- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

- Home

- News & analysis

- Forex

- FX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

News & analysisNews & analysis

News & analysisNews & analysisFX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

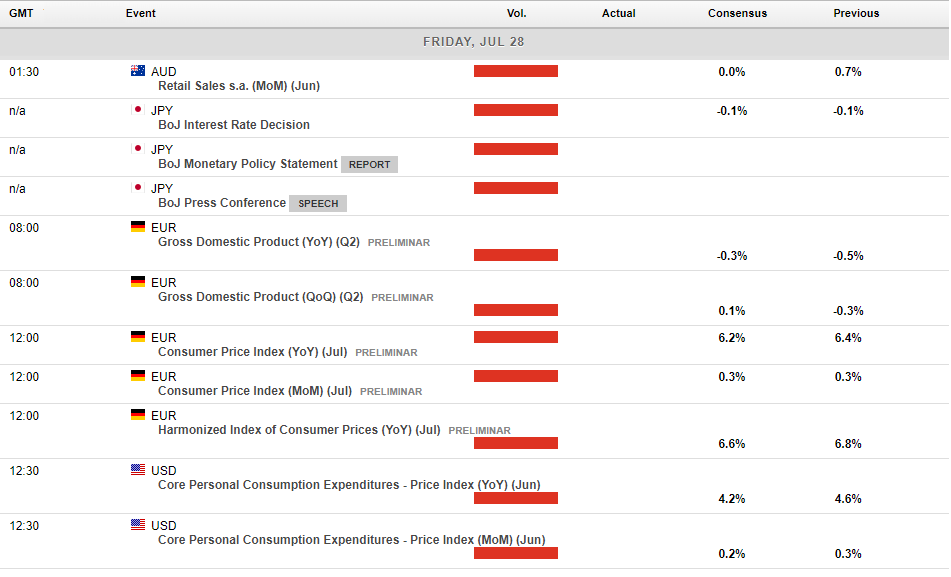

28 July 2023 By Lachlan MeakinUS equity markets snapped a record-breaking run of up sessions in Thursdays trading, with the Dow Jones looking set to close in the green for a 14th straight session (for the first time since the Dow’s inception), before seeing a sell-off on rising yields after a report that the BoJ is looking to tweak their YCC at their meeting today.

