- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – Rising US yields set FX tone as USD continues to grind higher

- Home

- News & analysis

- Forex

- FX Analysis – Rising US yields set FX tone as USD continues to grind higher

News & analysisNews & analysis

News & analysisNews & analysisFX Analysis – Rising US yields set FX tone as USD continues to grind higher

26 September 2023 By Lachlan MeakinThe ongoing sell-off in the US bond market has set the tone in FX and wider risk markets on Tuesday in an otherwise very slow news day. The USD has continued to grind higher against the higher yield backdrop with the US Dollar Index (DXY) adding to Mondays gains pushing above the 106 level, tracking yields higher.

The Fed’s recent “higher for longer” statement still supporting yields, worries of a US government shutdown looming and more hawkish comments from the Fed’s Kashkari on Monday also giving a tailwind to yields and the US dollar.

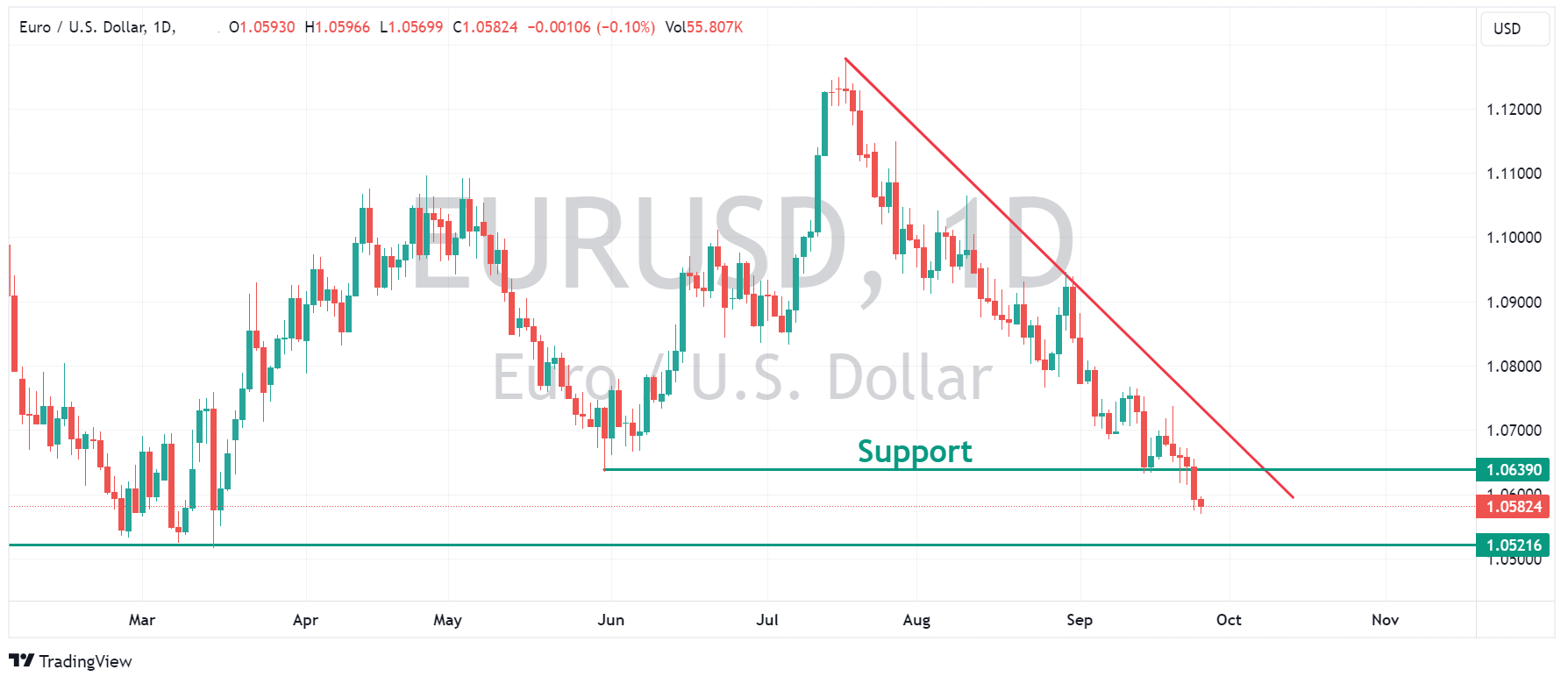

EURUSD saw further declines, first breaking support at the May 31 swing low, before also dropping below the psychological 1.06 level, with the major support of the Jan/Feb/Mar lows at 1.0521 very much in play. USD strength was the main driver but also weighing on the EUR was weak world merchandise trade volumes data , the eurozone suffers from a declining trade environment, as does the Euro.

