- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Market Analysis – Oil tumbles on Saudi price cut – USD, JPY, CHF

- Home

- News & analysis

- Forex

- Market Analysis – Oil tumbles on Saudi price cut – USD, JPY, CHF

News & analysisNews & analysis

News & analysisNews & analysisMarket Analysis – Oil tumbles on Saudi price cut – USD, JPY, CHF

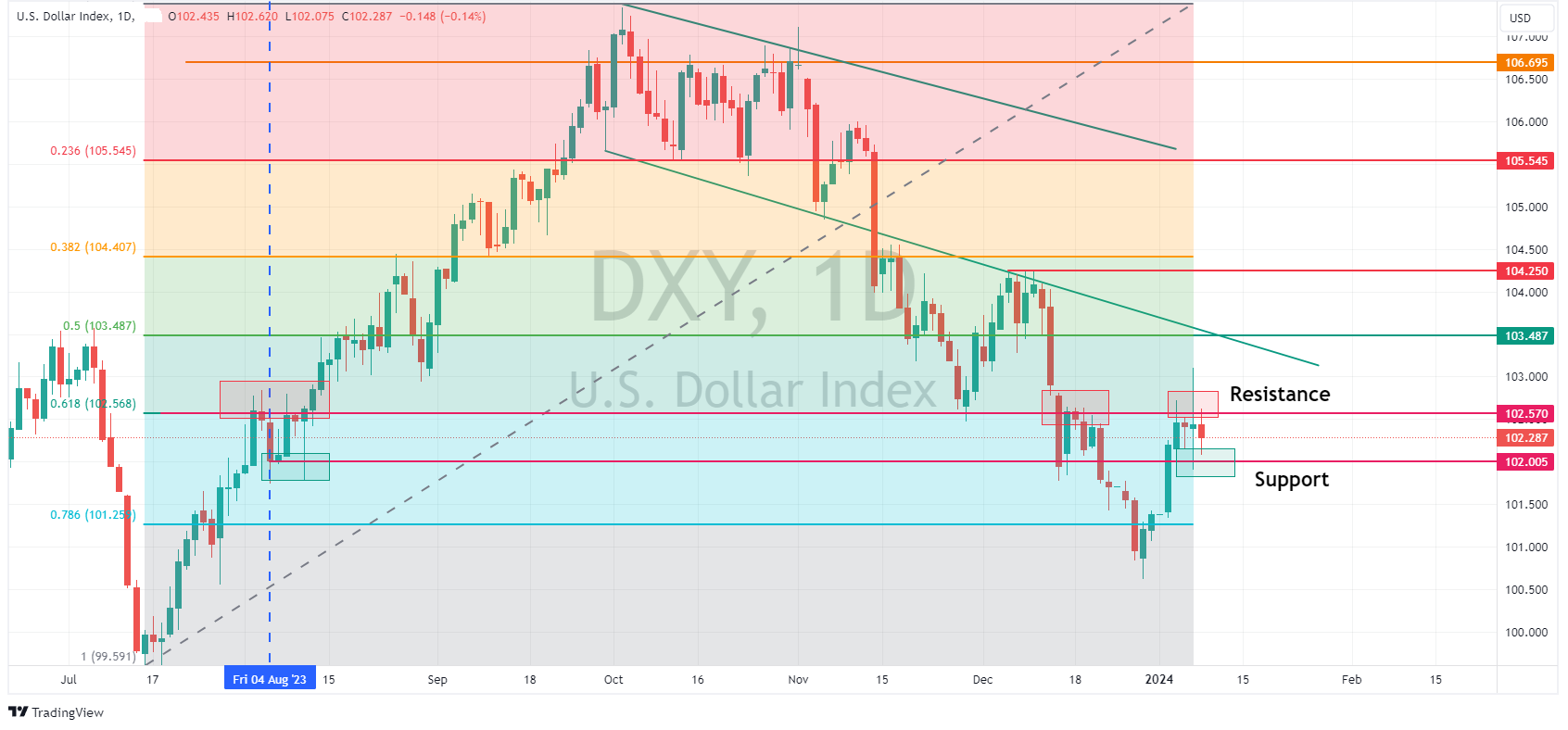

9 January 2024 By Lachlan MeakinUSD ultimately ended lower on Monday with the US Dollar Index (DXY) first testing the resistance at 102.57 to the upside before reversing course to test the support at 102 to the downside. A risk on equity markets and some dovish developments. Data saw the NY Fed Survey show lower than expected inflation expectations. There was also a dovish call from Bank of America regarding the Feds holdings of US Treasuries along with what was seen as dovish comments from Fed members Bostic and Logan all weighing on the Greenback.

