- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Potential Reversal on the NZDUSD?

News & analysisThe current market consensus is that the Reserve Bank of New Zealand (RBNZ) would likely keep interest rates at 5.50% at the upcoming meeting on 12th July. This is supported by the RBNZ’s monetary statement indicating that “monetary policy is having a sufficiently moderating effect on demand and inflation, and that we are yet to see the full effects of past tightening on the economy. A pause would also allow more time to assess the impact of the significant tightening, and the timing of any further increase that might be needed.”

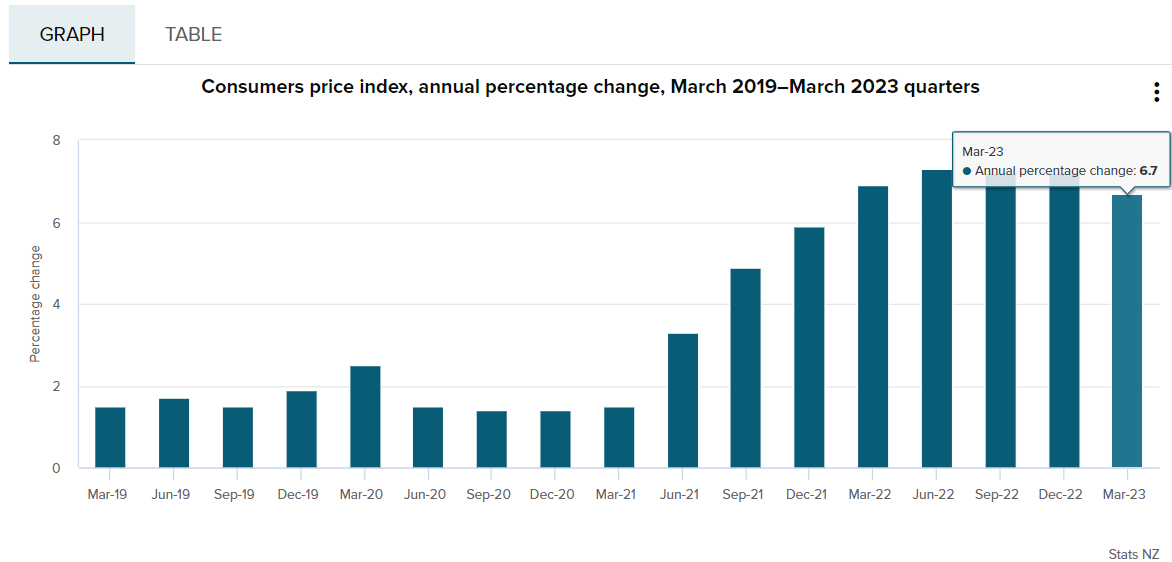

However, while the Consumer Price Index (CPI) has turned down from its peak of 7.3%, the most recent data was released at 6.7%, this is still significantly higher than the RBNZ’s target level of 1-3%. Therefore, another rate hike from the RBNZ cannot be ruled out.

In May, the RBNZ released its decision to hike rates to 5.50% but also indicated that the official cash rate has reached its peak at 5.50% but would need to remain at the restrictive level until at least the middle of 2024. This led to the NZDUSD falling steadily from 0.6250 to reach the round number support level of 0.60.

As the NZDUSD climbs toward the 0.6250 price area, formed by the previous swing high and the downward trendline, look for a potential reversal if the RBNZ holds interest rates at 5.50% as forecasted. A reversal to the downside could reach the price level of 0.61, supported by the upward trendline, and beyond that, the 0.60 round number key support level.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Understanding the US Dollar Index

The U.S. Dollar Index (USDX, DXY, DX, or, informally termed “the Dixie") is a measure of the value of the United States dollar relative to a basket of foreign currencies. It is often used as an indicator of the overall strength or weakness of the U.S. dollar in the foreign exchange market. Changes in the index value reflect shifts in the rel...

July 11, 2023Read More >Previous Article

Understanding market data: Purchasing Managers Index (PMI)

The Purchasing Managers' Index (PMI) is an economic indicator used to measure the health and activity level of a specific sector of an economy, namely...

July 5, 2023Read More >Please share your location to continue.

Check our help guide for more info.