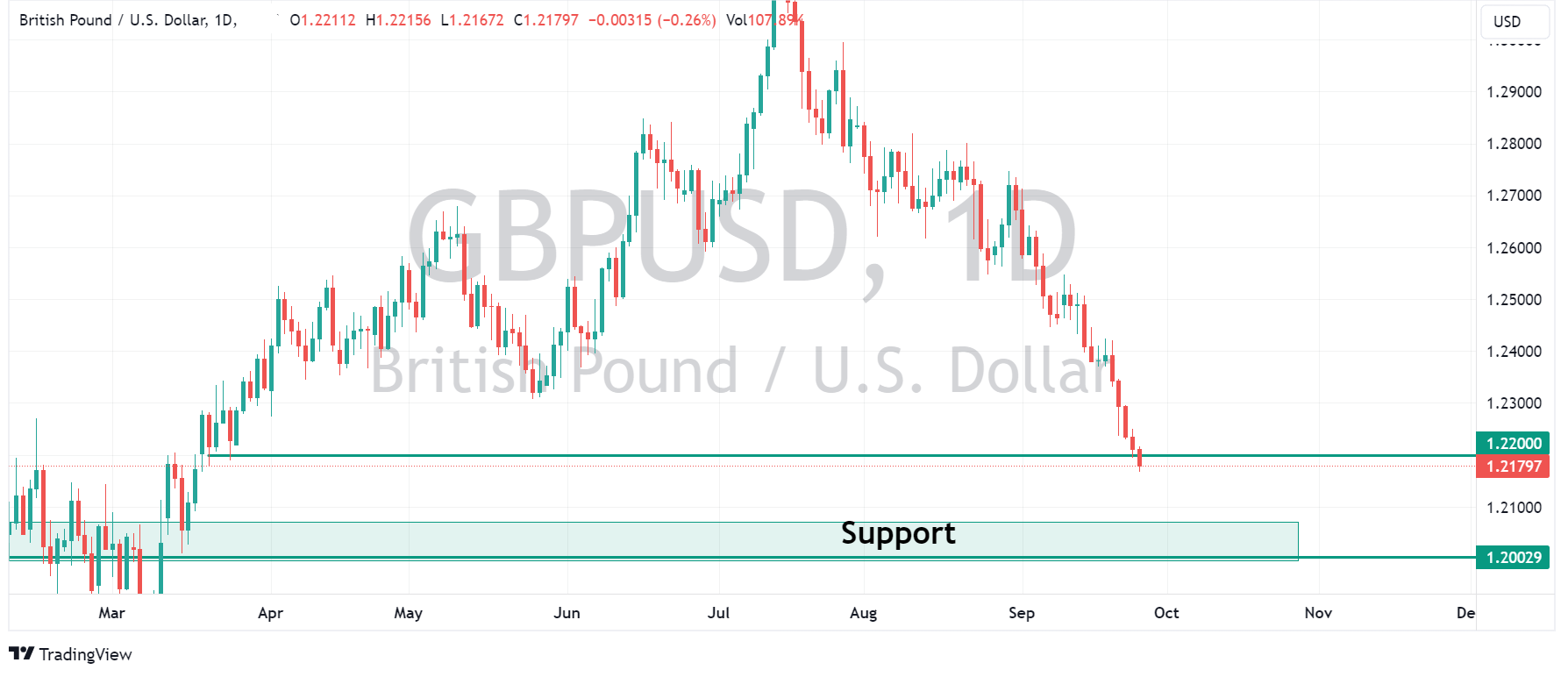

GBPUSD also continued to decline after last week’s surprise hold from the Bank of England. Ongoing USD strength, another hit to the cyclical GBP is the softening risk sentiment in global markets amid a possible US government shutdown. GBPUSD breaching the 1.22 support level and looking little in the way of technical support levels can be expected before the 1.2000/2075 area.

USDJPY stalled from its recent grind higher after climbing just shy of the 149.00 handle, another round of the familiar jawboning from Japan’s Finance Minister Suzuki holding it in place for now, JPY also helped somewhat by the weakening risk environment seeing haven flows to the Yen.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The Art of the Fundamental Exit: Knowing When to Walk Away

Entries for longer-term stock investment approaches can be based on either long-term technical trends or more commonly, fundamental data related to a company’s current and projected performance. Despite the plethora of such suggestions, there is often a lack of clear guidance, or even a complete absence, of instructions on determining the timing ...

October 3, 2023Read More >Previous Article

S&P 500 attempts to hold onto a key support level.

The S&P 500 index is currently teetering on the edge, desperately holding onto a crucial support level. This level has proven its resilience with ...

September 26, 2023Read More >Please share your location to continue.

Check our help guide for more info.