- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX analysis – USDJPY – Yield differentials pushing this pair higher

- Home

- News & analysis

- Forex

- FX analysis – USDJPY – Yield differentials pushing this pair higher

News & analysisNews & analysis

News & analysisNews & analysisFX analysis – USDJPY – Yield differentials pushing this pair higher

11 April 2023 By Lachlan MeakinUSDJPY

The USDJPY is on the march higher again after a better than expected Non-Farm payroll figure on Friday saw sentiment shift hawkishly toward Fed monetary policy with Fed fund futures now pricing in a 70% chance of a 25bp hike at the FOMC May meeting, up from around a 50-50 split earlier in the week.

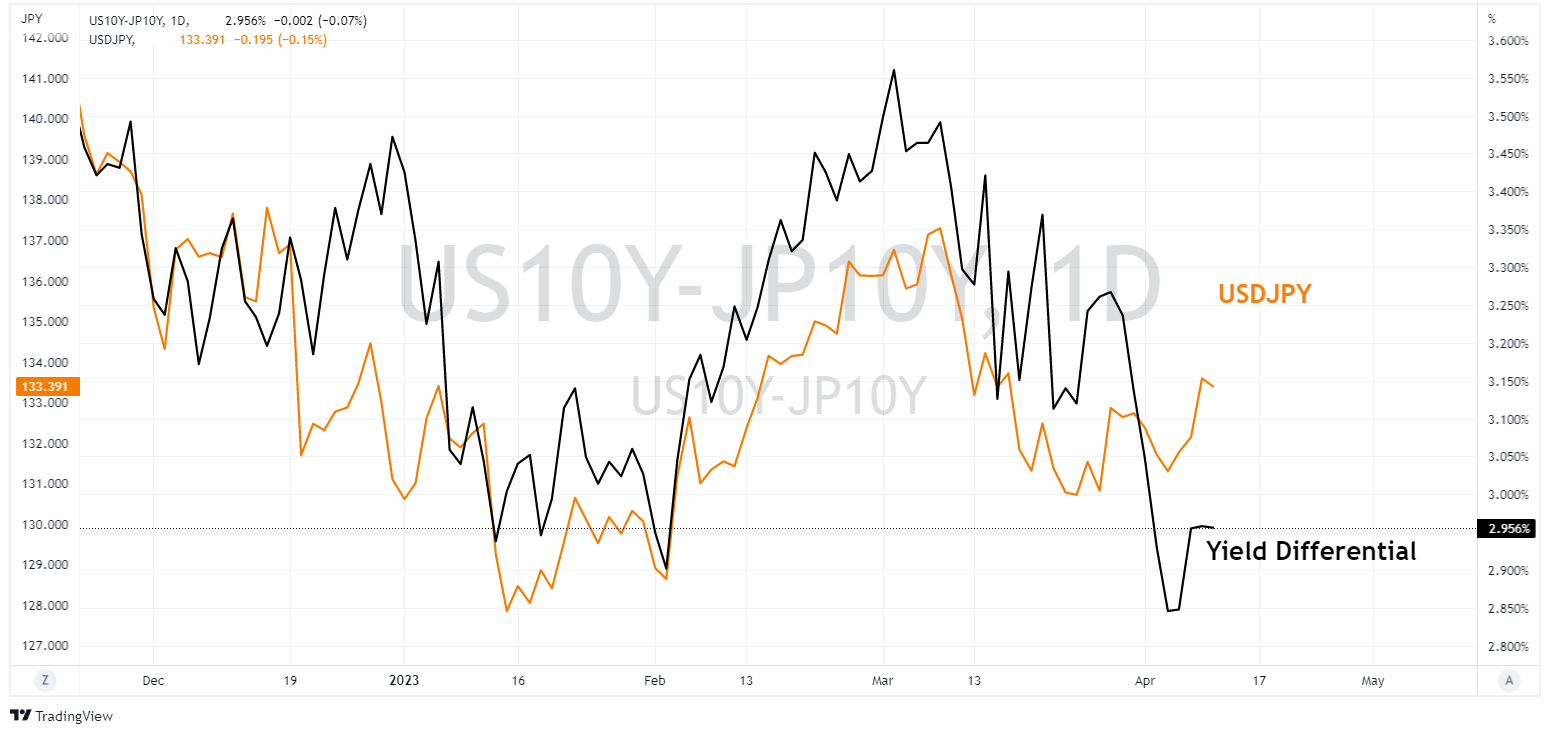

The policy divergence in the US and Japan and the subsequent yield differentials on their respective 10 year government bonds has been the main driver of this pair in the last 12 months. You can see the close relationship of this in the chart below. The black line is the difference between 10 year yields on US 10 years – Japanese 10 year years, the orange line, the USDJPY rate.

As the US yields increase their gap to their Japanese counterparts, the USDJPY will be pressured upwards as traders look for low risk carry trades. The Yen was also not helped recently by comments from the new incoming governor of the BoJ that indicated that any change to the current dovish policy was not imminent.

Key levels to watch

USDJPY has been forming a textbook uptrend since late March. With the upward trend line tested and holding as support on a handful of occasions, a resistance level of 133.85 has so far held any further upside, but is looking vulnerable.

Ways to trade this are

1, Playing the range, buying low at the trendline, selling high at the resistance level. Though whilst the uptrend is in place the more cautious approach would be to stick to buys.

2, Waiting for a break of these levels for the next push. The longer this takes, and the tighter the range gets the more explosive this move could be.

While economic announcements out of Japan are very light on the ground this week, The US will be releasing both CPI and PPI figures, how these inflation figures look will have a measurable effect on market sentiment towards Federal Reserve policy and will almost certainly see some big moves in the USD and rates markets, so the break of this range may come as early as tomorrow night.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Market Analysis 10-14 April 2023

XAUUSD Analysis 10 – 14 April 2023 The gold price outlook is positive in the medium term. As last week's closing of the buying bar was above the 1960 support or the latest high in price on the Weekly timeframe, it indicates continued buying momentum that will allow the price of gold to recover. It can rise further to test the 2070 resistan...

April 11, 2023Read More >Previous Article

RBA leaves cash rate unchanged but leaves the door open for future hikes if needed

After 10 hikes on the trot and what will no doubt be a relief for mortgage holders the RBA held the official cash rate at 3.60%. The rate decision was...

April 4, 2023Read More >Please share your location to continue.

Check our help guide for more info.