- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – Risk-off sees Gold soar to all time highs, Yen outperforms after hot CPI

- Home

- News & analysis

- Forex

- FX Analysis – Risk-off sees Gold soar to all time highs, Yen outperforms after hot CPI

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – Risk-off sees Gold soar to all time highs, Yen outperforms after hot CPI

6 March 2024 By Lachlan MeakinRisk off returned to the markets in Tuesdays session with US equity markets pulling back sharply led by tech stocks with the NASDAQ being the biggest loser, shedding 1.65%.

The big headline for the day in FX was gold touching on all-time highs, rallying for a fifth straight session, buoyed by haven flows and a drop in US treasury yields. XAUUSD RSI reading in extreme overbought territory at over 78, the highest level since the blow off top in March 2022.

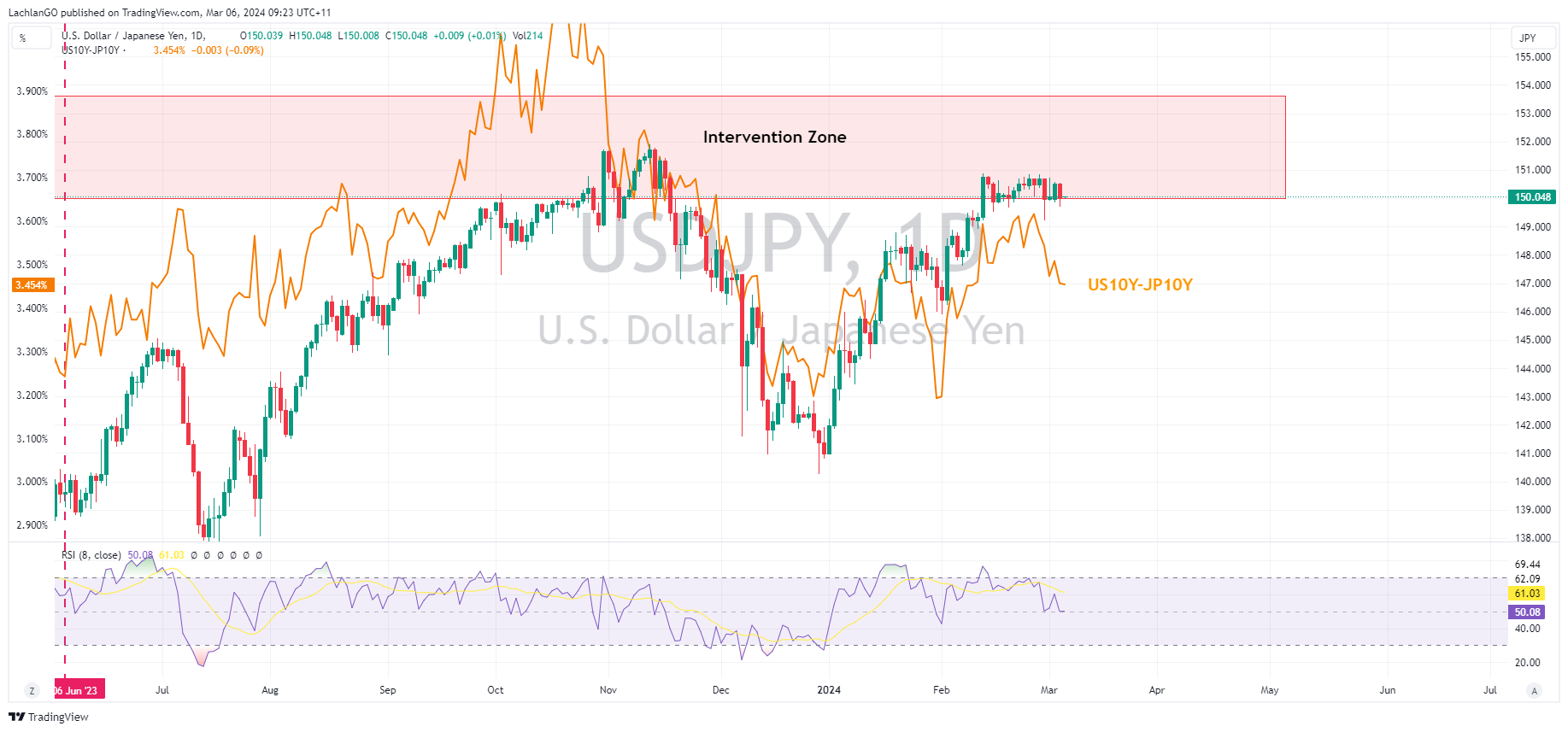

JPY was the G10 outperformer with USDJPY pushing briefly below the key 150 level after a hotter the expected Tokyo inflation print. Yen was also helped by more jawboning out of currency diplomat Kanda who said that markets must brace for higher interest rates environment.

