- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- GO Markets trading app

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Forex

- Forex This Week: What to Expect

News & analysisIn the month of May, major currencies were stronger against the US dollar as risk sentiment improved and haven currencies like the US dollar, the Yen and Swiss franc have lost momentum. Commodity-linked currencies were among the best performers against the US dollar; lifted by higher commodity prices.

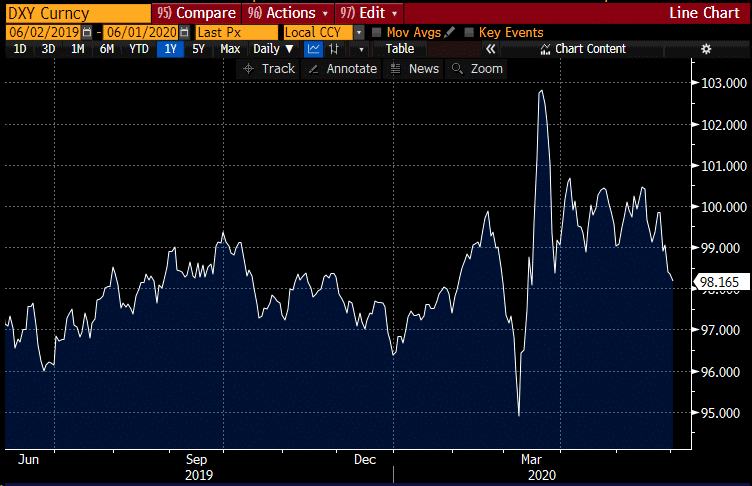

Source: BloombergThe US Dollar

As geopolitical tensions continue to rip through markets, protests following the death of Mr George Floyd is spreading nationwide and overshadowing the reopening of states and raising fears of new waves of coronavirus outbreaks, the US dollar might struggle to rebound. The US dollar index which tracks the performance of a basket of currencies against the greenback is back to levels seen mid-March.

US Dollar Index

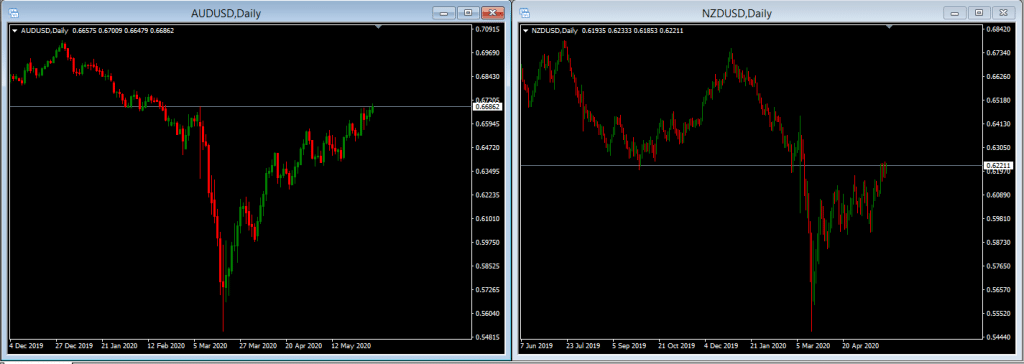

Source: BloombergThe Antipodeans

Australia and New Zealand were able to better contain the spread of the virus and have eased lockdown measures quicker compared to their peers. Both the AUDUSD and NZDUSD pairs are back to trading in the familiar levels seen before the sharp plunge linked to the coronavirus jitters. However, the US-China tussle is keeping a lid on gains and at those levels, traders will likely await for fresh positive catalysts to push the pairs higher.

AUDUSD and NZDUSD (Daily Chart)

Source: GO MT4Australia seems to have gone through the worst of the pandemic and the lockdown measures are slowly easing across the country. While the national health outcomes were better than feared, the reopening of the economy is also happening faster than initially anticipated. After the Australian Treasury announced the $60 billion accounting error, investors were reassured that the Australian economy was not as severely impacted as initially forecasted.

