- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – USD and GBP up on hot data, JPY and AUD under pressure

- Home

- News & analysis

- Forex

- FX Analysis – USD and GBP up on hot data, JPY and AUD under pressure

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – USD and GBP up on hot data, JPY and AUD under pressure

18 January 2024 By Lachlan MeakinA hotter than expected CPI reading out of the UK along with a beat in US retail sales saw global markets turn risk off as rates markets hawkishly re-priced chances of cuts coming from Central Banks.

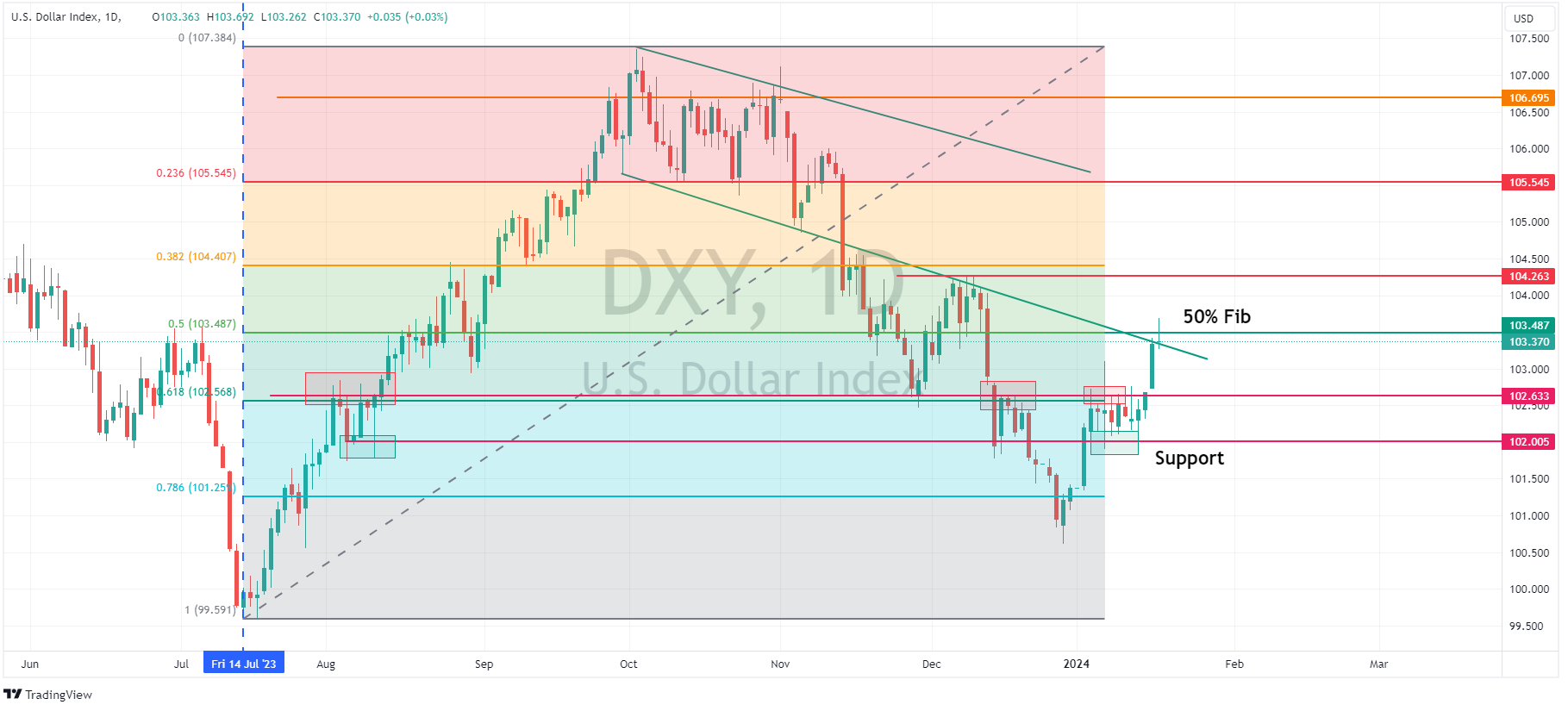

The unwinding of priced in Fed cuts saw a spike in treasury yields and the USD bid, with DXY hitting a high of 103.69 after the December US retail sales report came in hotter than expected. DXY finding resistance at the July-October 50% Fib level before paring gains.

