- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Forex

- FX Analysis – AUD, GBP, EUR, USD, XAUUSD

News & analysisUSD – The US dollar index was ultimately firmer in a choppy session where DXY hit a low of 103.18 in the APAC session only to reverse course later hitting a high of 103.71 in the US session. A sour risk environment after some misses in US retail earnings and traders getting long before the FOMC minutes seem to be the key drivers. Reaction to the minutes ended up being muted with a slight pop that retraced in quick time. DXY now sandwiched between its 200-day SMA and key support level at 103.60 heading into the APAC session.

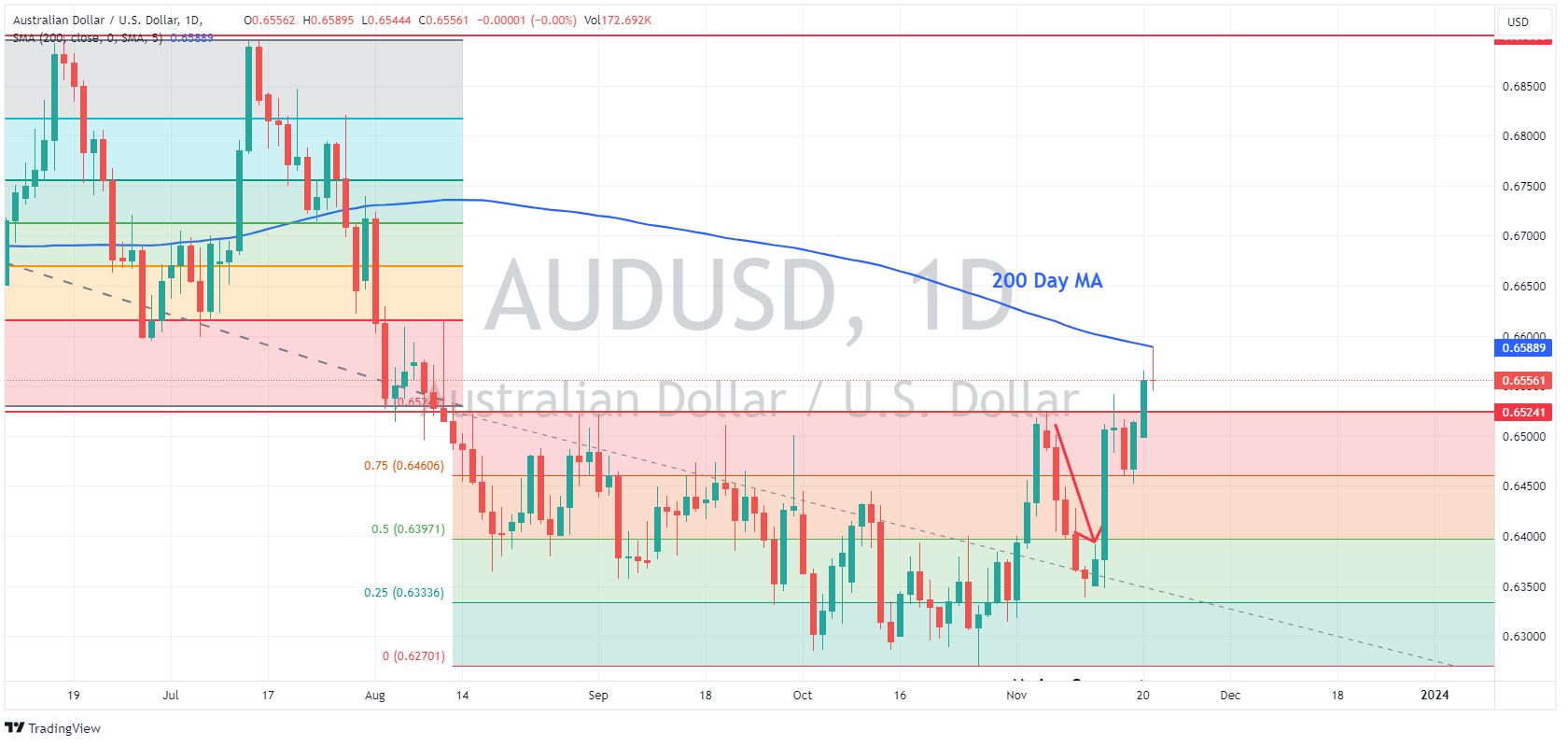

AUD – AUDUSD got off to a flier in the APAC session after what was seen as hawkish RBA minutes released early in the session. The Aussie did fade later as it failed to breach key technical resistance at the 200-day SMA at 0.6590 and finished the session flat. Key levels to watch today will be 0.6524 to the downside which was the top end of its recent range and the aforementioned 200-day SMA to the upside, Aussie traders will have comments from Governor Bullock later today to watch out for.

