- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- GBPAUD – Brexit ‘No Deal’ To Spark A 1000 Pip Move?

News & analysisSince September last year, the British Pound has enjoyed a relatively easy time against the Australian Dollar, often described as a solid bull run. However, many fundamental drivers have turned sour for the Sterling crosses, and with GBPAUD in particular, we may be in for a significant price reversal.

What’s Driving the Pound Aussie Pairing?

The obvious elephant in the room would be Brexit. For a while, it seemed there might have been light at the end of the tunnel for the UK and the EU, hence the bull run. However just recently, UK Trade Secretary Liam Fox has predicted that the odds of a ‘no deal’ are now as high as 60-40 due to difficulties, and subsequently, the general sense of doom and gloom weighing on the UK economy has reared its ugly head once more.

Australian Dollar Not Resistant To A Few Headaches

On the flip side, conditions aren’t necessarily much better south of the equator. As a commodity-centric currency, the Australian Dollar is struggling while trade-war-like tensions brew between the US and China. If we add jitters in Turkey creating a sell-off in higher risk currencies, as well as the RBA’s more cautious tone on inflation, the overall picture for AUD appears just as bleak as the Pound Sterling.

Since we’ve established both currencies have their potholes on the road ahead, let’s push the fundamentals aside and discover a potential trading opportunity from a technical perspective which appears to be gaining traction.

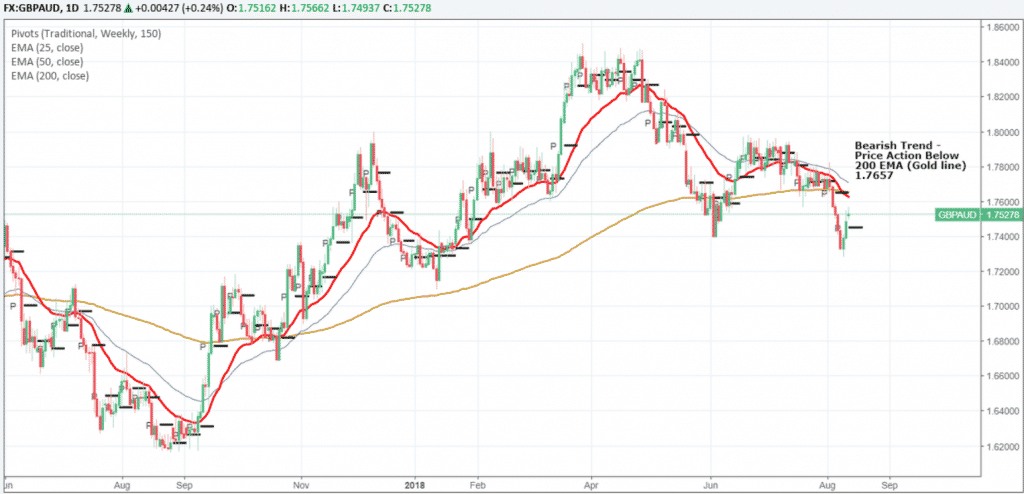

GBPAUD – Daily

Starting with the daily chart above, notice the price action is trading considerably below the 200 day moving average line in gold. It indicates an overall bearish trend so long as the prices continue to close below 1.7657.

A Potential 1000 Pip Move?

