- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX analysis – JPY , AUD, NZD, CAD, USD

News & analysisUSD tracked higher with yields in Tuesday’s session with the Dollar Index (DXY) hitting a high of 103.820, setting a new YTD high and breaking through the key technical levels of the 200-day SMA as well as a 50% Fib resistance level. DXY saw initial weakness in the European morning which emanated from APAC hours amid a firmer post-BoJ Yen but reversed course in the US session as UST yields climbed and earnings disappointments saw US equites struggle.

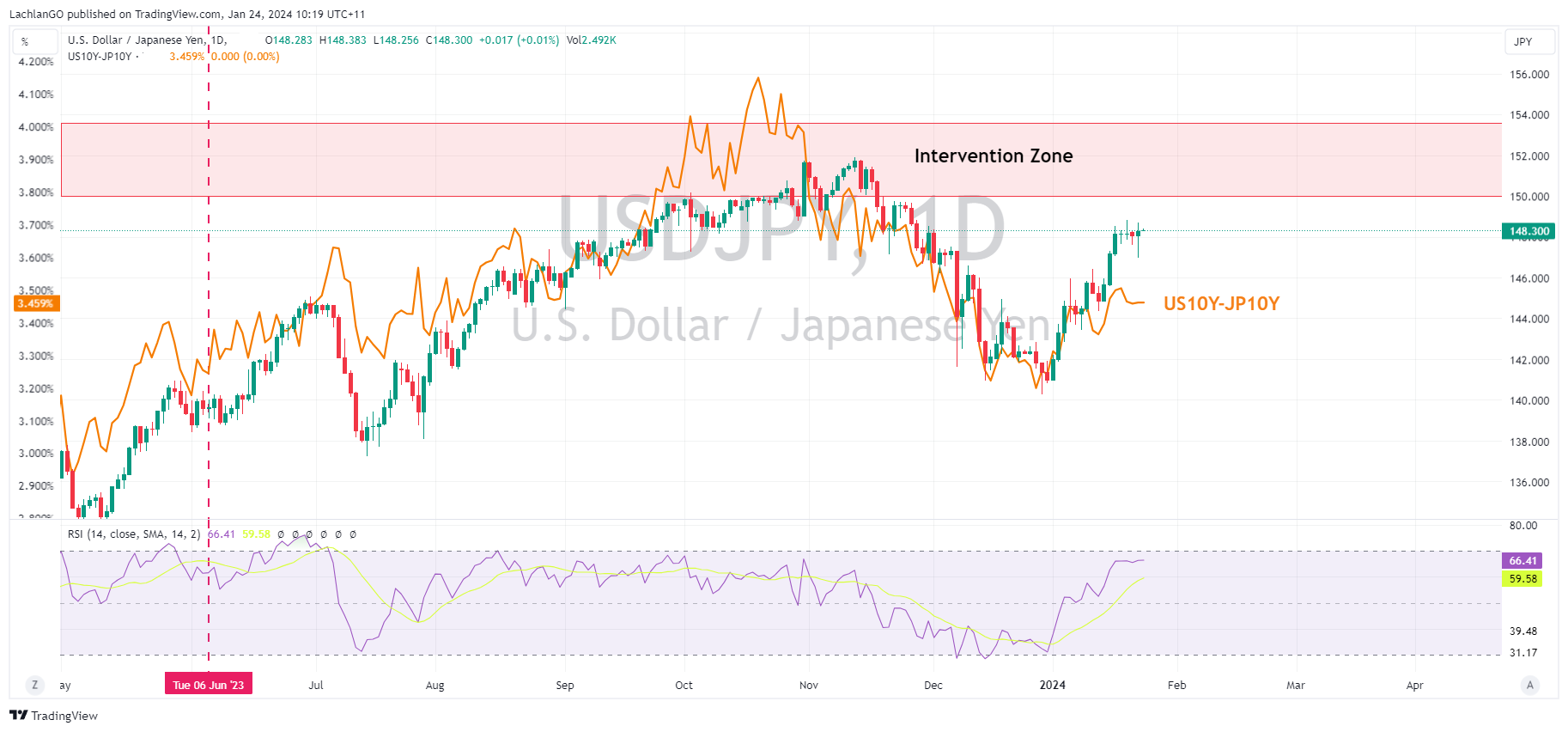

JPY closed the session seeing marginal losses against the USD. USDJPY did drop to a low of 146.97 after BoJ Governor Ueda delivered a hawkish-leaning press conference after the BoJ policy decision where he said he will certainly foresee further rate hikes when exiting negative interest rate policy. JPY gains failed to hold though with the pair retaking the 148 handle coming into the APAC open.

