- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- Market Analysis – Hot CPI whipsaws markets – USD, Gold, JPY, AUD

- Home

- News & analysis

- Forex

- Market Analysis – Hot CPI whipsaws markets – USD, Gold, JPY, AUD

News & analysisNews & analysis

News & analysisNews & analysisMarket Analysis – Hot CPI whipsaws markets – USD, Gold, JPY, AUD

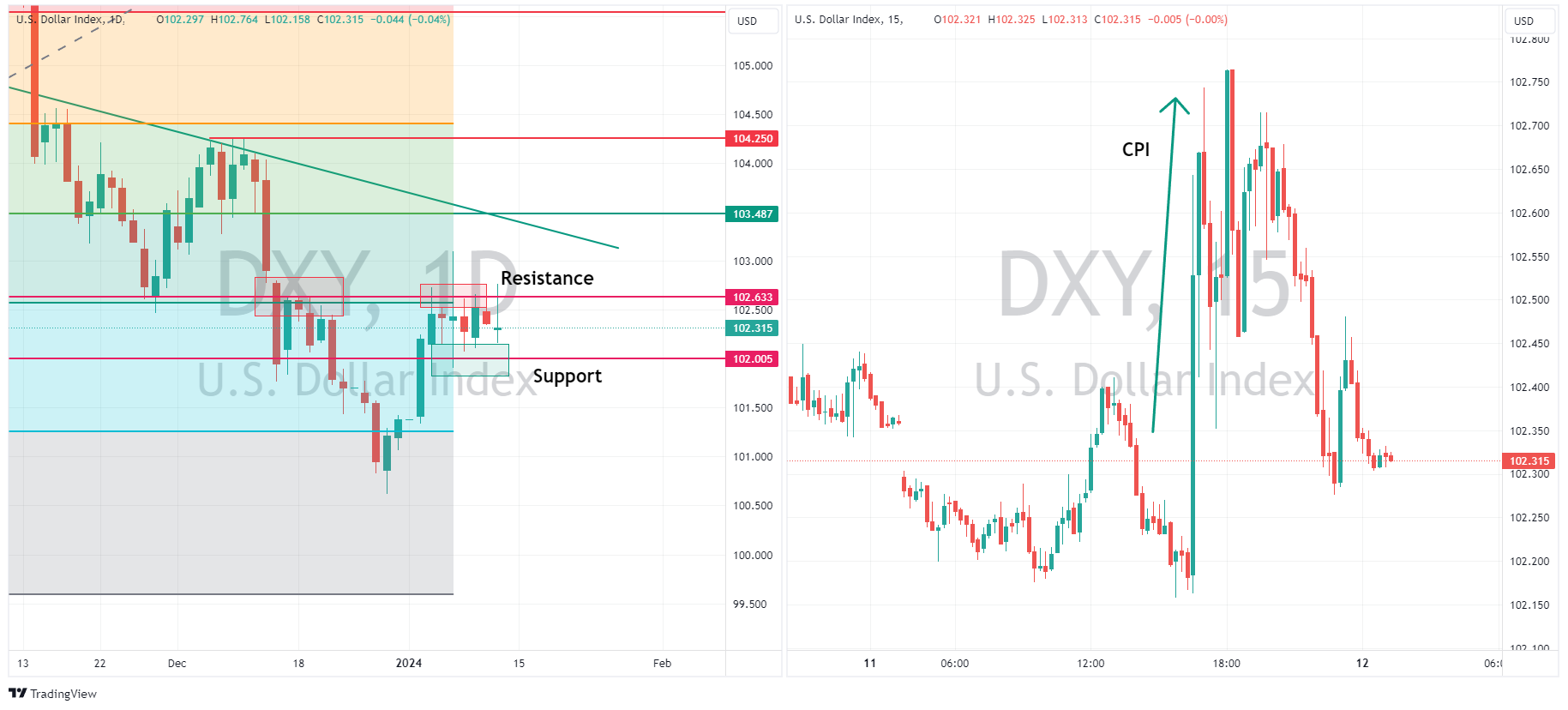

12 January 2024 By Lachlan MeakinUSD was ultimately flat in a choppy session on Thursday after hotter-than-expected US CPI data. The US Dollar Index (DXY) hitting briefly breeching the resistance at 102.63 to hit a high of 102.76. This proved to be another false breakout of this level with DXY gradually retracing for the rest of the session to unchanged levels.

JPY outperformed, after an initial spike higher in USDJPY above 146 after the CPI reading, the retracement was more profound in this pair with it ultimately trading just above the psychological 145 level. A report did hit the newswires that said the BoJ is considering lowering its price outlook for FY2024 to the middle 2% range, though with dovish BoJ expectations being priced in it didn’t deter the Yen bulls.