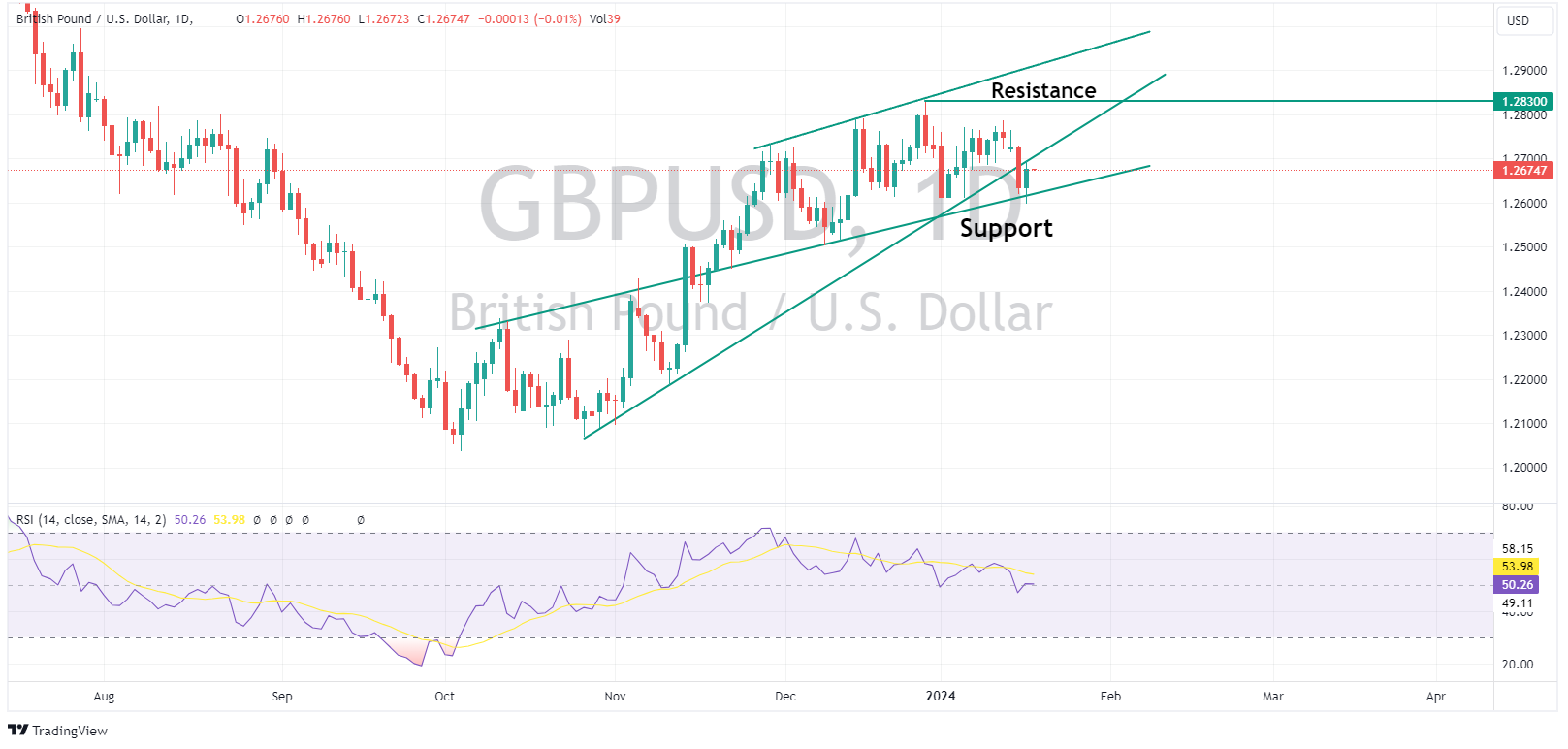

GBP saw decent gains vs the USD and EUR after a beat in the December UK CPI reading where the Y/Y figure came in at 4% vs an expected 3.8%. GBPUSD fell just short of breaching the 1.2700 level, hitting a high of 1.2696 as UK rates markets priced in a lower amount of 2024 rate cuts.