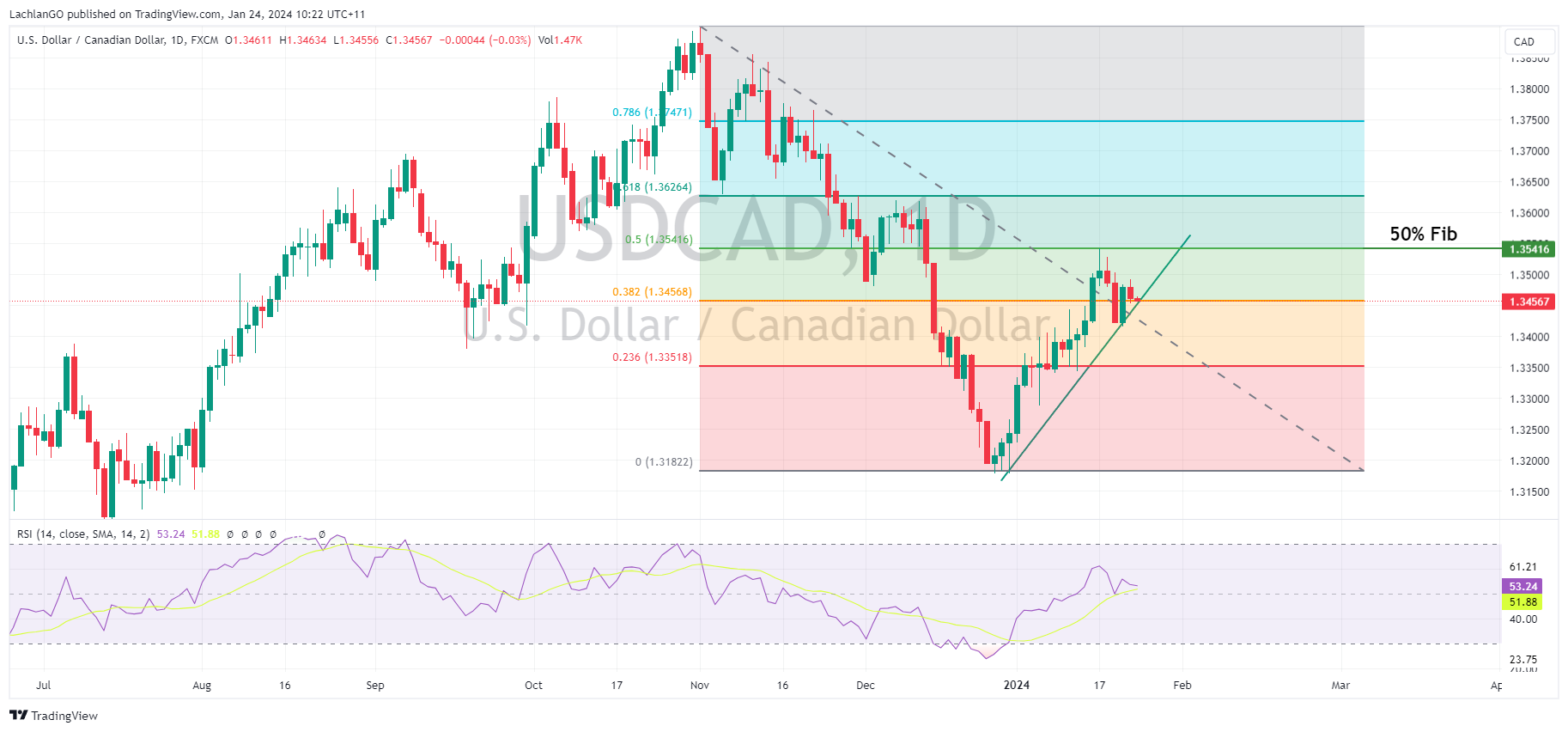

AUD, NZD and CAD were the G10 outperformers, with all making gains against the USD. NZD and AUD were bolstered by overnight Yuan gains and resilience in commodity prices. CAD was bid ahead of todays Bank of Canada policy meeting where the central bank is expected to hold rates steady, and possibly pushback against rate cut predictions after a hotter than expected December inflation reading.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

FX Analysis – Hot PMIs support EUR and GBP, BoC disappoints CAD bulls

USD was ultimately lower on Wednesday after a rollercoaster of a session. Broad risk-on sentiment early on saw the Dollar Index (DXY) plummet to hit a low of 102.77 until strong S&P Global Flash PMIs coupled with souring risk sentiment after a dismal US 5yr auction saw a sharp turn-around. DXY retaking the 103 handle at session end, with the 50...

January 25, 2024Read More >Previous Article

Netflix’s total paid subscribers hits an all-time high – the shares are rising

American online streaming service company, Netflix Inc. (NASDAQ: NFLX), released its latest financial results for Q4 of 2023 after the market closed o...

January 24, 2024Read More >Please share your location to continue.

Check our help guide for more info.