- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Market analysis – USD lower ahead of key CPI figure, GBP breaks out on strong jobs data

- Home

- News & analysis

- Forex

- FX Market analysis – USD lower ahead of key CPI figure, GBP breaks out on strong jobs data

News & analysisNews & analysis

News & analysisNews & analysisFX Market analysis – USD lower ahead of key CPI figure, GBP breaks out on strong jobs data

12 July 2023 By Lachlan MeakinUSD was marginally lower in Tuesdays session , trading in a tight range amid thin newsflow and market participants awaiting the key June CPI reading released later today. After breaking the psychological 102 level in Mondays session, DXY tested a re-entry into the range but found the previous support at 102 acting as stiff resistance, seeing DXY finish at the session lows around 101.65.

NZD was the G10 underperformer with NZDUSD hitting a low of 0.6168 where it found support at Mondays lows as the currency traded defensively ahead of the RBNZ rate decision today. Futures markets are expecting rates will be held at 5.5%, confirming the RBNZ as being the first developed Central Bank to reach the end of its tightening cycle.

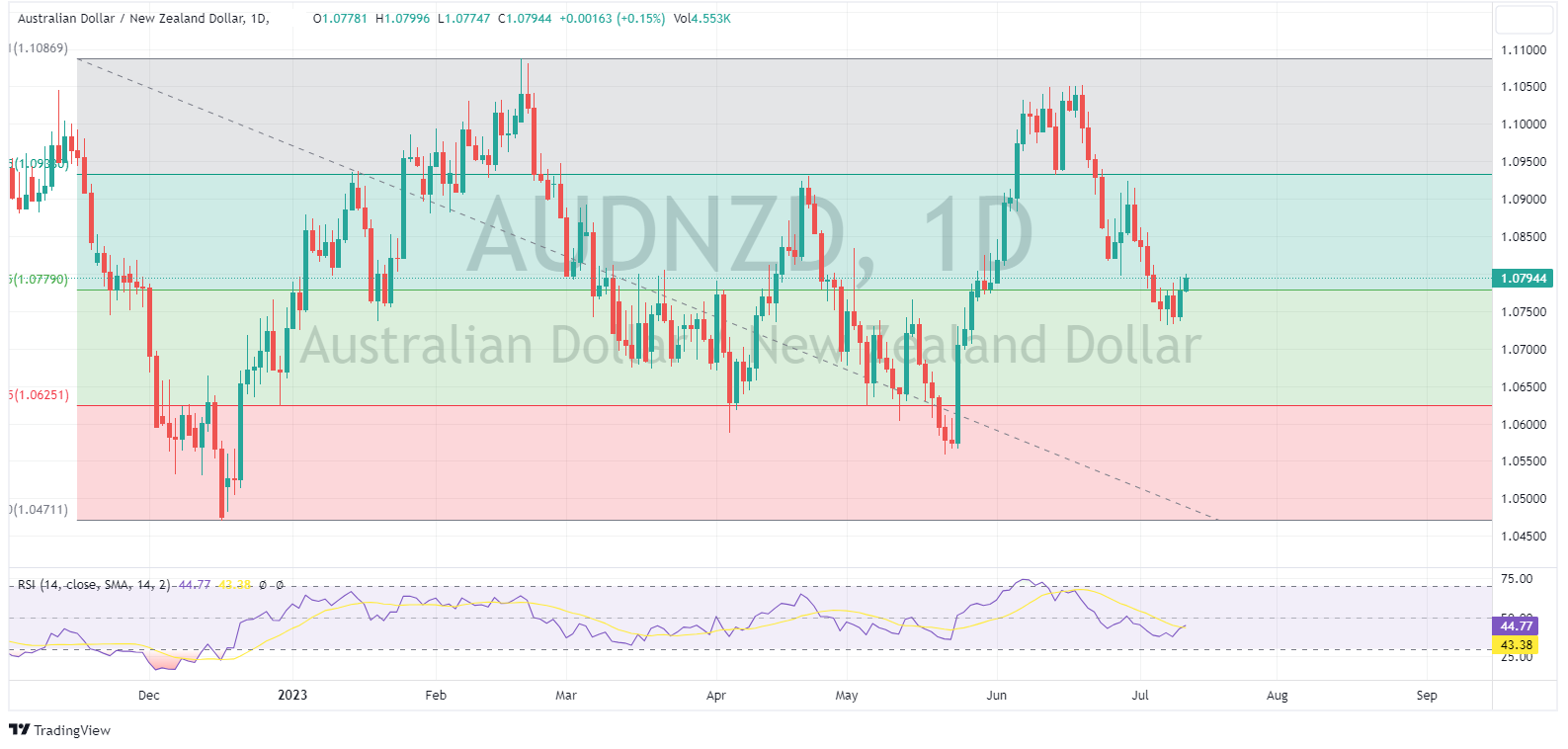

AUD was marginally firmer against the USD, after initially struggling in tandem with the Kiwi before later reversing losses on a USD pull-back. AUDNZD moving higher, back above the mid-price of it’s 2023 range.