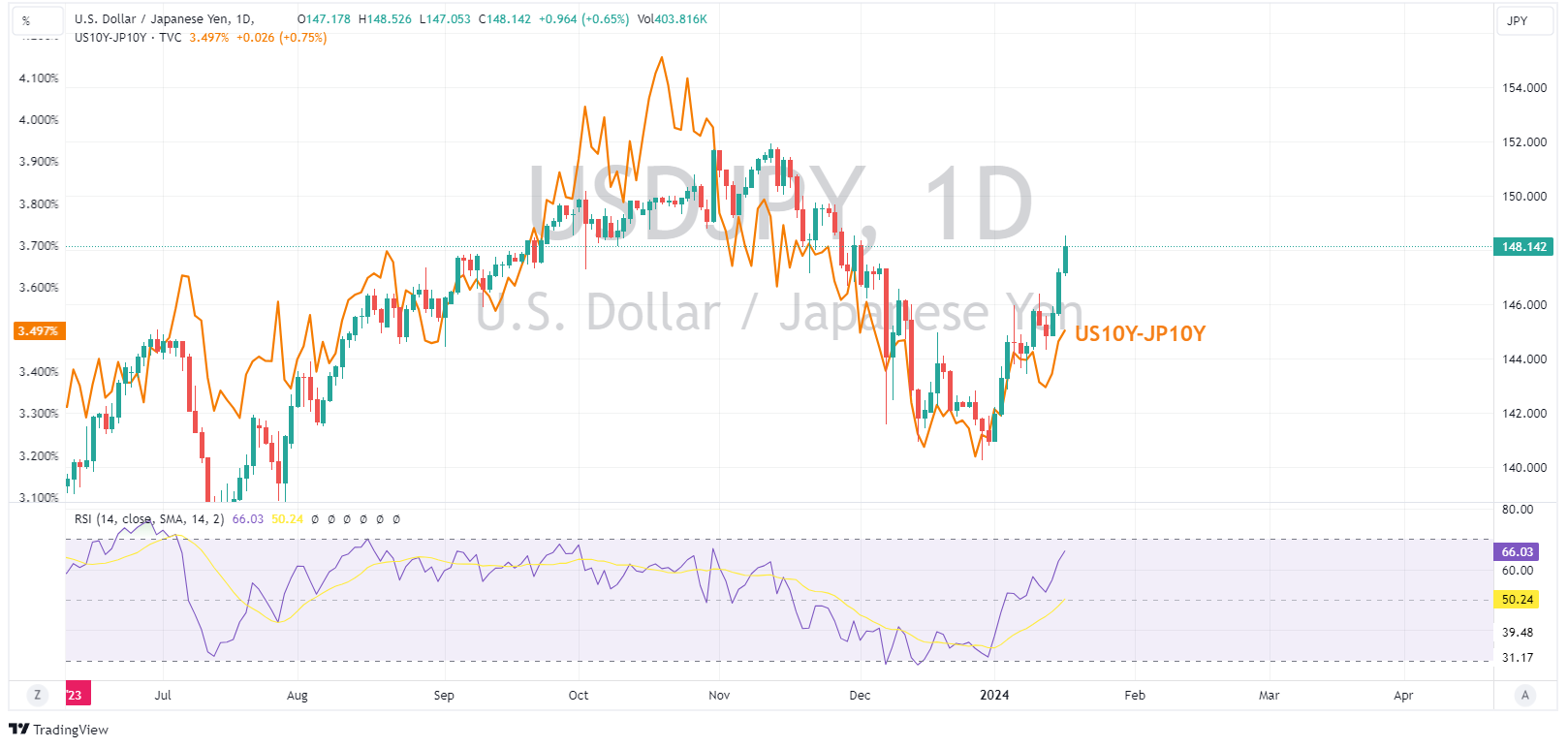

JPY was weak throughout the session with losses accelerating after the US retail sales report. USDJPY taking out the big figure at 148 rising in lockstep the US-JP yield differential. On current momentum the psychological 150 level is possibly coming into play, and with it, BoJ intervention speculation.