The coordinated monetary and fiscal measures have helped the RBA and the government to provide assistance to households and businesses. The Bank taped into quantitative easing (QE) mid-March for the first time in history and purchased $50 billion of Australian Government Securities (AGS) and semi-government securities (semis). Given that the measures put in place are working as broadly as expected, the RBA has even started to scale back daily market open operations. Unlike some major central banks, the RBA has also ruled out negative interest rates. Based on the current developments and the prospects of a quicker recovery, the RBA is widely expected to remain on hold on Tuesday and to maintain a less-dovish tone compared to its peers recently.

The recent Governor Philip Lowe’s speech before the Senate Select Committee was also broadly positive about the economy and its recovery. The Aussie dollar may have some room for upside momentum if the Bank maintains its optimistic tone. Other notable events to watch are the GDP numbers and Retail Sales figures on Wednesday and Thursday.

In New Zealand, the economic calendar is relatively subdued for the week. There are enough positive developments to help the Aussie dollar and Kiwi to hold on to gains. However, the Antipodeans may struggle to push the rally seen recently further as US-China risks loom.

The Euro

The downside risks for the Eurozone have eased which has helped the Euro to advance higher, but the shared currency was unable to benefit fully from the overall risk-on sentiment and the weakness of the US dollar dragged by the political dynamics within the Eurozone. On the economic calendar, the focus will be on the ECB. Interest rates are not expected to shift, but attention will be on the central bank’s decision to expand the QE program. Following recent comments from policymakers, market participants are widely expecting more easing next Thursday with an expansion of the Pandemic Emergency Purchase Programme (PEPP) by EUR500 bn.

The impact on the shared currency would likely depend on the extent the ECB will go to support the eurozone economy. Until geopolitical risks recede and there is a compromise on the EU recovery plan, the EURUSD pair may struggle to firm outside its current range and significantly above the 1.10 level.

EURUSD (Daily Chart)

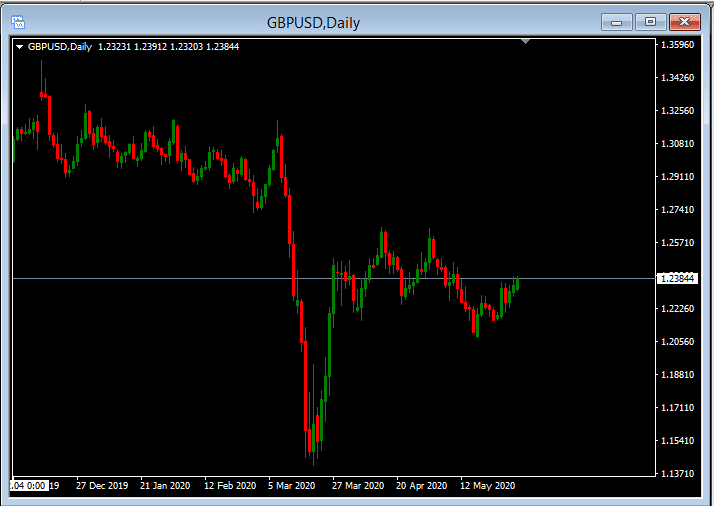

Source: GO MT4The Pound

The Sterling Pound was the worst performer against the US dollar in May and will likely remain under pressure dragged by Brexit uncertainties. The negotiations have stalled and as the deadline for extending the transition period is coming closer, traders are finding little positive narratives to rule out a no-deal Brexit. All eyes are on the resumption of Brexit negotiations this week. As of writing, the GBPUSD pair is trading just below the 1.24 level – buoyed mainly by the broad weakness in the US dollar.

GBPUSD (Daily Chart)

Source: GO MT4Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Creating a trading edge – Is it possible?

A trading edge is a certain approach or special system techniques that, in theory, gives a trader some type of advantage over other market participants, hence making a trader more likely to achieve positive trading results. Many are cynical about the objective of creating a trading edge, despite the plethora of articles and books on va...

June 9, 2020Read More >Previous Article

Inner Circle video – INNOVATION: Creating a NEW trading system

Please find below the video recording from this weeks Inner circle session “INNOVATION: Creating a NEW trading system”. Please send any commen...

May 27, 2020Read More >Please share your location to continue.

Check our help guide for more info.