FX Markets

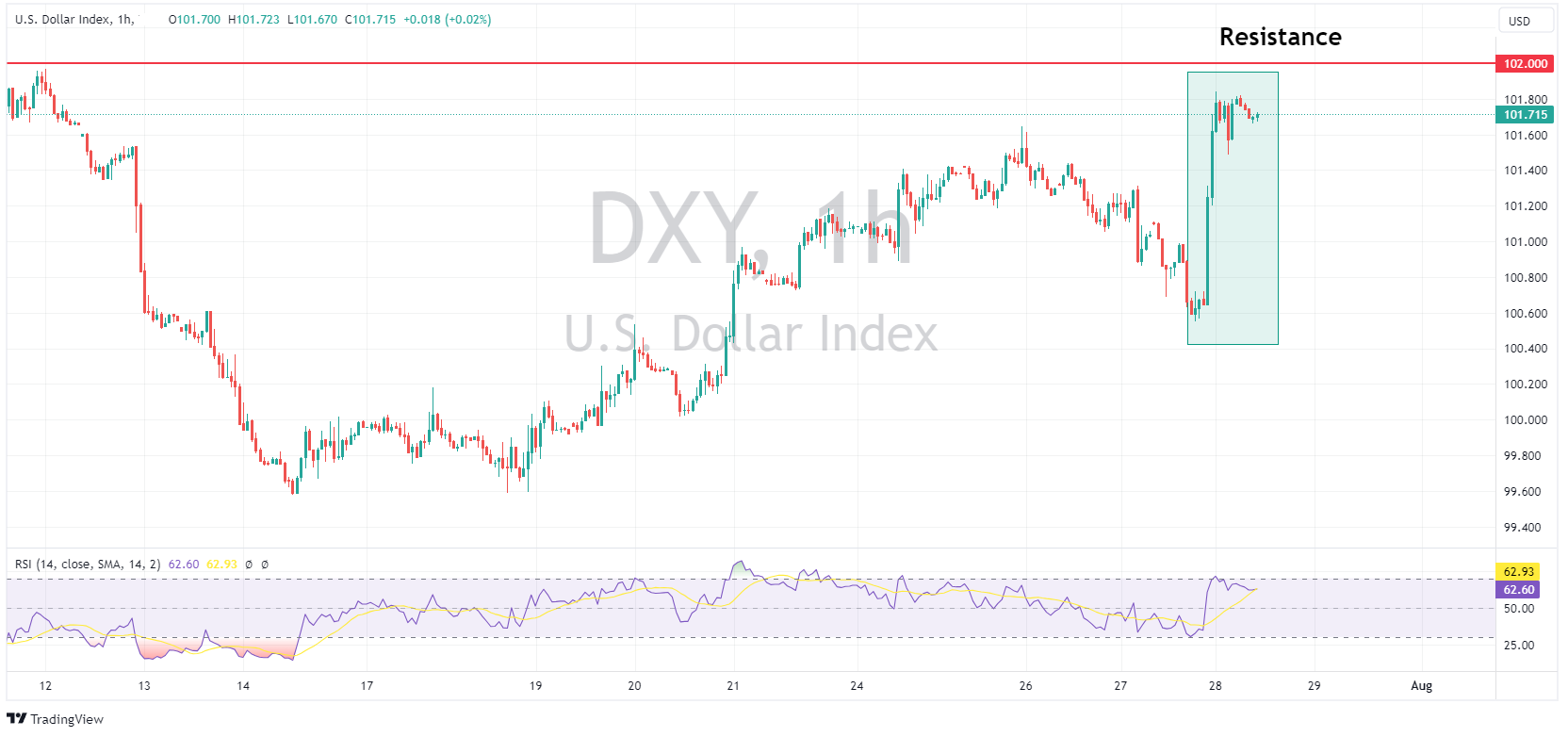

USD bounced back from its post-FOMC weakness with the Dollar supported by rising US Treasury yields after beats in US GDP and employment data and the aforementioned hawkish report regarding the BoJ. US 10yr yields surged over the 4% level, an area recently that has marked the top in yields. With Powell stressing that the Fed would be “data dependent” going forward as to rate increases the hot US data saw traders shifting hawkishly on rates, this saw the US Dollar Index surge through the 101 level, hitting 2-week highs and looking to test the major resistance at 102. Todays PCE Index figure will be another piece in the Fed puzzle, and is likely to move the USD and yields on it’s release.