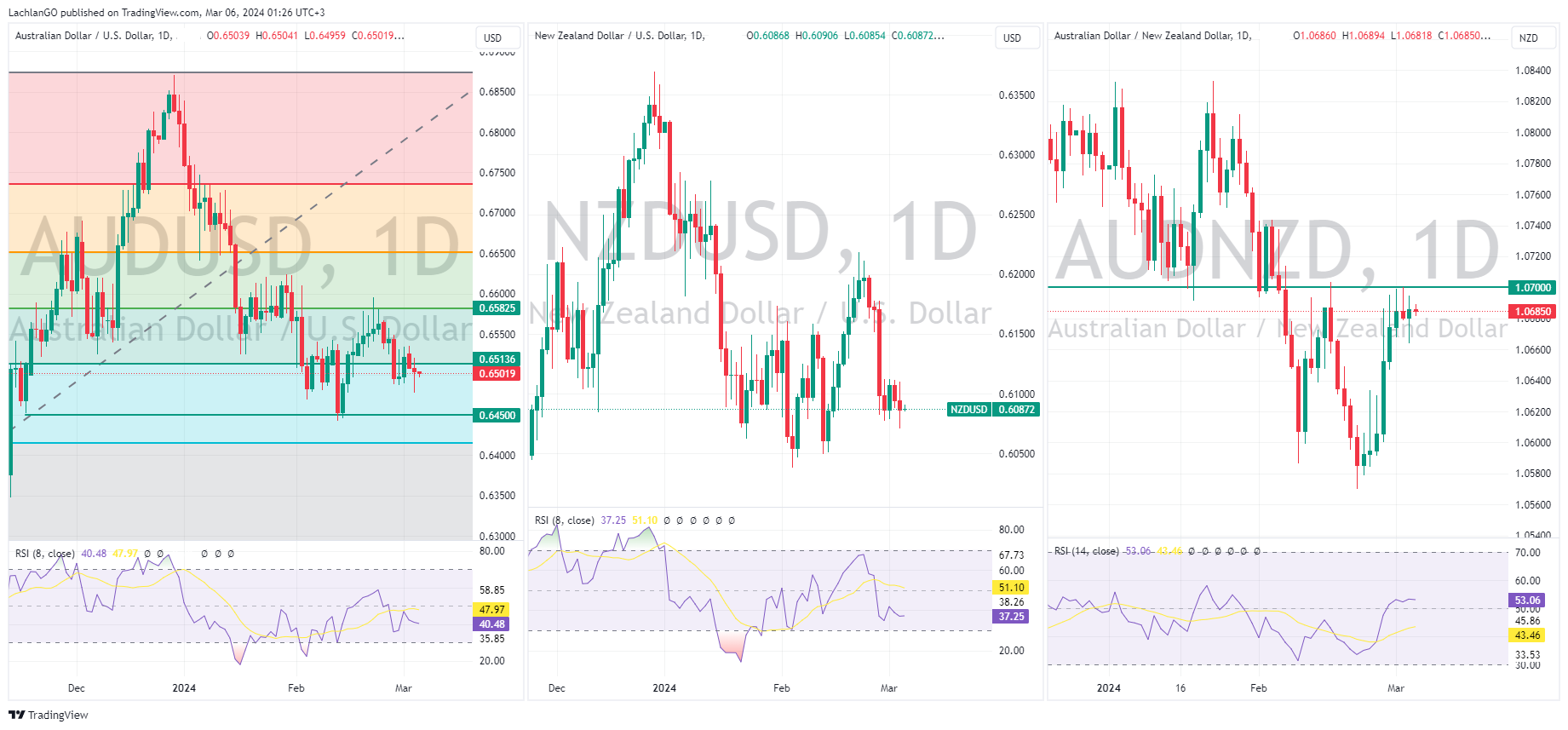

AUD and NZD saw marginal losses against the greenback, with AUD modestly outperforming the Kiwi. In the APAC session both currencies were softer amid disappointment out of China which weighed on sentiment before recovering somewhat in the US session. AUDUSD briefly dropped below 0.65 and hit a low of 0.6478 before finding support to head into the APAC session above 0.65. NZDUSD pushing below last week’s RBNZ-led low and 200DMA at 0.6076 to make a low at 0.6072 before recovering to trade above the key support at 0.61.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

JD.com earnings announced – the stock is up

It hasn’t been the best start to 2024 for JD.com Inc. (NASDAQ: JD) with the stock down by over 14%. On Wednesday, the Chinese e-commerce company announced the latest financial results, which sent the stock higher. Beijing based company achieved revenue of $43.111 billion vs. $42.216 billion expected. Revenue increased by 3.6% year-over-year...

March 7, 2024Read More >Previous Article

NIO Q4 2023 and full-year results are here

Last week, Chinese electric vehicle manufacturer NIO Inc. (NYSE: NIO) released its latest delivery numbers for February. On Tuesday, it was time for t...

March 6, 2024Read More >Please share your location to continue.

Check our help guide for more info.