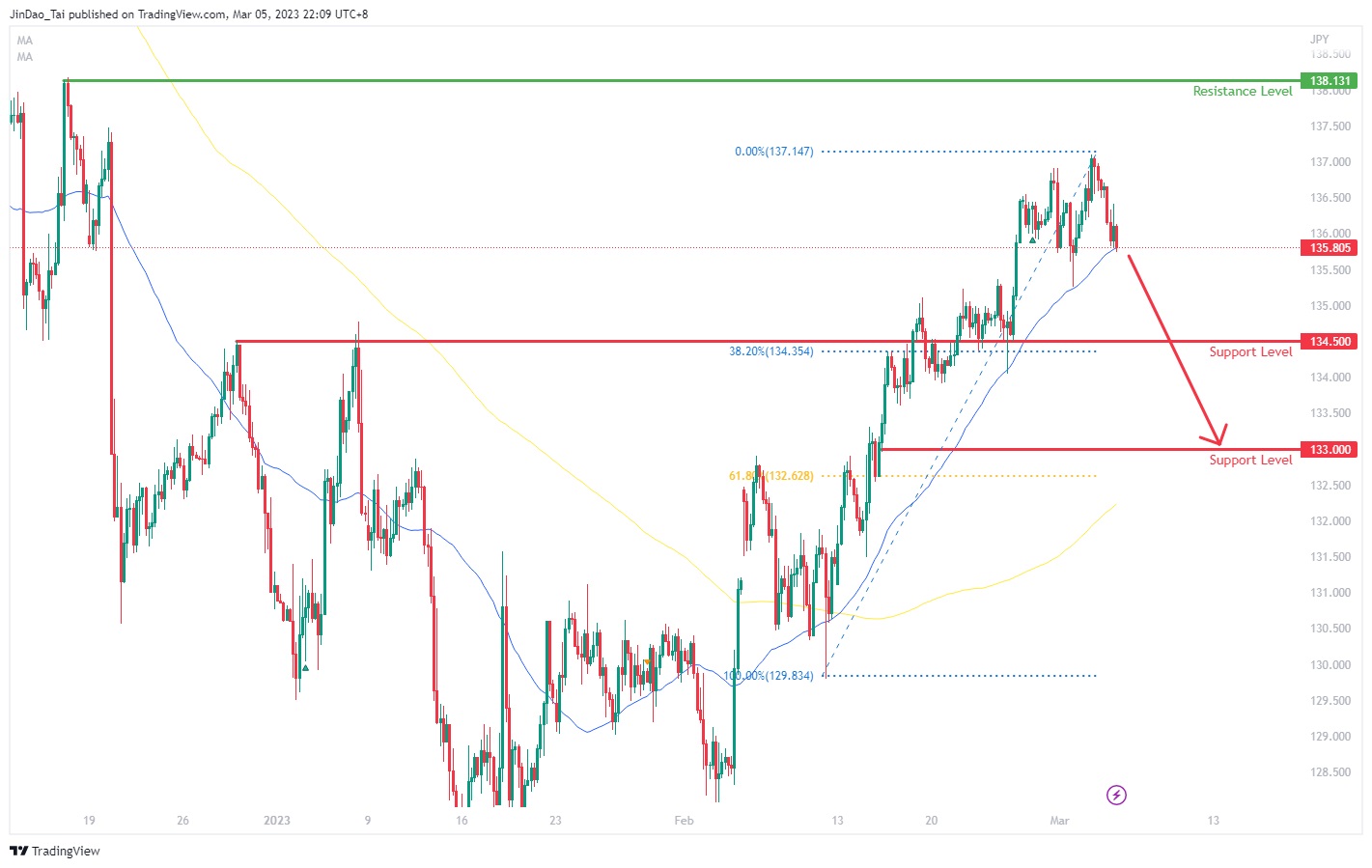

News & analysisNews & analysisThe USDJPY had been trading steadily higher in February, from the 128.50 support level, up toward the 137 round number resistance level. This move was driven by a combination of fundamental reasons (strengthening of the DXY and overall weakness of the Japanese Yen) and technical setup (the golden cross, where the 50-period Moving Average crossed over the 200-period Moving Average).

This week, the Bank of Japan (BoJ) is set to release its latest decision on its Policy Rate and the accompanying Monetary Policy Statement. The BoJ is expected to persist with its current stance, maintaining an ultra-lose monetary policy approach as it is the last BoJ policy meeting for Governor Kuroda.

However, last week, the yield on the 10-yr Japanese Government Bonds (JGBs) consolidated slightly above the 0.5% ceiling adjusted by the BoJ on 20th December 2022. Following the announcement of the increased yield limit, the Japanese Yen strengthened significantly, with the USDJPY trading down from 137.30 to 130.60. The markets are now watching if the BoJ would take on a similar action again.

As the DXY weakened toward the end of the week, the USDJPY was dragged lower, reversing from the 137 resistance level, down to the 135.80 price level to test the 50-period Moving Average. If the price breaks below the Moving Average support level, the USDJPY could trade down to the key support level of 134.50 which coincides with the 38.3% Fibonacci Retracement level.

If the BoJ were to further adjust the yield limits on the 10-yr JGBs, the USDJPY could see a continuation of the downside beyond 134.50, with the next key support level at the 133 price area, formed by the round number and 61.8% Fibonacci Retracement level.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

XAUUSD, GBPJPY, and GBPUSD Analysis

XAUUSD Analysis The gold price outlook remains positive in the short and medium term. Gold price has rested above support 1847 and support 1830 is the next support in case support breaks 1847 down, but if the price rises, resistance 1858 is a short-term target or High. The latest that the price has made And the next resistance at the price l...

March 7, 2023Read More >Previous Article

AUD CPI eases but Interest Rates could continue rising

The Consumer Price Index (CPI) is an inflation indicator that is closely watched by the markets and policymakers as a gauge of economic fluctuation an...

March 2, 2023Read More >Please share your location to continue.

Check our help guide for more info.