EUR GBP

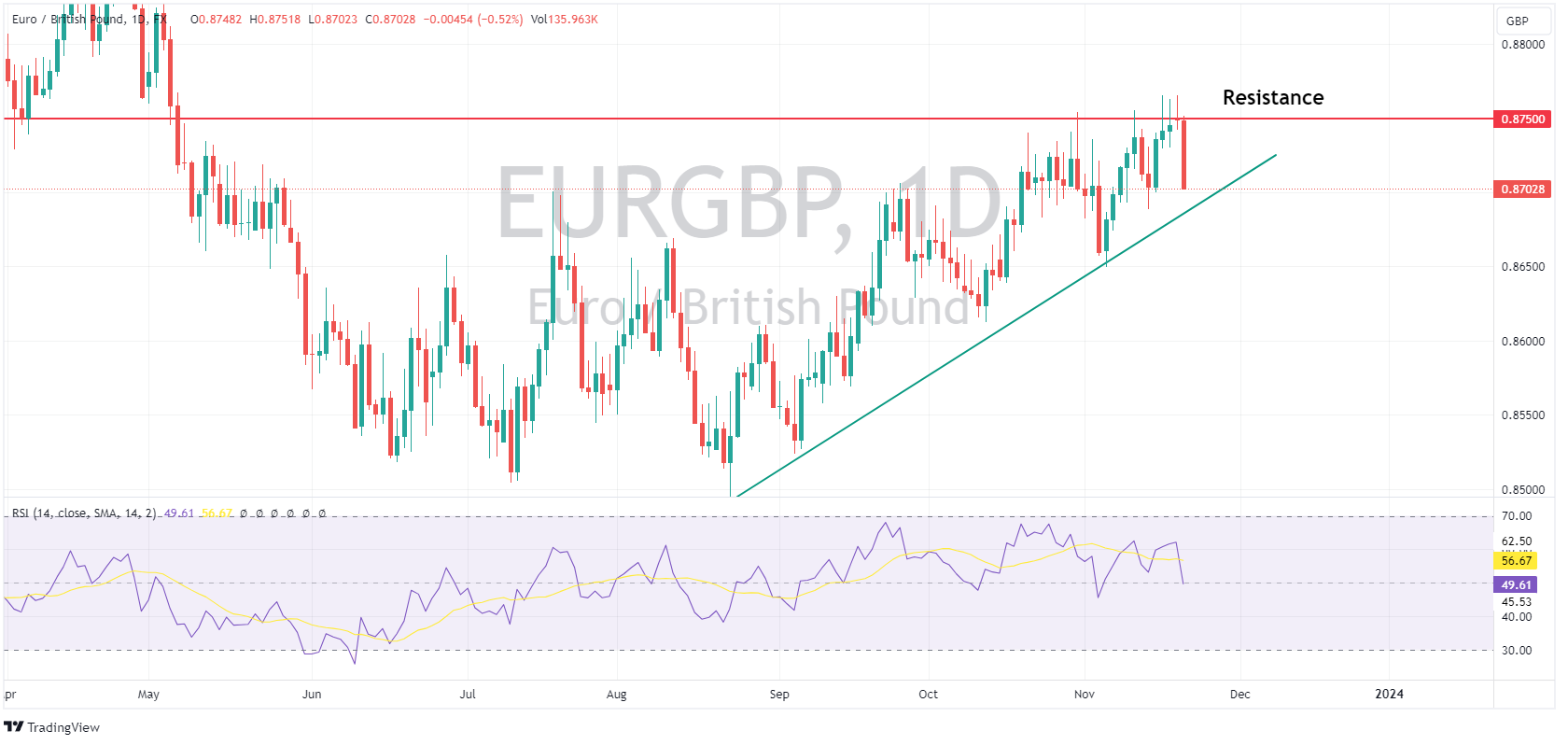

EUR was the G10 laggard with EURUSD hitting a low of 1.0901 before finding some support at the big figure. ECB president Lagarde did speak but failed to inspire the bulls, also some budgetary issue out of Germany weighed on the single currency. GBP on the other hand outperformed with cable having a positive session after some hawkish commentary from the BoE. This saw a sharp drop in EURGBP from its resistance at 0.8750 and heading towards its lower trend line support.

