- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

- Home

- News & analysis

- Forex

- FX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

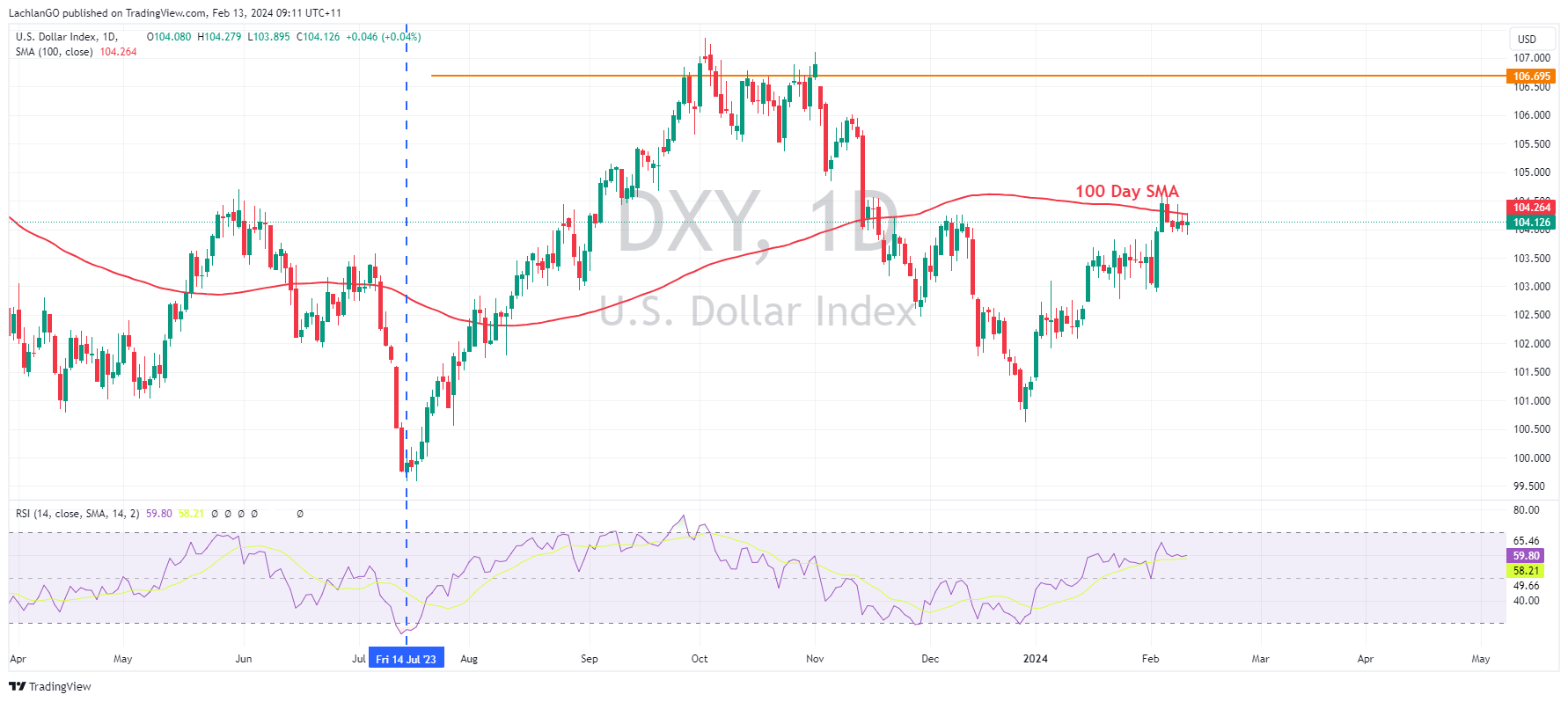

13 February 2024 By Lachlan MeakinUSD Dollar saw mild strength in Monday’s session, DXY trading either side of the psychological 104.00 level but again being capped to the upside by the 100-day SMA resistance. The was little in the way of a catalyst with no tier one data released, that will change today with US CPI figures released, which will help market participants and the Fed gauge the timing of the first rate cut.

