- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

- Home

- News & analysis

- Forex

- FX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

News & analysisNews & analysis

News & analysisNews & analysisFX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

9 August 2023 By Lachlan MeakinGlobal markets were buffeted by a risk-off catalysts in Tuesdays session. Weak Chinese trade data, hawkish Fed-speak and a Moody’s downgrade of US regional banks saw stocks and yields tumble

FX Markets

USD was firmer Tuesday in a session that was firmly risk-off following the Chinese trade data and Moody’s downgrade. Later in the session we also had the Fed’s Harker who said barring any “alarming” new data by mid-September he believed “we may be at the point where we can be patient and hold rates steady”, dashing traders hops of a Fed pivot anytime soon. DXY printed a high of 102.800, falling just short of the July 3rd high of 102.84 where it found resistance just under the round 103 figure and it’s June/July trendline.

Risk sensitive AUD and NZD were the G10 underperformers, with NZD performing mildly worse than its AUD counterpart. Both NZD and AUD were weighed on by the aforementioned risk-off tone and dismal Chinese trade data. AUDUSD hit a low of 0.6497, briefly breaking the major support at the 0.65 big figure before finding some bids, 0.6500 looking to be a key level. NZDUSD bottomed out at 0.6035 ahead of the closely watched New Zealand inflationary forecasts today.

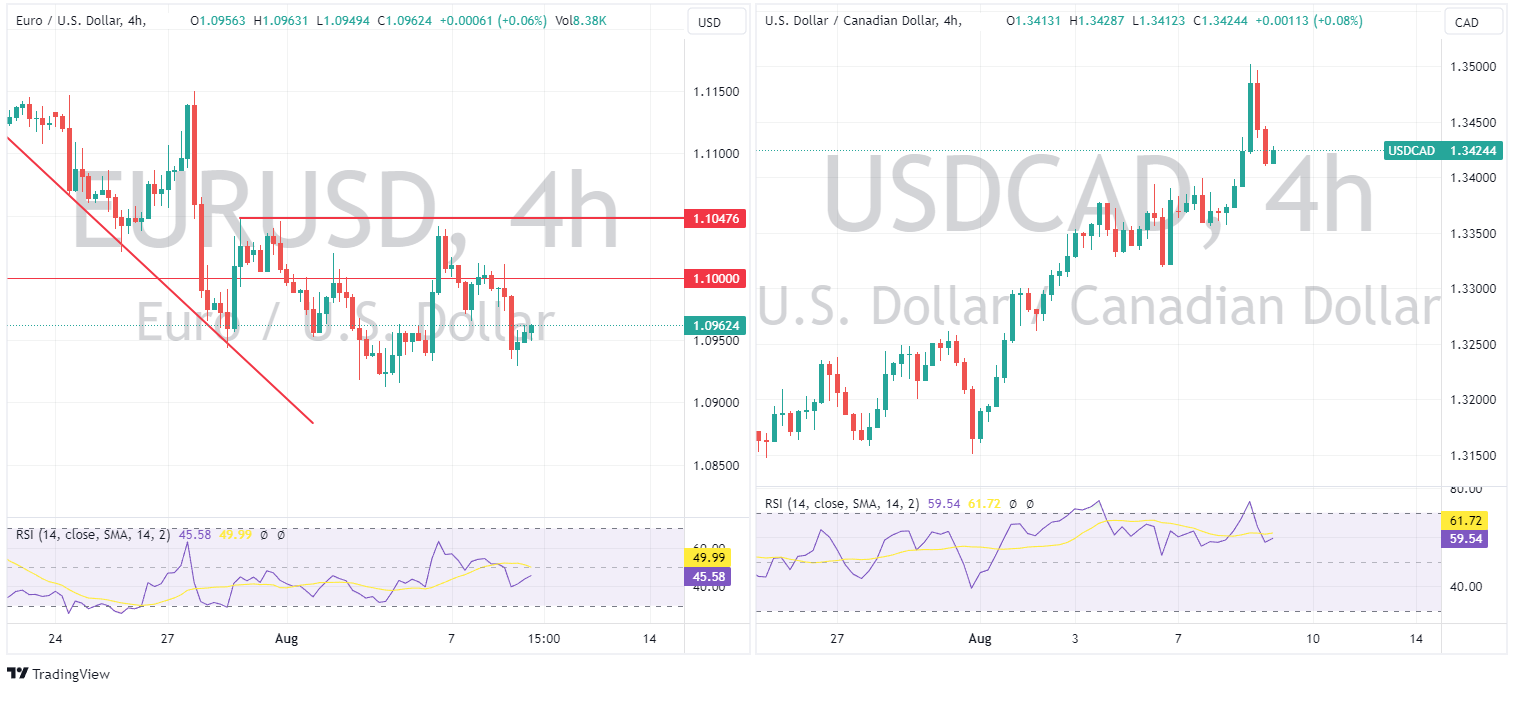

EUR, CAD, and GBP were all weaker to varying degrees against the USD due to the risk-averse trading conditions and the general USD strength as opposed to anything currency specific. USDCAD traded up to 1.3501 until paring gains as a rally in crude oil lent the CAD some support. EUR saw little reaction to the ECB June Consumer Inflation Expectations survey which downgraded the 12-month and 3-year inflation forecasts. EURUSD losing hold of the psychological 1.10 handle , hitting a low of 1.0930 before recovering modestly.

JPY weakened with USDJPY continuing its march to the 145 “intervention” zone. JPY’s haven demand offset by BoJ doubts after Japanese wage data suggested the BoJ has less scope to reduce its easy policies. USDJPY trading to a high of 143.49, testing its August highs.

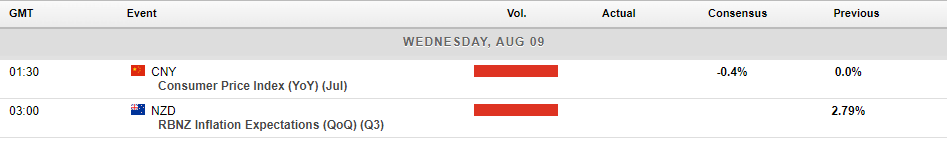

Today’s calendar:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

From Data to Dollars: An introduction to Quantitative Trading

Quantitative trading, often referred to as quant trading, is a trading strategy that relies on the use of mathematical models, statistical analysis, and data-driven approaches to make trading decisions. Often associated with the creation of specific automated trading systems, terms Expert advisors (EAs) on MetaTrader platforms, it a perceived as a ...

August 12, 2023Read More >Previous Article

$APPL: Apple finds key support after August sell-off.

Apple has had a spectacular start to 2023, locking in 7 consecutive positive months and putting in an increase of 52.16% year to date at its peak. ...

August 9, 2023Read More >Please share your location to continue.

Check our help guide for more info.