- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Forex

- The Loonie – Best Performing G10 Currencies

- The Liberals won in terms of seat numbers.

- The Conservatives won 121 seats in Parliament compared with 99 in 2015 and have won the popular votes claiming 34.4% over the Liberals’ 33%.

- Bloc Quebecois was a huge win as they gained 22 seats.

- If there is a coalition between the Liberals and the NDP, there could be a much larger fiscal spending than originally expected.

- Tax cuts would also help to boost consumer spending.

News & analysisThe Loonie

Best Performing G10 Currencies

After a tight campaign marred by scandals, Justin Trudeau secured another term as Prime Minister. Unlike a clear win in 2015, the Prime Minister did not pass the threshold of 170 seats and will lead a minority government. The governing party will be forced to depend on other parties to pass legislation.

The voting results show deep divisions in the country:

The outcome of the election is unlikely going to drastically change the dynamics in the Canadian markets. On a broader level, there are layers of similarities between the agendas of the different political parties which will help to reduce the uncertainties that generally arises from election results. However, the Liberals governing as a minority government will rely on smaller parties to push legislation which will be challenging.

In the money markets, the Canadian dollar was trading near three-months high against its US counterpart on the Liberals win. The loonie has been on an upswing this year backed mostly by strong economic data and is currently the best performing G10 currencies:

Source: Bloomberg TerminalCanada’s Economy

The Canadian economy outperformed its rivals which allowed the Bank of Canada to keep its benchmark interest rate steady at 1.75% while other central banks have cut their own rates in response to the global backdrop.

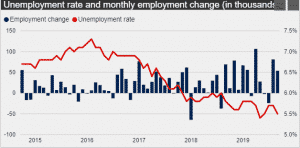

Employment

Employment rose by 54,000 in September driven by gains in full-time work while the unemployment rate declined by 0.2% to 5.5%. The growth was mostly seen in the self-employment and public sector employees.

Source: Bank of CanadaWage Growth

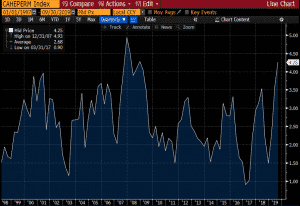

The Average Hourly Wage Rate year-on-year in September jumped to 4.25% and marked the strongest month in a decade.

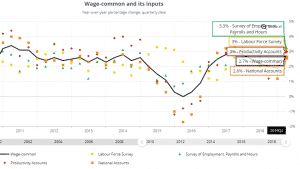

Source: Bloomberg TerminalThe Wage-common, a wage measure that the Bank of Canada uses to capture the underlying wage pressures reflecting the common trend across data sources rose to 2.7% in the second quarter in 2019.

Source: Bank of CanadaInflation

The Bank of Canada aims to keep inflation at the 2% midpoint of an inflation-control target range of 1% to 3%. The recent annual inflation rate stood steady at 1.9% but fell low of market expectations of 2.1%. However, inflation remains close to or on target since March 2019.

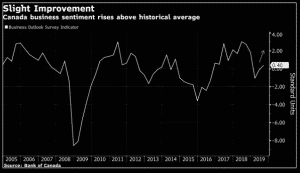

Business Outlook Survey

The Business Outlook Survey indicator rose to 0.40 which shows a slight improvement in overall sentiment. However, due to the challenges in the energy sector, the sentiment in Prairies remain predominantly negative.

The Loonie

While major central banks have been cutting interest rates, the BoC has been reluctant to do so despite the global downturn because of the sound economic environment. The Canadian dollar has been on the rise and has retained the number 1 spot among the G10 currencies against the US dollar.

After the election, the prospects of growth-boosting fiscal policies combined with a resilient economy may keep the BoC on the sidelines.

Investors are expecting further divergence between the Fed and the BoC. While the BoC is expected to keep its interest rate on hold this year and until late 2020, the Fed is widely expected to cut rates.

In the short-term, we expect the loonie to benefit from the rate divergence and the fiscal boost. In the medium-term, the Canadian dollar may weaken as the effective implementation of the fiscal expansionary policy will lower the Canadian exchange rate.

See our introduction to forex for more information, including currency trading for beginners here.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The MACD – Useful indicator or just another pretty picture?

The MACD (or the ‘Moving Average Convergence/Divergence oscillator’ to give its full name) is one of the popular extra pieces of information we often see added to charts. The purpose of this article is to clarify what it may be telling you about market sentiment and offer a description as to how traders commonly apply this in their de...

November 3, 2019Read More >Previous Article

Quick Trading Tip #1 – Developing patience in your trading

When we first start to trade, or subsequently (as a more experienced trader) when we trade a new symbol or system we are often “excited” as we...

October 23, 2019Read More >Please share your location to continue.

Check our help guide for more info.