- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Market Analysis – USD slides, AUD hits key level, Gold rallies

- Home

- News & analysis

- Forex

- Market Analysis – USD slides, AUD hits key level, Gold rallies

News & analysisNews & analysis

News & analysisNews & analysisMarket Analysis – USD slides, AUD hits key level, Gold rallies

22 December 2023 By Lachlan MeakinRisk on returned to global markets in Thursdays session with equities rebounding strongly on weak US data that refuelled hopes of a faster pace to the Feds rate cutting cycle come 2024.

USD sold off sharply partly due to month-end flows ahead of the holidays but accelerated by a bis miss in Q3 US GDP which came in at 4.9% vs the expected 5.2%. This saw rate cut odds in March push above the 80% mark with yields and the Dollar tumbling as a result.

The Dollar Index (DXY) pushing below last weeks trough to new 5-month lows, also losing the 102 handle in the process.

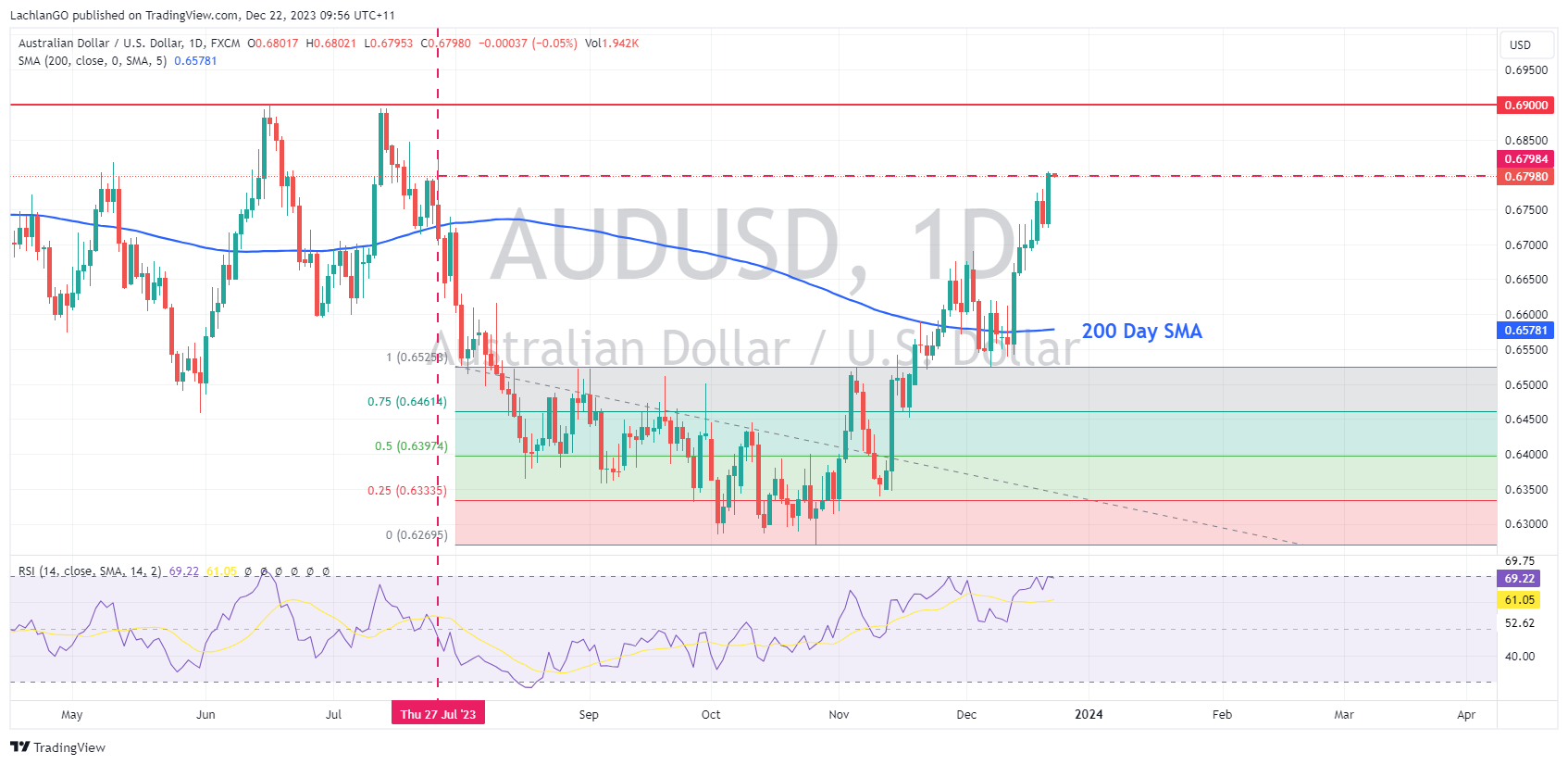

AUD outperformed after the weaker than expected US GDP reading and an upbeat market risk sentiment. AUDUSD poking its head above the psychological 0.68 for the first time since July before finding some resistance at the big figure. The major resistance at 0.6900 the next big test to the upside if this rally continues.