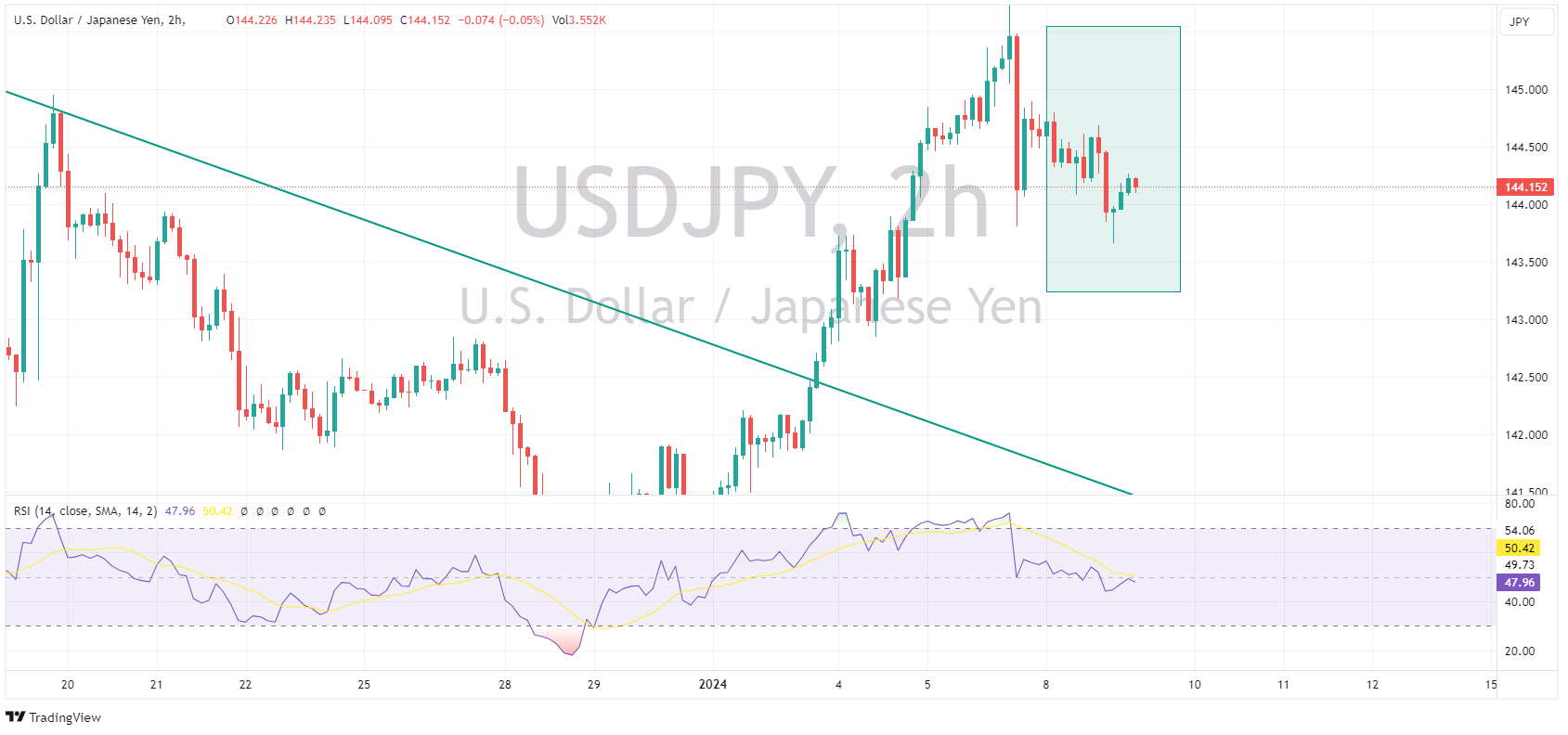

JPY bounced back against the USD after its weak start to 2024. USDJPY falling from highs of 144.92 to lows of 143.67 before finding some support. Possible positioning before todays Tokyo CPI figure and a fall in US yields seemingly the drivers.