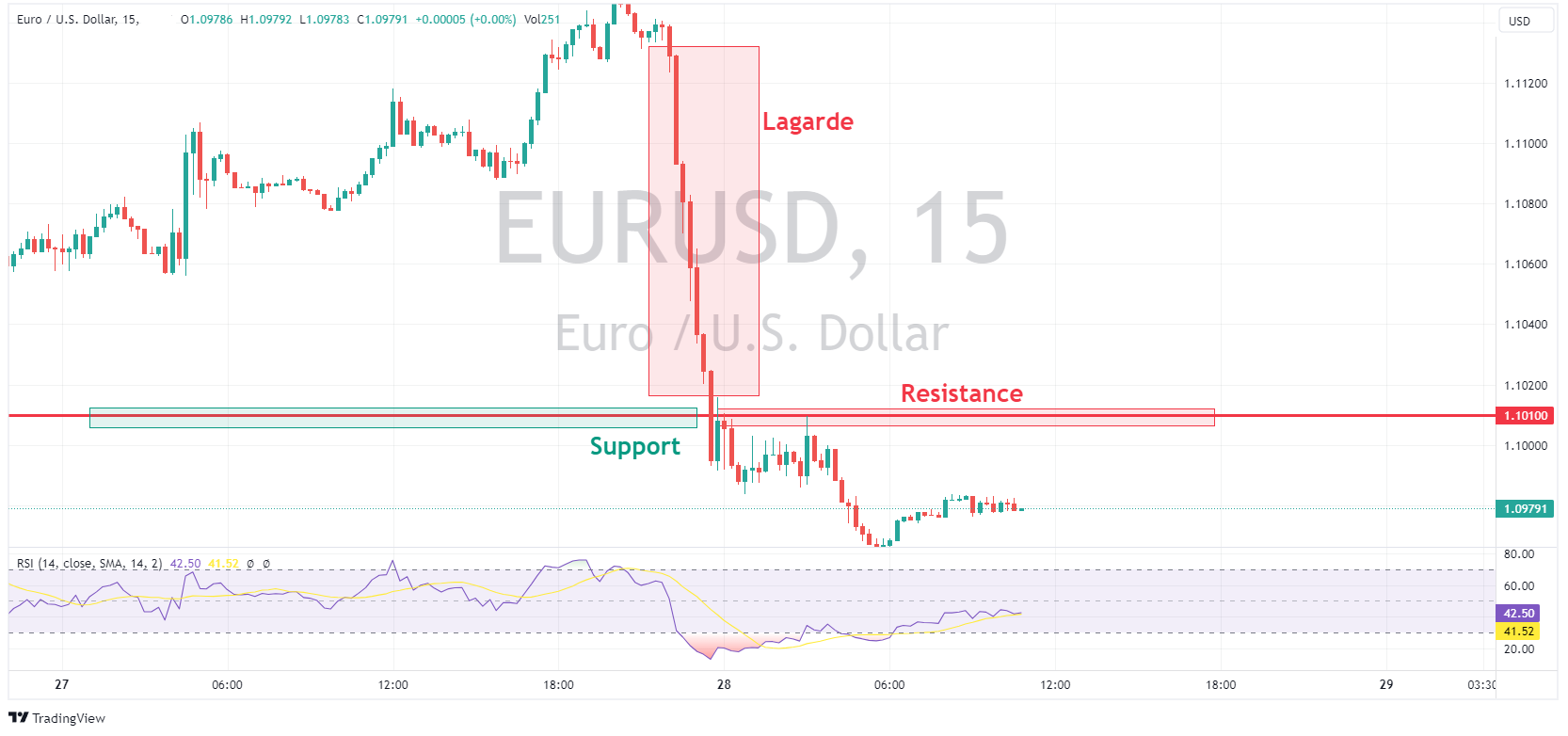

EUR pushed higher early in the session until the ECB meeting where the market took comments from President Lagarde as dovish, seeing EURUSD hit a low of 1.0967, breaking through the support at 1.10 , holding below with 1.10 now looking like resistance.. The ECB did hike rates 25bp as expected but it was Lagarde’s comments that she does not believe that more work needs to be done, given the current data, implying future meetings could be a hike or a hold, that saw EUR moving. Later today, some key German inflation figures will be released, EUR volatility should be expected.