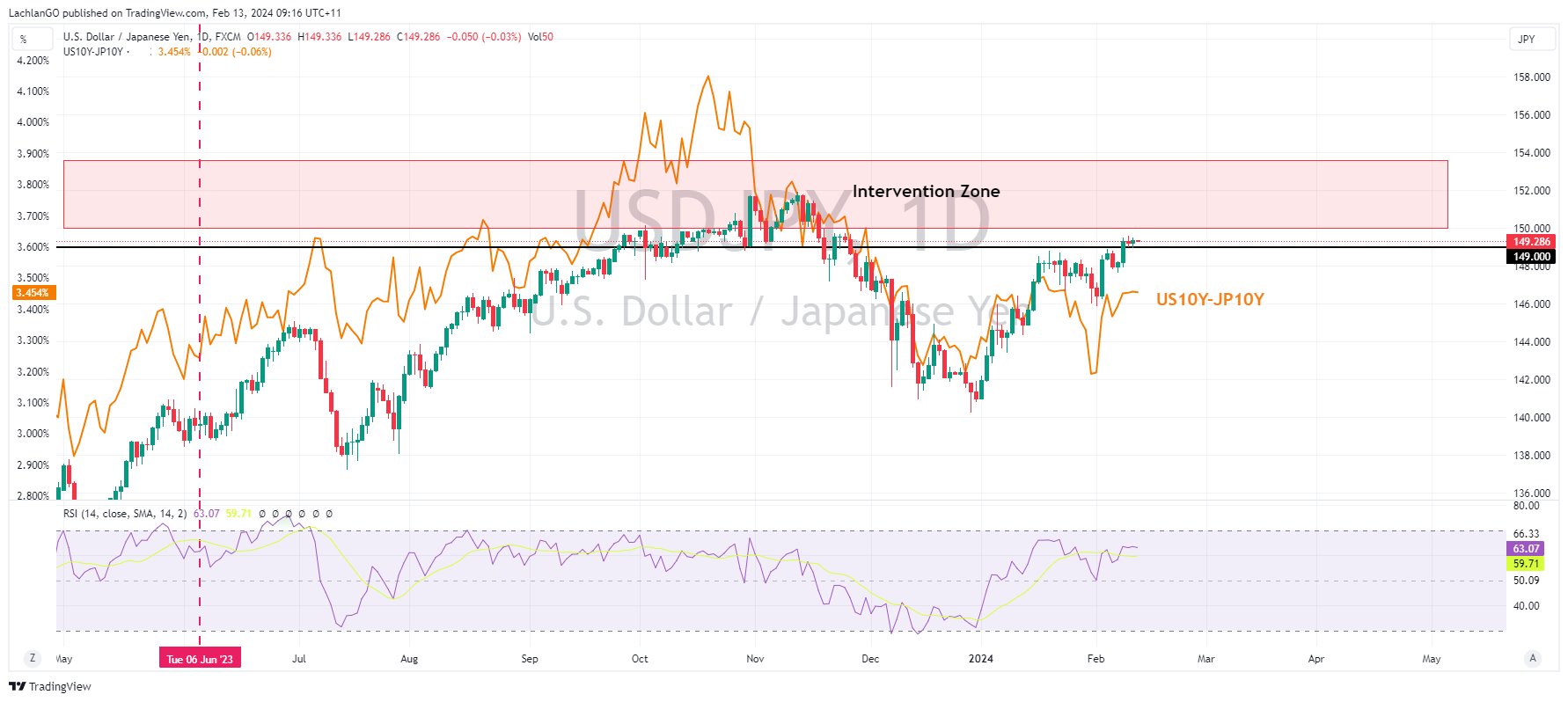

USDJPY was mostly flat for the second straight session, volume was low with Japan away for a holiday. USDJPY hit a low of 148.94 but failed to stay beneath 149.00 for long as a rise in US yields dragged the pair higher and held it above the key 149 level.

AUDUSD rallied through the 0.6525 resistance level, this will be a key level to watch for Aussie traders today to see if it can re-establish itself as support. NZD lagged despite hawkish RBNZ commentary where RBNZ Governor Orr said inflation is still too high, NZDUSD finding resistance at the February highs and dropping to a low of 0.6120. This also saw AUDNZD have its biggest up day of 2024 hitting a high of 1.0650 and retracing all and then some of Fridays steep drop. Attention turns to the New Zealand inflation expectations and RBA’s Kohler both on Tuesday.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Coca-Cola earnings announced

American beverage giant The Coca-Cola Company (NYSE: KO) reported the latest financial results before the opening bell on Wall Street on Tuesday. Coca-Cola reported revenue of $10.948 billion (up by 7% year-over-year) for the last three months of 2023 vs. $10.675 billion expected. Earnings per share reached $0.49 (up by 10% year-over-year) vs...

February 14, 2024Read More >Previous Article

Arista Networks Q4 2023 and full year results announced

It’s set to be another busy week of US earnings with The Coca-Cola Company, Shopify Inc., Airbnb Inc., Deere & Company and more expected to anno...

February 13, 2024Read More >Please share your location to continue.

Check our help guide for more info.