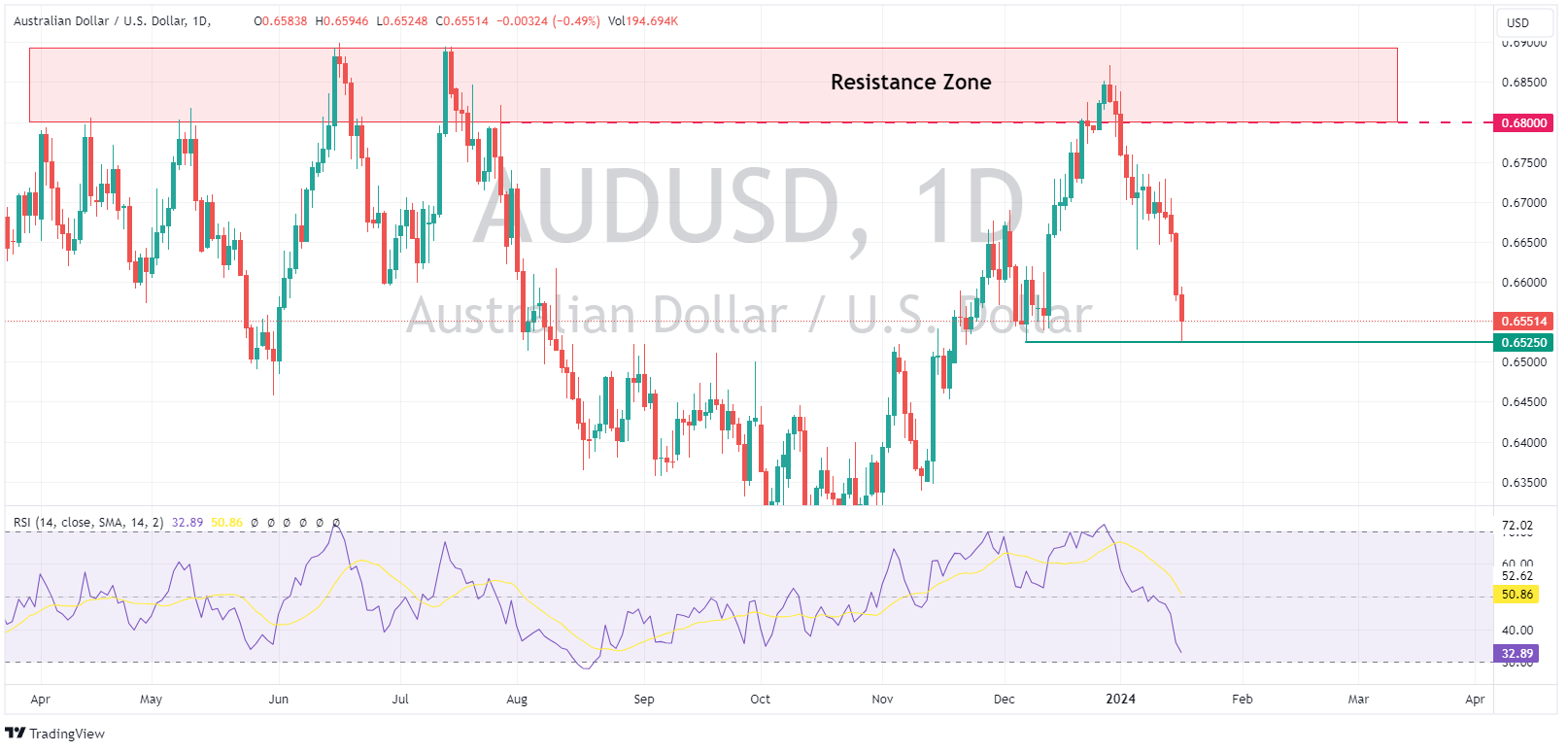

AUDUSD extended January’s losses on the sour risk sentiment and mixed Chinese figures on Wednesday. The Aussie holding below 0.6600 and dropping to Decembers lows at 0.6520 before finding some support. AUD traders have todays key December employment report to look forward to, after a bumper November reading this one will be watched closely.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Morgan Stanley’s share price dips after earnings

US financial services company, Morgan Stanley (NYSE: MS), announced Q4 2023 and full year financial results before the US open on Tuesday. Morgan Stanley reported revenue of $12.896 billion for the previous quarter, narrowly beating analyst estimate of $12.773 billion. Earnings per share (EPS) fell well short of Wall Street expectations at $0...

January 18, 2024Read More >Previous Article

Middle East conflict & US interest rates send Gold back towards all-time highs.

Since reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%. Closing its third consecutive positive ses...

January 16, 2024Read More >Please share your location to continue.

Check our help guide for more info.