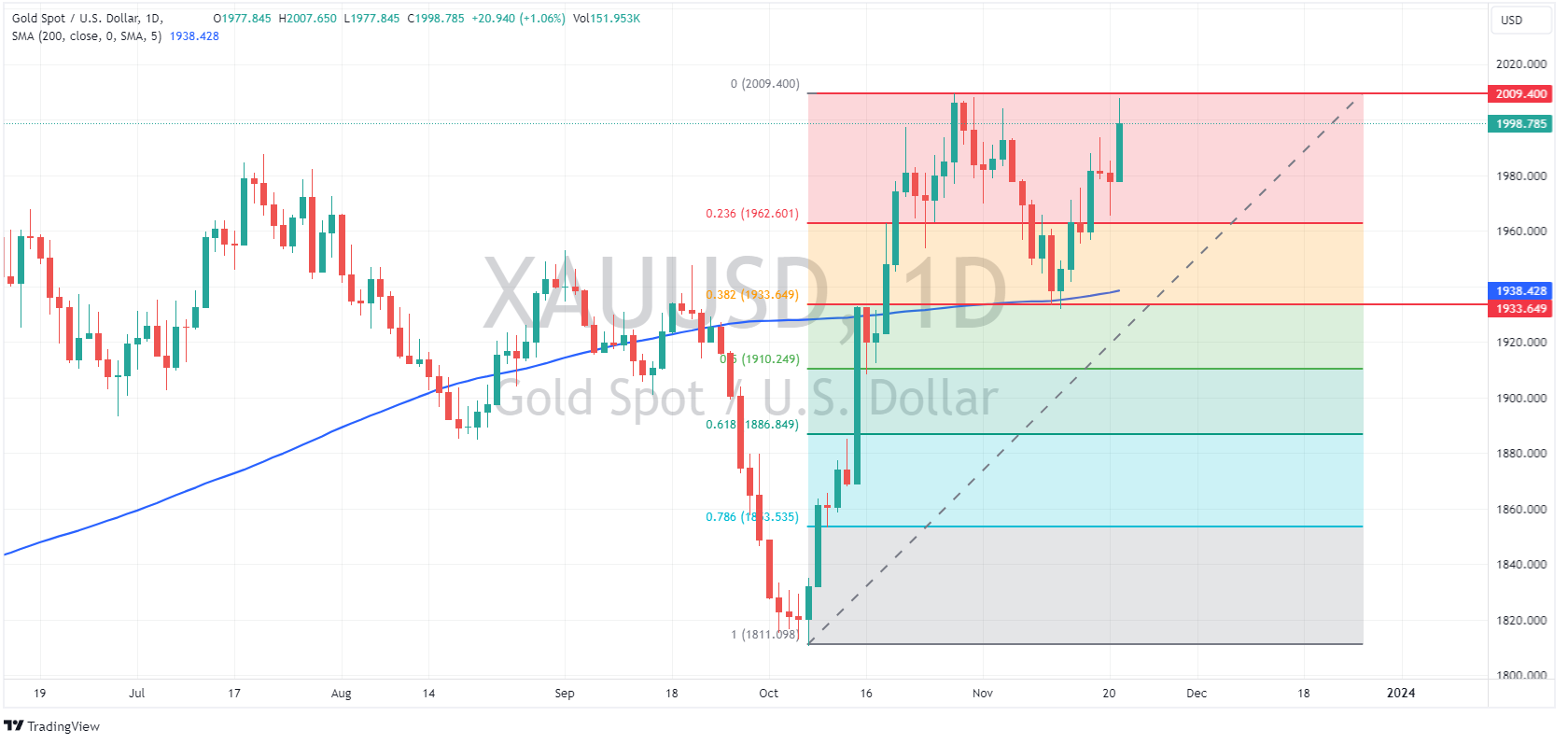

Gold – XAUUSD broke out, setting new November highs and testing the October highs at 2009 before finding some resistance. This came despite a stronger USD on the session, which would cheer the gold bulls.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Deere & Company results top estimates but the stock is falling

Deere & Company (NYSE: DE) reported the latest results for the fourth-quarter ending October 29, 2023 and full fiscal 2023 before the market opens in the US on Wednesday. The American manufacturer of farm machinery and industrial equipment beat Wall Street estimates for the fourth-quarter but fell short on future outlook expecations. Company...

November 23, 2023Read More >Previous Article

NVIDIA exceeds expectations

One of the most anticipated earnings releases in the calendar is here. NVIDIA Corporation (NASDAQ: NVDA) announced the latest results after the closin...

November 22, 2023Read More >Please share your location to continue.

Check our help guide for more info.