- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- The week ahead – RBNZ rate decision, USD, AUD and JPY inflation data

- Home

- News & analysis

- Forex

- The week ahead – RBNZ rate decision, USD, AUD and JPY inflation data

News & analysisNews & analysis

News & analysisNews & analysisThe week ahead – RBNZ rate decision, USD, AUD and JPY inflation data

26 February 2024 By Lachlan MeakinFX markets enter the new week with market sentiment firmly risk-on with all-time highs seen in US and Japanese indexes after a blowout earnings report from AI darling Nvidia (NVDA) sent stocks surging.

Ahead this week we have key inflation data out of the US, Australia and Japan along with a RBNZ rate decision which is certainly in play.

The Charts to watch this week

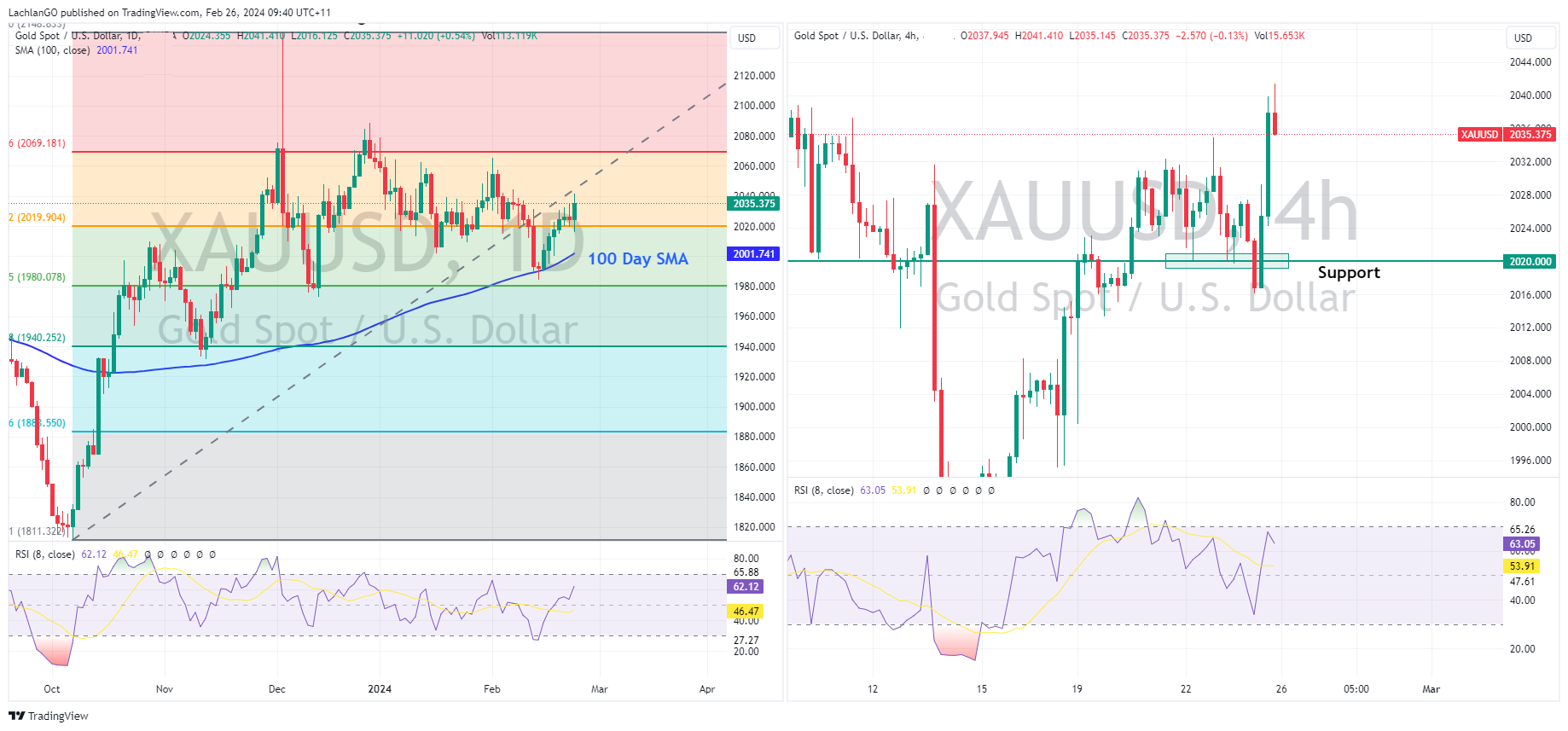

Gold – XAUUSD

Despite the buoyant market sentiment gold gained last week as the USD chopped around without real direction. XAUUSD finding good support at the 2020 USD an ounce level in the second half of the week. This will be a key level to watch coming into Thursdays PCE inflation data out of the US a cooler than expected reading could see the USD decline continue and likely to add to golds bullish recovery.

USDJPY

Japanese inflation data released Thursday is expected to show a sharp drop in January due to a high base last year this could impact the JPY even further, raising doubts around one of the Bank of Japan’s two conditions for policy normalisation and be bullish for USDJPY.

Though above 150 there is the specter of BoJ intervention such as we saw at these levels late in 2022. Currently 150 has become a support level for USDJPY, but upside in this pair seems capped with little upside momentum shown recently, FX traders no doubt cautious at these levels.

AUDNZD

Both AUD and NZD outperformed last week as market optimism and steps by Chinese authorities to support their stock market lifted both the Antipodean currencies. NZD did outperform the Aussie though, with AUDNZD hitting new 9-month and 2024 lows. This week will be a big one for AUDNZD traders, with Aussie CPI expected to rise and a RBNZ rate decision where the bank is expected to hold rates both happening on Wednesday. The market is pricing in a 30% of a hike from the RBNZ, so whichever way they go expect some volatility in NZD crosses over this announcement.

Full Economic calendar of the week ahead at the following link:

https://www.gomarkets.com/au/economic-calendar/

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Li Auto stock surges as earnings arrive above estimates

Chinese electric vehicle company Li Auto Inc. (NASDAQ: LI) announced Q4 and 2023 fully-year results before the US market opened on Monday to kick off a new trading week. Li Auto achieved revenue of $5.878 billion (up by 136.4% from Q4 2022) vs. $5.599 billion expected. EPS was reported at $0.594 per share in Q4, above estimate of $0.446 per s...

February 27, 2024Read More >Previous Article

FX Analysis – USD whipsaws , AUDNZD hits new lows, Gold holds key support

USD was ultimately flat in Thursdays session after a rollercoaster of a ride, DXY printed a low in the European session of 103.43 before rallying up t...

February 23, 2024Read More >Please share your location to continue.

Check our help guide for more info.