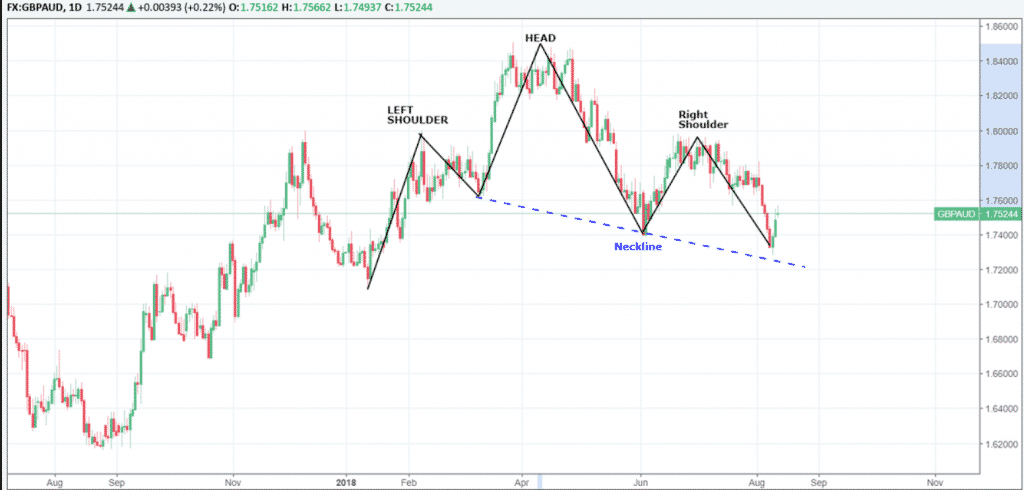

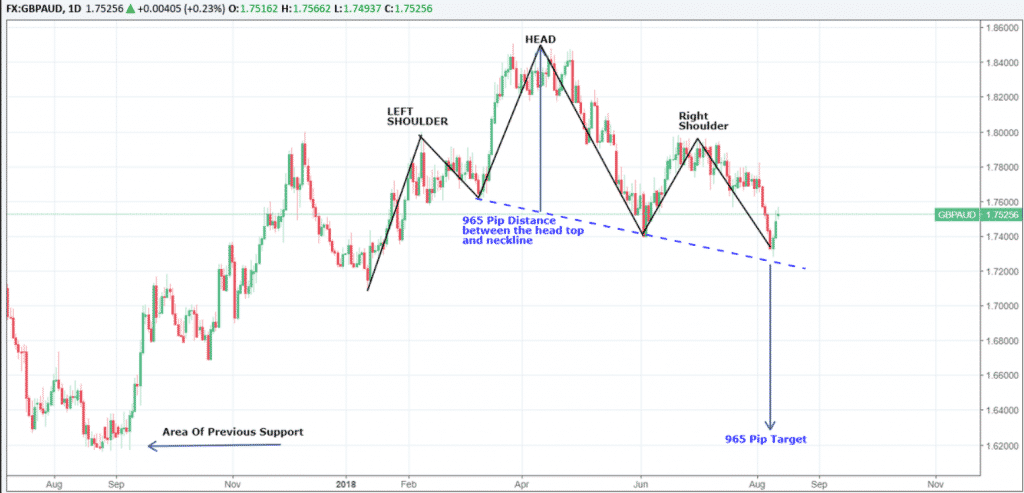

Well not quite. Based on the latest technical analysis, the formation of a head and shoulders reversal pattern is developing, and should it follow through, we would be looking at a downside target of approximately 965 pips. How was this estimation reached? Let me explain.

Below the chart highlights the developing Head and Shoulders reversal pattern.

Next we draw the neckline in blue.

We then measure the distance between the neckline and the top of the head formation and record this figure. Once the price closes below the neckline closest to the right shoulder, we minus the length of this distance to the levels below creating a price target. In this case, we see a target price of 1.6265 or (1.7230 – 965 = 1.6265).

What I find most interesting with this potential price target (1.6265) is the fact that the 1.62 regions have been known to be a substantial area of support back in September last year when the latest bull run first began to emerge. It’s almost as if the pair is attempting to return full circle should this move come to fruition.

With both domestic economies currently under fire, it will be tough to know which of these currencies will win the battle and come out on top. If Brexit negotiations are as much of a mess as we’re lead to believe in the media, it’s only logical that the Pound will haemorrhage across the board and we could see some severe moves such as this. However, given the level of risk out there in the markets at this stage, we could just as quickly see the Australian Dollar lose its footing and tumble down.

By Adam Taylor CFTe

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Tradingview, BloombergReady to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The New “Lows”

By Deepta Bolaky Trade and geopolitical risks were at the forefront of the meltdown that rattled the markets on Friday. Turkey’s currency crisis prompted a massive sell-off across the markets hitting the European banking sectors the hardest. Fears began to mount as investors freted its rippling effects on the global markets. The current risk...

August 13, 2018Read More >Previous Article

China Taking Stock Of US Trade Deficit Figures

The US official trade deficit number with China is $375.2bn in 2017. But According to China Customs General Administration, this number should be $275...

August 9, 2018Read More >Please share your location to continue.

Check our help guide for more info.