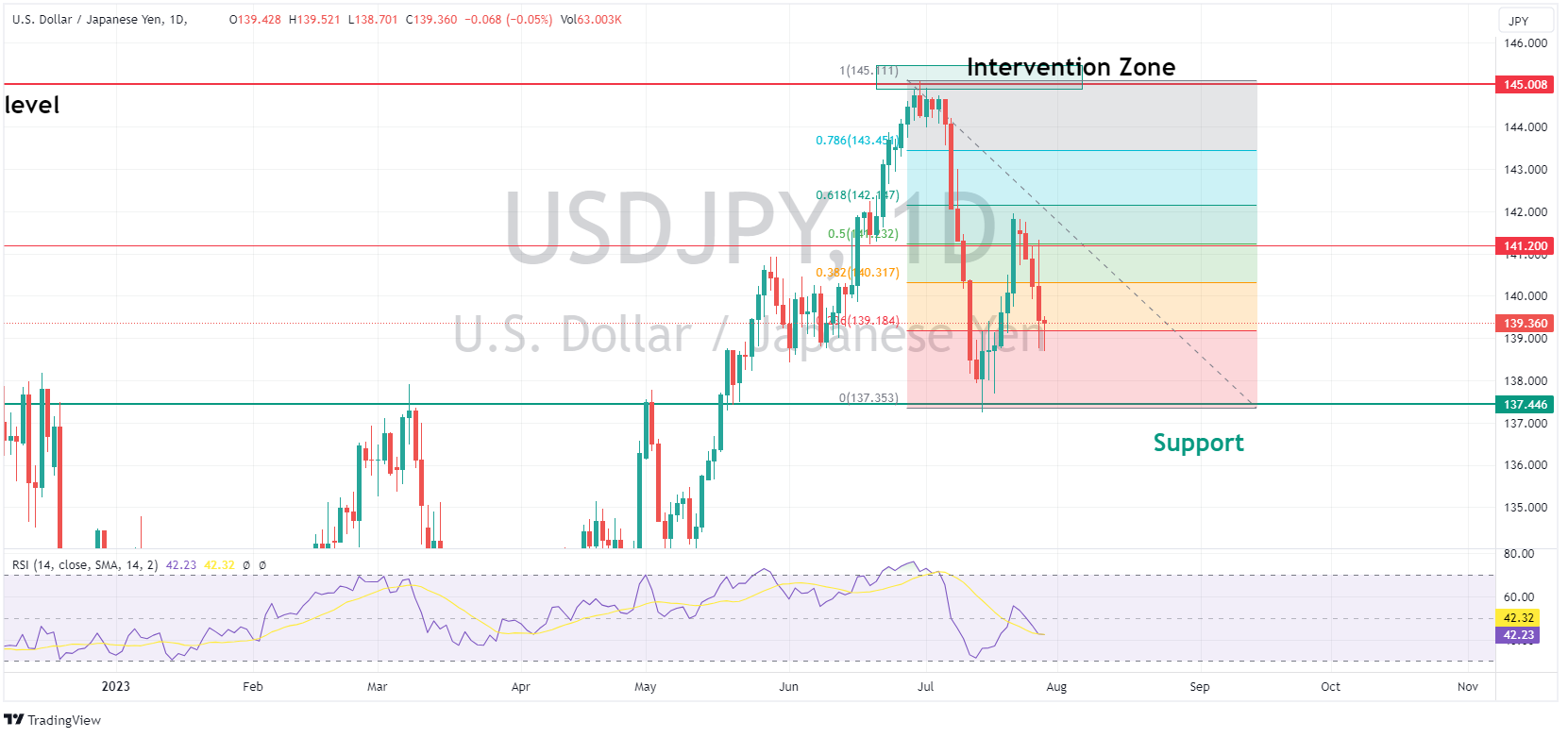

JPY saw big gains on Thursday, with USDJPY sliding from highs of 141.31 to hit a low of 138.75 after reports in Nikkei that the BoJ are to discuss a YCC tweak at today’s pivotal monetary policy meeting. Noted however, similar rumours have been reported on in the recent past, so really nothing new. The overreaction in JPY shows how jittery FX traders are going into today’s meeting, it is likely we’ll see some big moves in the Yen in today’s session as well, whichever way the BoJ goes.

Calendar:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

FX Analysis – USD Catches a Bid, AUD outperforms ahead of RBA, JPY struggles

USD rallied modestly into month end with DXY pushing to the top of its recent range to again test the big 102 resistance level. The data highlight out of the US was the Chicago PMI figure which rose from the prior 41.5 to 42.8, but missing expectations of 43.3. in FedSpeak, Governor Goolsbee added little new from the FOMC statement last week st...

August 1, 2023Read More >Previous Article

Crude Realities: The extent of OPEC’s influence on financial markets

OPEC stands for the Organization of the Petroleum Exporting Countries. Founded in 1960, OPEC's main objective is to coordinate and unify the petroleum...

July 28, 2023Read More >Please share your location to continue.

Check our help guide for more info.