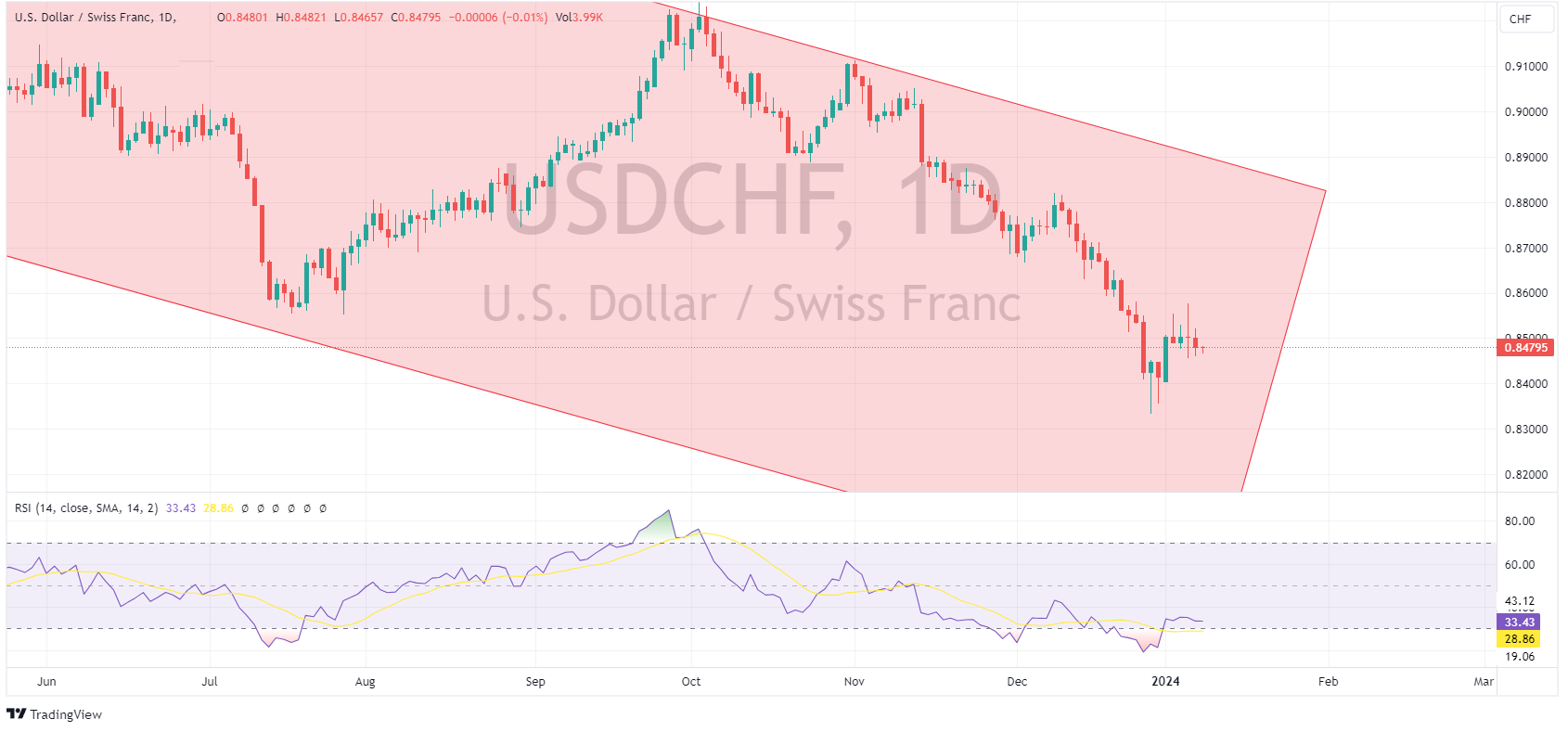

CHF also saw decent gains against the USD and EUR after a hotter than expected December Swiss CPI print where the year-on-year inflation rate rose to 1.7% against an expected 1.5%