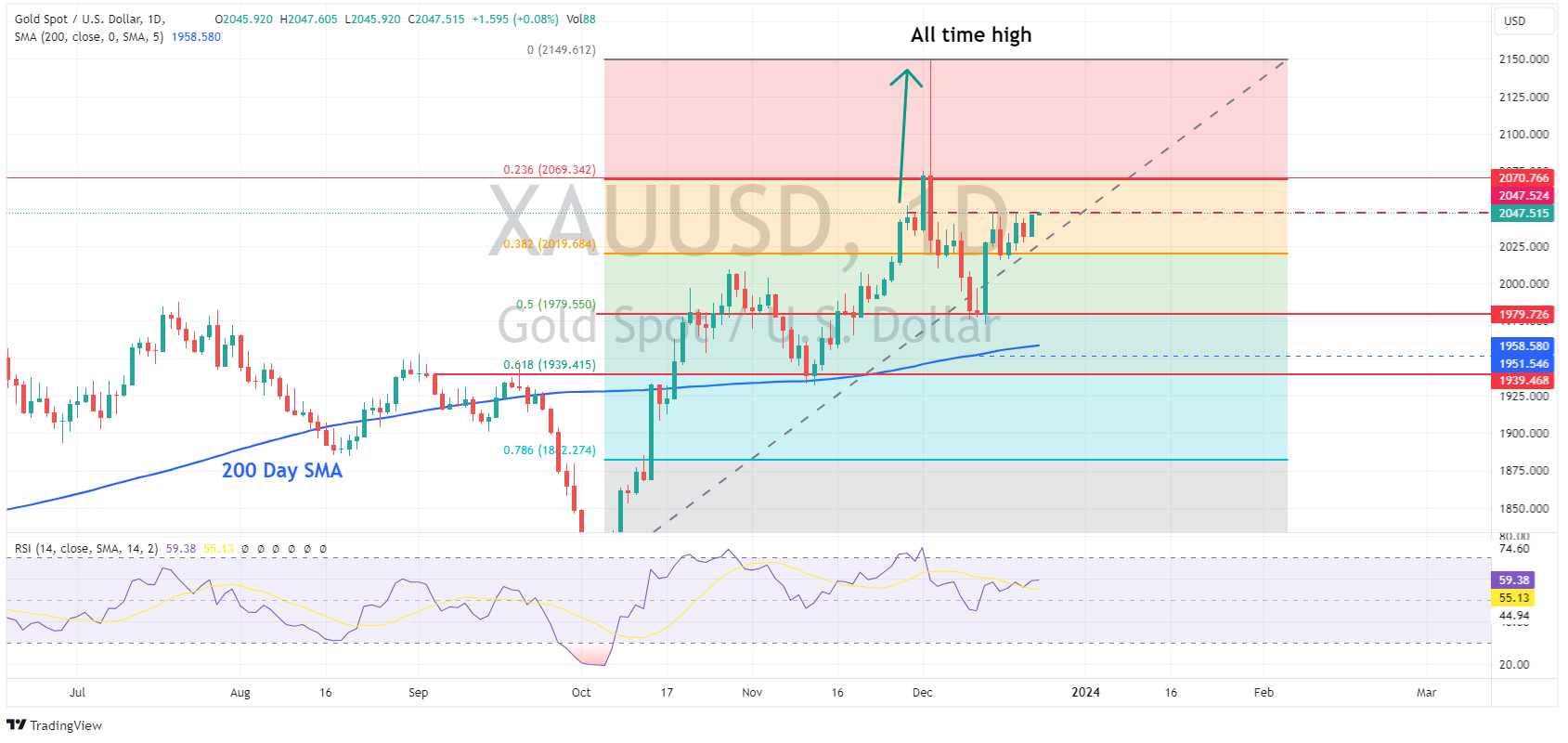

Gold pushed higher on the weaker USD and falling yields, XAUUSD again testing the resistance at 2047. The last break out of this level took gold to all-time highs a couple of weeks ago, making it a key level to watch for gold traders.

Ahead today the Feds preferred inflation gauge, the PCE price index will be the main risk event for FX traders.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

FX Analysis – AUDUSD, XAUUSD – Testing Key Levels

The US Dollar has continued its year end decline after the holiday break in thin volume. Traders still holding onto the view of a dovish Fed come 2024 seeing yields also drop creating a headwind for the Greenback. AUDUSD The Aussie pushed has pushed higher this week, taking advantage of a weak USD and a risk on environment. AUDUSD breaking th...

December 27, 2023Read More >Previous Article

Paychex results announced – the stock is down

US professional services company, Paychex Inc. (NASDAQ: PAYX), released financial results for second quarter of fiscal 2024 before the market open on ...

December 22, 2023Read More >Please share your location to continue.

Check our help guide for more info.