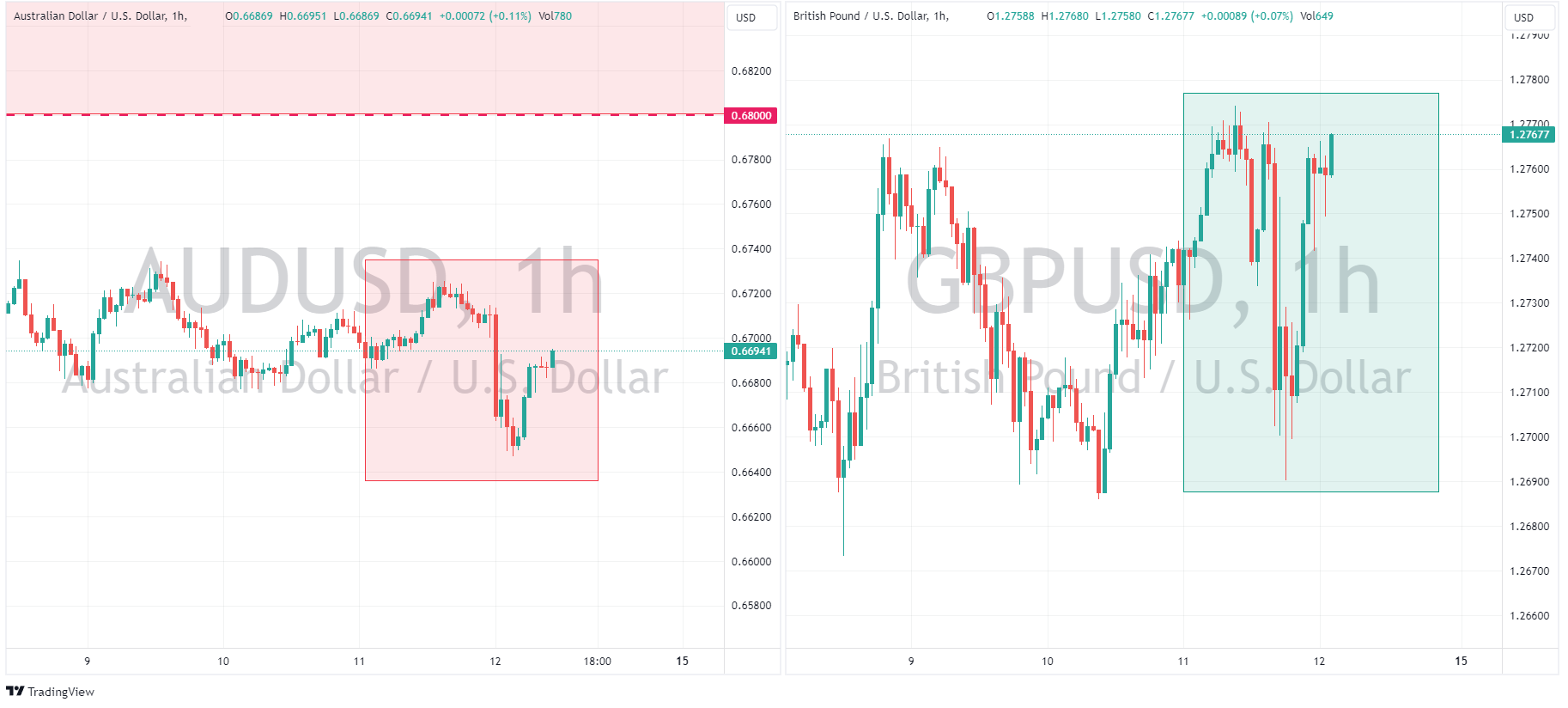

Risk sensitive currencies GBP and AUD had a mixed reaction. GBPUSD making gains ahead of the UK GDP reading today. AUDUSD posting losses despite better than expected trade data that seemed to be interpreted as more evidence of a slowing Aussie economy.

Gold again tested the 2040 USD an ounce resistance before a spike in the USD post CPI saw a steep decline to a low of 2013. Early in the APAC session the Gold bulls look keen to test this level again with XAUUSD rebounding to around 2035. This will be a key level to watch for Gold traders.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

JP Morgan Q4 2023 earnings results are here

US financial services giant, JP Morgan Chase & Co. (NYSE: JPM), reported the latest financial results for Q4 2023 before the market open in the US on Friday. JP Morgan reported revenue of $38.574 billion for the quarter, falling short of Wall Street estimate of $39.73 billion. Revenue was up by 11.65% year-over-year. Earnings per shar...

January 15, 2024Read More >Previous Article

FX Analysis – GBP, EUR JPY, USD

USD saw weakness in Wednesday’s session with a risk on equity market and only a marginal move higher in yields weighing on the Greenback ahead of to...

January 11, 2024Read More >Please share your location to continue.

Check our help guide for more info.