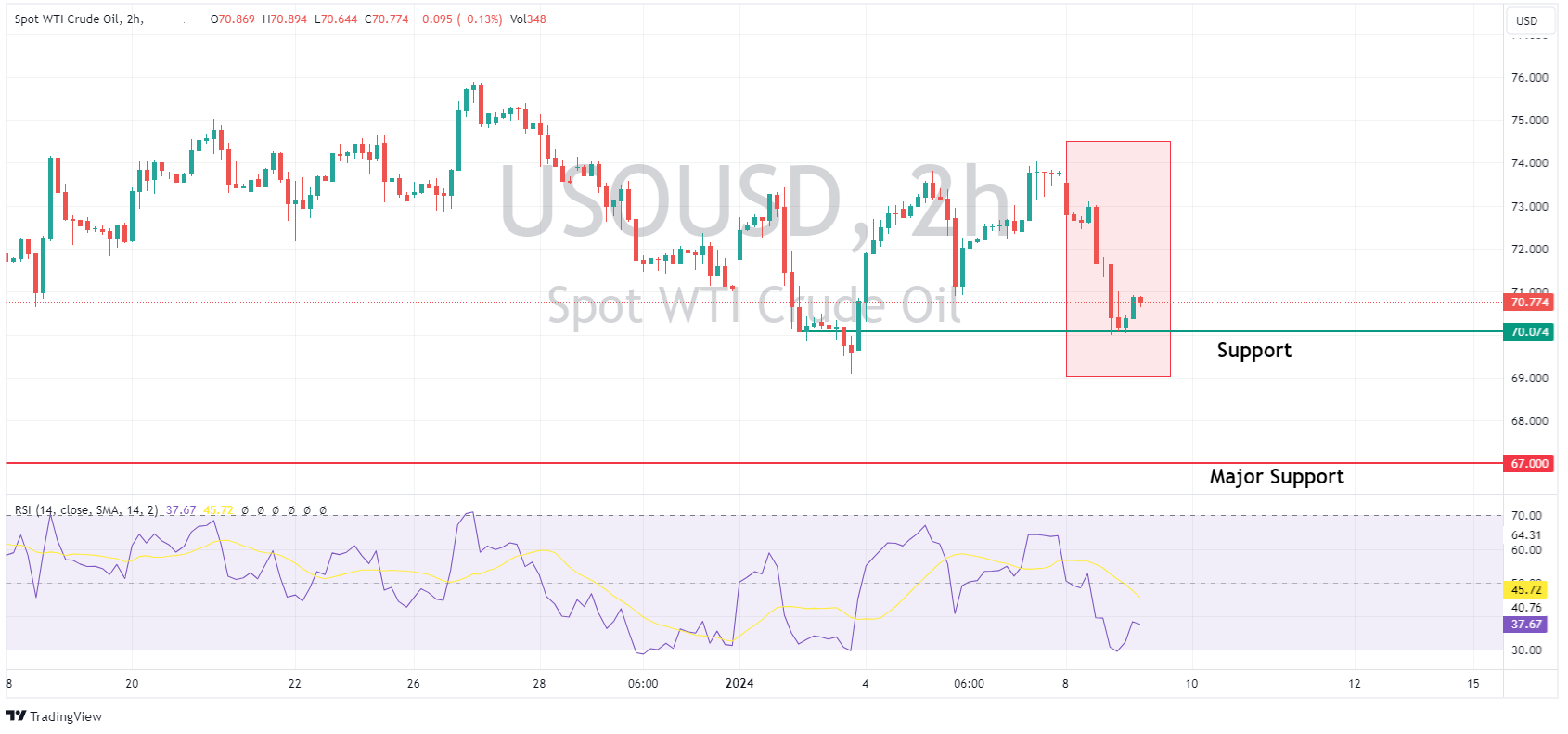

Crude Oil prices were a big mover with USOUSD dropping almost 3% as a result of sharp price cuts by top exporter Saudi Arabia stoked demand fears. There was also a reported rise in OPEC output offsetting any supply worries generated by the ongoing tension in the Middle East.

USOUSD finding support at the 70 USD a barrel support level for now, the next level lower to watch will be the major support at 67 USD a barrel.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Gold slides as DXY recovers

The recovery in strength on the DXY has led to Gold reversing strongly from the all-time high of 2088 which was reached at the end of 2023. Last week, the US employment data was released stronger than expected with the Non-Farm employment change at 216K (Forecast: 168K), however, wage inflation remained unchanged at 0.4%. This set of data is likel...

January 9, 2024Read More >Previous Article

The Week Ahead – XAUUSD, AUDUSD, DXY

Global markets enter the second week of the new year in cooldown mode with risk assets taking a hit after the red-hot finish to 2023. The NASDAQ havin...

January 8, 2024Read More >Please share your location to continue.

Check our help guide for more info.