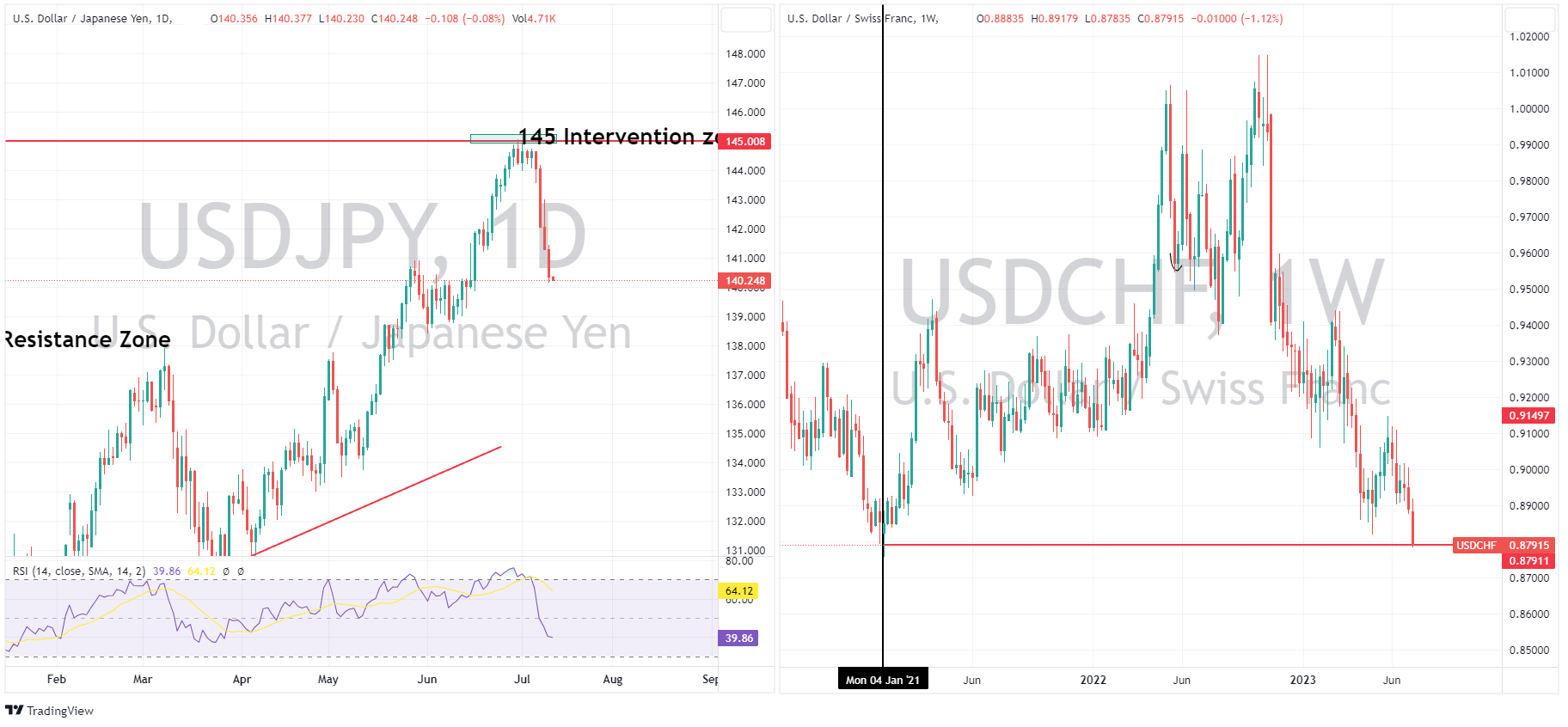

Safe-havens, JPY and CHF, saw gains despite risk-on equity markets on some defensive positioning ahead of big data releases later in the week. USDCHF retraced from a peak of 0.8863 to a low of 0.8791 with the cross pair hitting its lowest level since January 2021. USDJPY traded between 141.46-140.17, continuing its strong down move after testing the 145 “intervention” zone last week. USDJPY appears one of those most at risk of any upside surprises in the US CPI data given its sharp decline over recent sessions.

GBPUSD saw gains with Cable breaking it’s 1.2850 resistance level, surpassing 1.2900 to a peak of 1.2934, its highest level in over a year. A strong UK Labour market figure saw futures markets re-price a 50bp hike as the favoured outcome of the BoE policy meeting on August 3rd, driving gains in the Pound.

EUR was flat with EURUSD just about clawing back above 1.10 at the US session end amid a USD pullback, with EURUSD trading in a narrow range despite a weak German ZEW survey.

CAD saw slight gains against the USD, bolstered by the continued upward momentum in crude oil with WTI crude settling at 10-week highs and seeing USDCAD break its 4h trendline. CAD traders have the BoC rate decision later today to look forward to, where after a five-month ‘pause’, the consensus looks for rates to be lifted by 25bps for the second straight meeting, taking its key rate to 5.00%

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

US Dollar analysis ahead of pivotal CPI reading

The US Dollar Index (DXY) has closed its fourth consecutive day in the red, reaching levels last seen in early May 2023. Despite the recent decline, the DXY is coming into support around the 100 level, which has proven to be a resilient bounce point multiple times. However, each bounce appears to be getting smaller, which might indicate growing ...

July 12, 2023Read More >Previous Article

Understanding the US Dollar Index

The U.S. Dollar Index (USDX, DXY, DX, or, informally termed “the Dixie") is a measure of the value of the United States dollar relative to a basket ...

July 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.